- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Discover These 3 Undiscovered Gems in United Kingdom with Strong Potential

Reviewed by Simply Wall St

The market in the United Kingdom has climbed 1.1% over the last week and is up 5.8% over the past 12 months, with earnings forecast to grow by 14% annually. In this favorable environment, identifying stocks with strong potential involves looking for companies that are well-positioned to capitalize on growth opportunities and demonstrate resilience in their operations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market cap of £1.14 billion.

Operations: The company generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

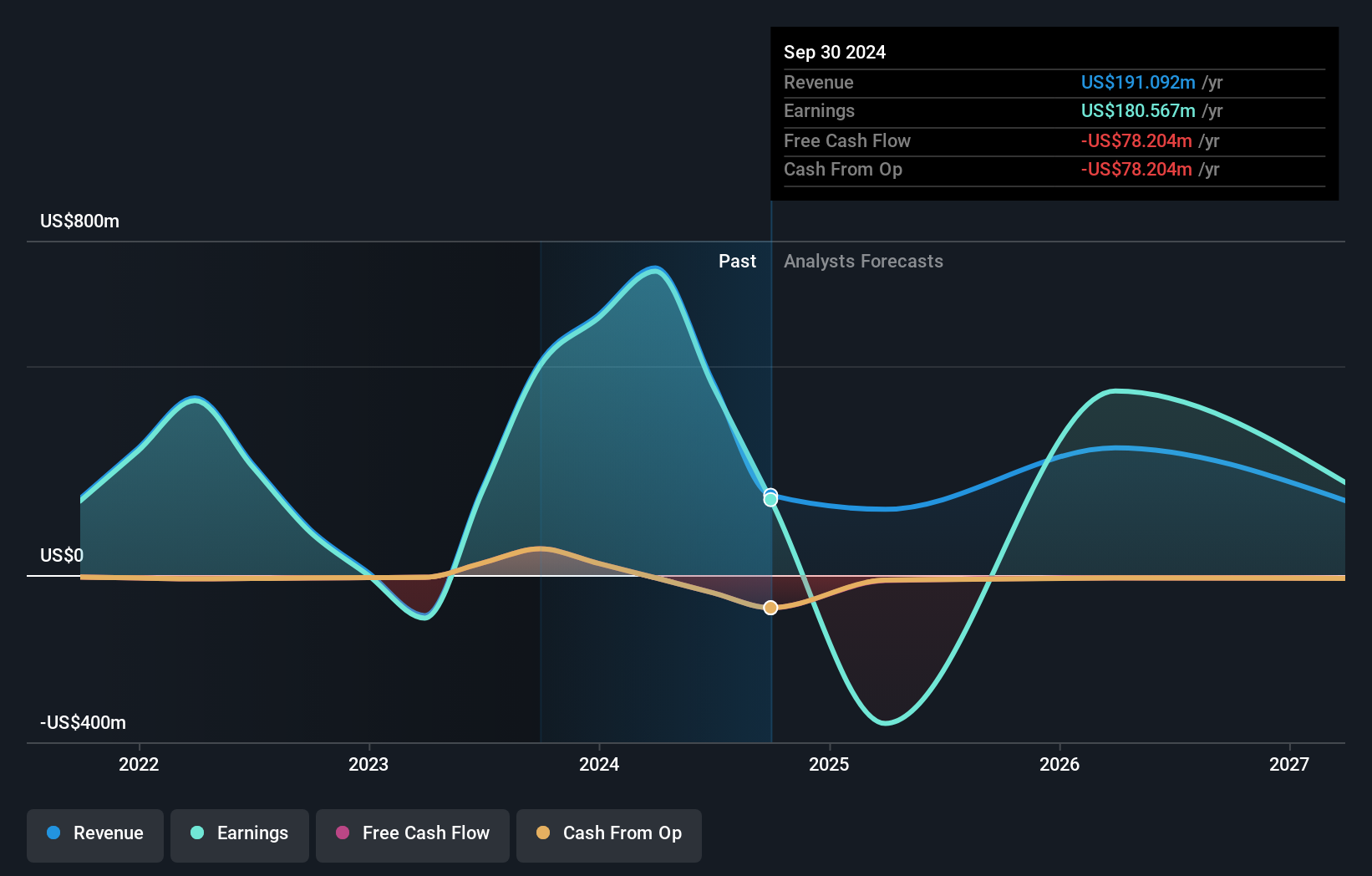

Yellow Cake has recently reported impressive financial results, with revenue reaching US$735.02 million for the year ending March 31, 2024, compared to negative revenue of US$96.9 million the previous year. Net income surged to US$727.01 million from a net loss of US$102.94 million last year. Despite being debt-free and trading at a low price-to-earnings ratio of 2.1x against the UK market's 16.5x, shareholders faced dilution over the past year due to high non-cash earnings levels and an expected earnings decline by an average of 91% annually over the next three years.

- Click here and access our complete health analysis report to understand the dynamics of Yellow Cake.

Understand Yellow Cake's track record by examining our Past report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £285.33 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: Yü Group PLC generates revenue primarily from its Retail segment (£459.80 million) and Smart solutions (£5.56 million), with minimal contributions from Metering Assets (£0.08 million).

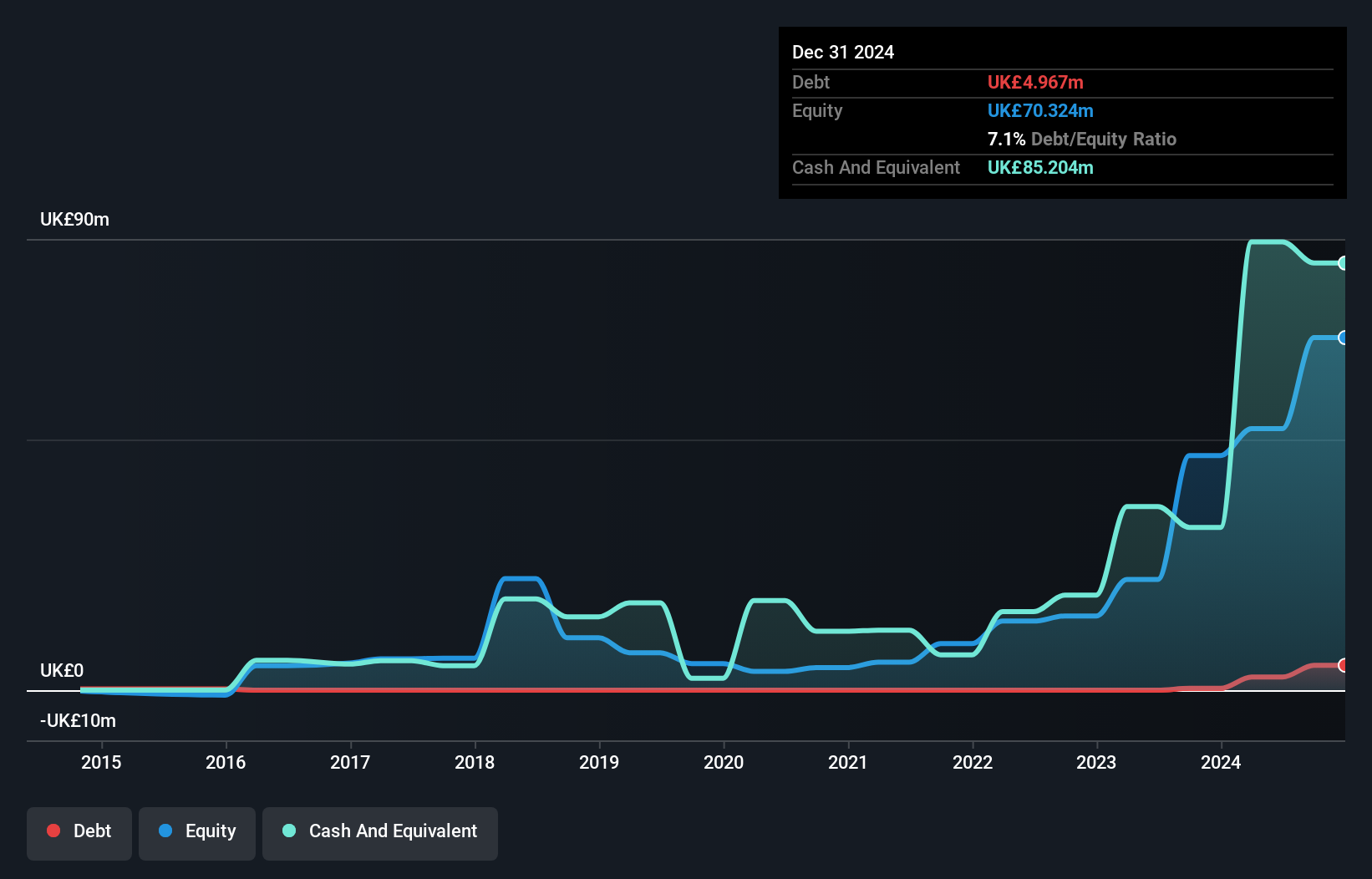

Yü Group's earnings surged by 547% last year, outpacing the Renewable Energy industry's -13.6%. Trading at 64% below estimated fair value, it offers good relative value compared to peers. With high-quality earnings and more cash than total debt, financial stability is evident. The company's debt-to-equity ratio has risen from 0% to 0.8% over five years, showing prudent leverage management. Future profits are expected to grow annually by 8.35%, indicating strong growth prospects ahead.

- Delve into the full analysis health report here for a deeper understanding of Yü Group.

Assess Yü Group's past performance with our detailed historical performance reports.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc, a holding company with a market cap of £985.29 million, operates as a home and community builder in Ireland.

Operations: Cairn Homes derives its revenue primarily from building and property development, generating €813.40 million.

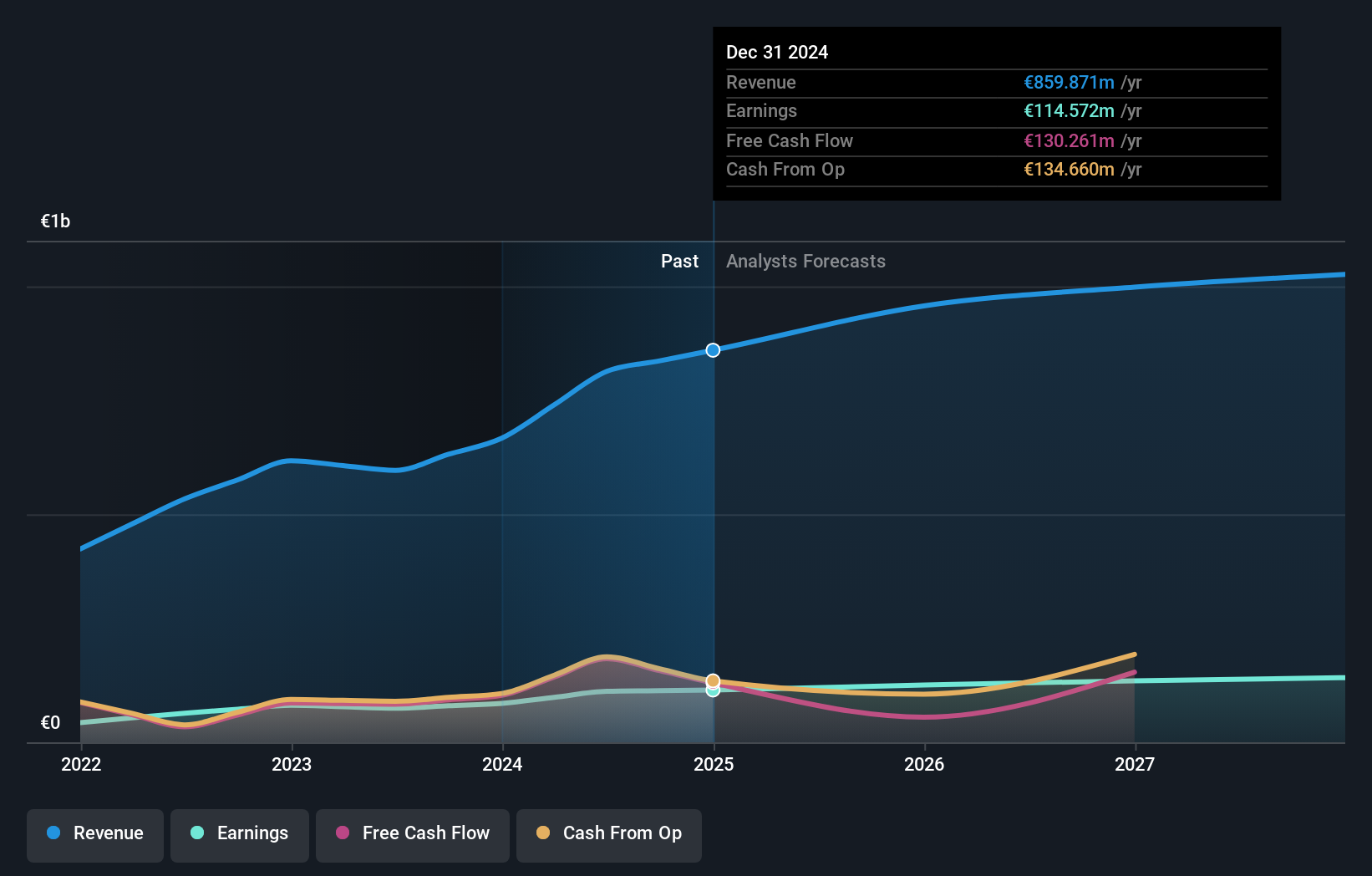

Cairn Homes, a notable player in the UK housing market, has demonstrated impressive financial performance. Earnings surged by 49.5% last year, significantly outpacing the Consumer Durables industry’s -14.6%. The company repurchased 17.74 million shares for €27.2 million in early 2024 and announced an interim dividend of €0.038 per share payable in October 2024. With a debt to equity ratio rising from 31.3% to 39.1% over five years and trading at a P/E ratio of 10.5x below the UK market average of 16.5x, Cairn Homes offers solid value while maintaining high-quality earnings and robust interest coverage (9.5x EBIT).

- Take a closer look at Cairn Homes' potential here in our health report.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Make It Happen

- Dive into all 81 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet and fair value.