- United Kingdom

- /

- Communications

- /

- LSE:BVC

BATM Advanced Communications Ltd.'s (LON:BVC) Shares Leap 31% Yet They're Still Not Telling The Full Story

BATM Advanced Communications Ltd. (LON:BVC) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

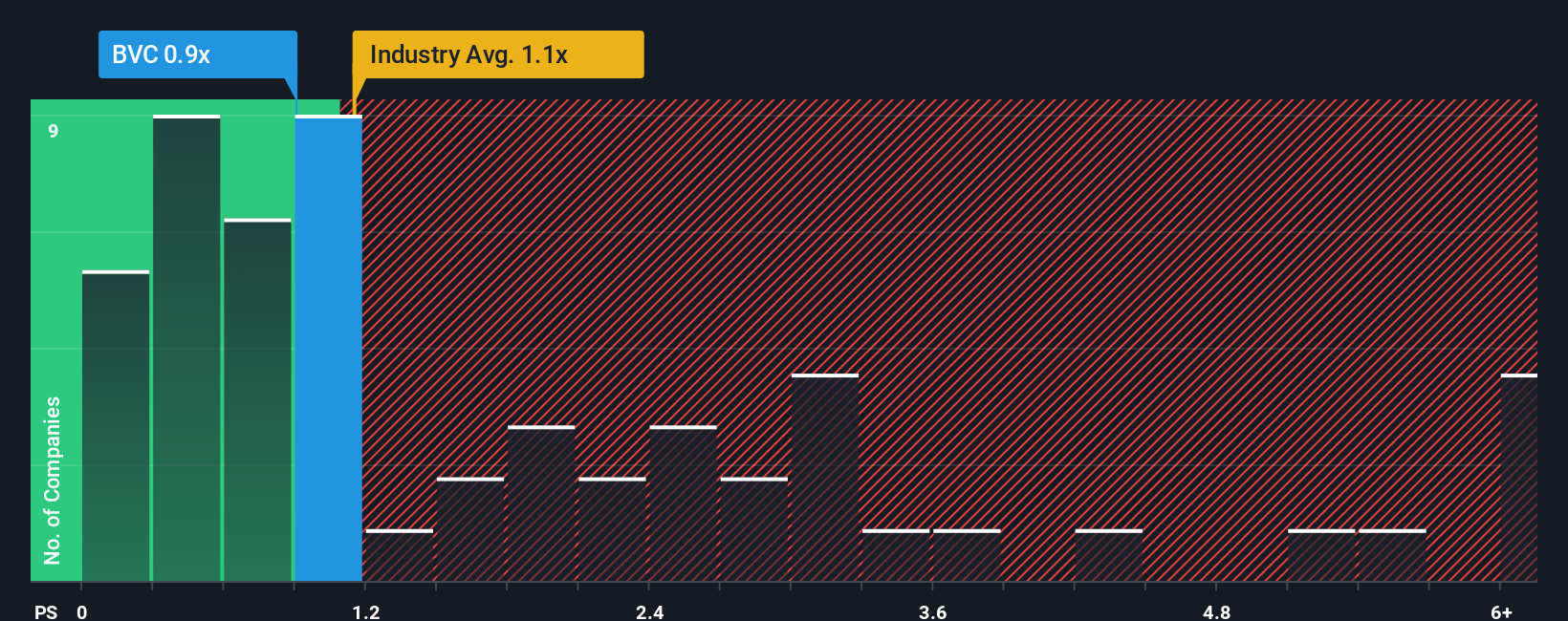

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about BATM Advanced Communications' P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Communications industry in the United Kingdom is also close to 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for BATM Advanced Communications

How BATM Advanced Communications Has Been Performing

With revenue growth that's inferior to most other companies of late, BATM Advanced Communications has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think BATM Advanced Communications' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

BATM Advanced Communications' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 16% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 11% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 2.8% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that BATM Advanced Communications' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does BATM Advanced Communications' P/S Mean For Investors?

BATM Advanced Communications appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at BATM Advanced Communications' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for BATM Advanced Communications with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BATM Advanced Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BVC

BATM Advanced Communications

Engages in the development, production, and supply of real-time technologies and associated services in Israel, the United States, and Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives