- United Kingdom

- /

- IT

- /

- LSE:KNOS

High Growth Tech Stocks To Watch In The United Kingdom November 2025

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies and their impact on local indices. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and innovation, capitalizing on technological advancements despite broader market headwinds.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gooch & Housego | 9.29% | 32.45% | ★★★★☆☆ |

| Pinewood Technologies Group | 28.67% | 49.21% | ★★★★★☆ |

| M&C Saatchi | -16.51% | 38.50% | ★★★★☆☆ |

| One Media iP Group | 6.76% | 32.48% | ★★★★☆☆ |

| Kainos Group | 7.16% | 16.16% | ★★★★☆☆ |

| Beeks Financial Cloud Group | 11.54% | 32.46% | ★★★★☆☆ |

| ActiveOps | 14.97% | 40.69% | ★★★★★☆ |

| Skillcast Group | 14.52% | 31.61% | ★★★★☆☆ |

| Itim Group | 8.33% | 109.98% | ★★★★☆☆ |

| Raspberry Pi Holdings | 16.78% | 40.87% | ★★★★☆☆ |

Click here to see the full list of 14 stocks from our UK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally with a market capitalization of approximately £1.11 billion.

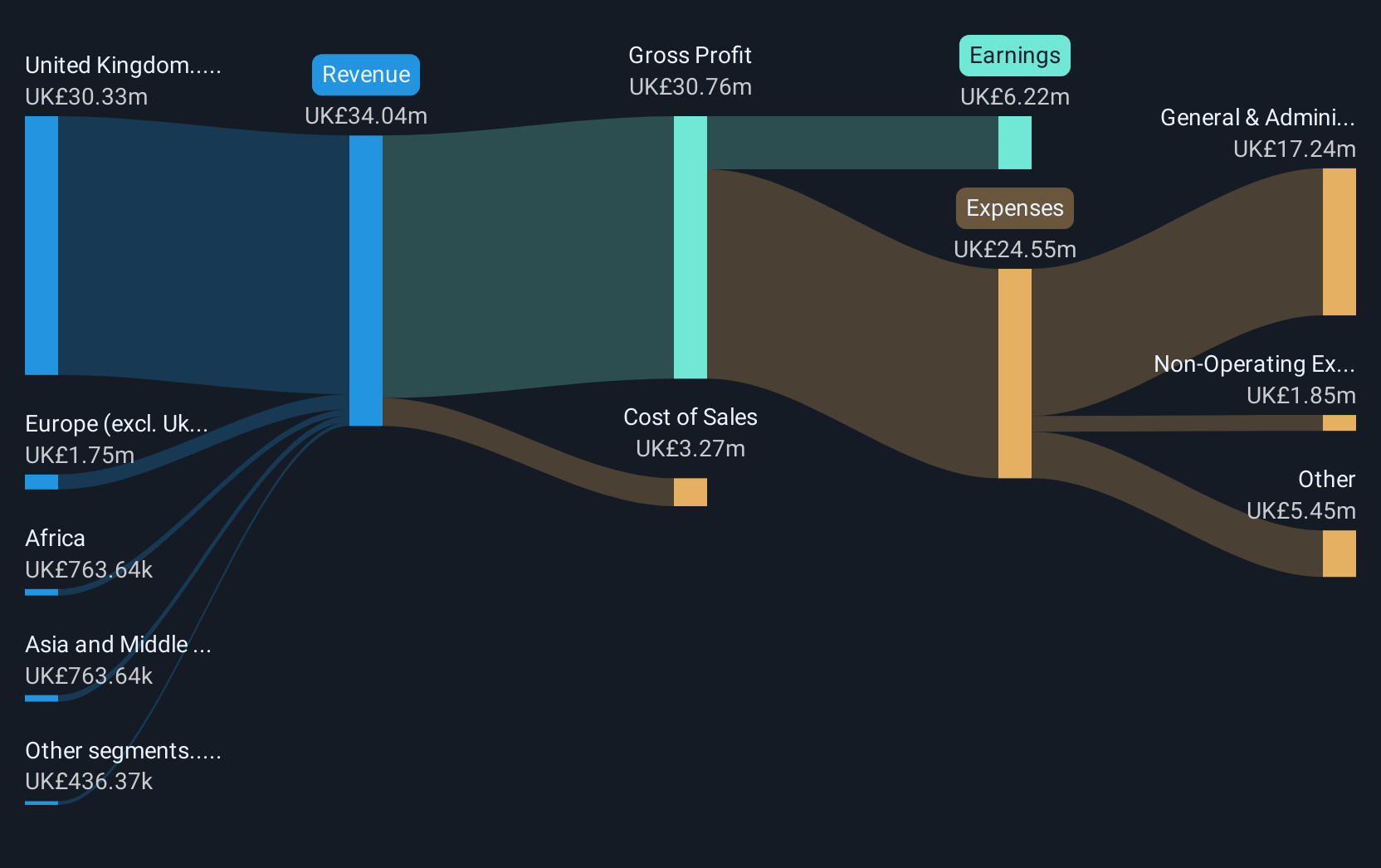

Operations: The company generates revenue primarily through Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

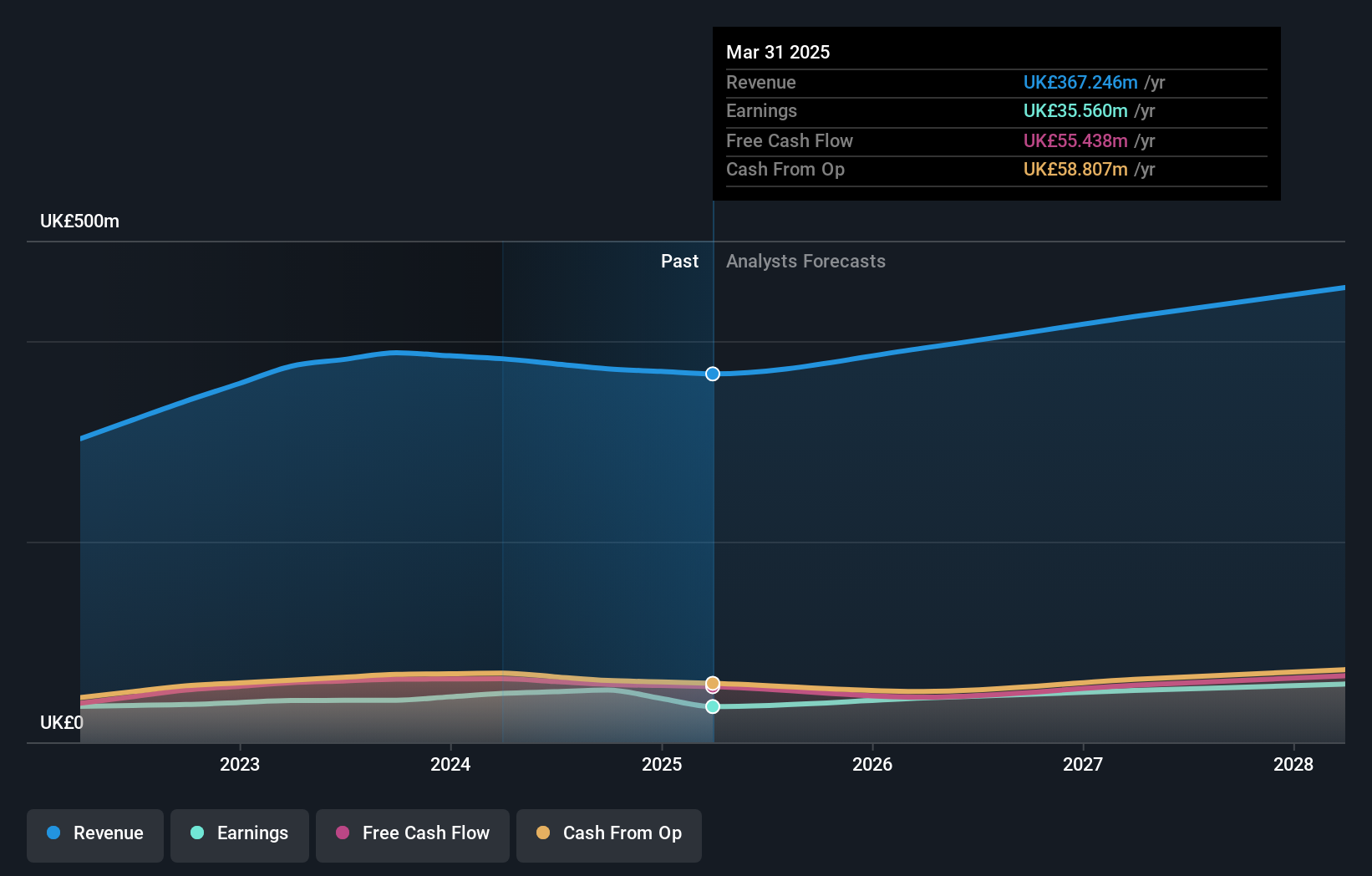

Kainos Group, a UK-based tech entity, has demonstrated robust growth with a projected revenue increase of 7.2% annually, outpacing the UK market's 4.2%. Despite facing challenges like a 27% drop in earnings last year compared to the IT industry's average growth of 19.6%, the company is poised for recovery with expected annual earnings growth of 16.2%, surpassing the national market forecast of 14.5%. At its recent Analyst/Investor Day on October 20, Kainos outlined its strategy focusing on enhancing customer partnerships and expanding its product offerings, which could significantly influence its trajectory in the competitive tech landscape. Moreover, with new leadership under Director Shruthi Chindalur and an optimistic revenue forecast reaching up to £393.4 million for FY2026, Kainos is strategically positioning itself for sustained advancement in high-growth sectors.

- Get an in-depth perspective on Kainos Group's performance by reading our health report here.

Understand Kainos Group's track record by examining our Past report.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving markets in the United Kingdom, Europe, Africa, Asia, the Middle East, and internationally with a market cap of £361.43 million.

Operations: Pinewood Technologies Group focuses on providing cloud-based dealer management software across various international markets. The company generates its revenue primarily through software licensing and subscription services, with a notable emphasis on technological innovation to enhance customer experience.

Pinewood Technologies Group PLC, with its substantial annual revenue growth of 28.7% and earnings surge of 49.2%, is outpacing the broader UK market significantly. The firm's commitment to innovation is evident from its R&D spending trends, which have strategically bolstered its competitive edge in the tech sector. Recent leadership enhancements and strategic board appointments suggest a focused path towards leveraging technological advancements and market opportunities. Moreover, being added to the FTSE 250 Index underscores its growing influence and potential within the tech landscape, marking it as a notable entity in high-growth technology sectors across the United Kingdom.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raspberry Pi Holdings plc designs and develops single-board computers, compute modules, and semiconductors for a global market, with a market cap of £670.60 million.

Operations: Raspberry Pi Holdings generates revenue primarily from its computer hardware segment, amounting to $251 million. The company operates in various regions, including the United Kingdom, Europe, the United States, and Asia Pacific.

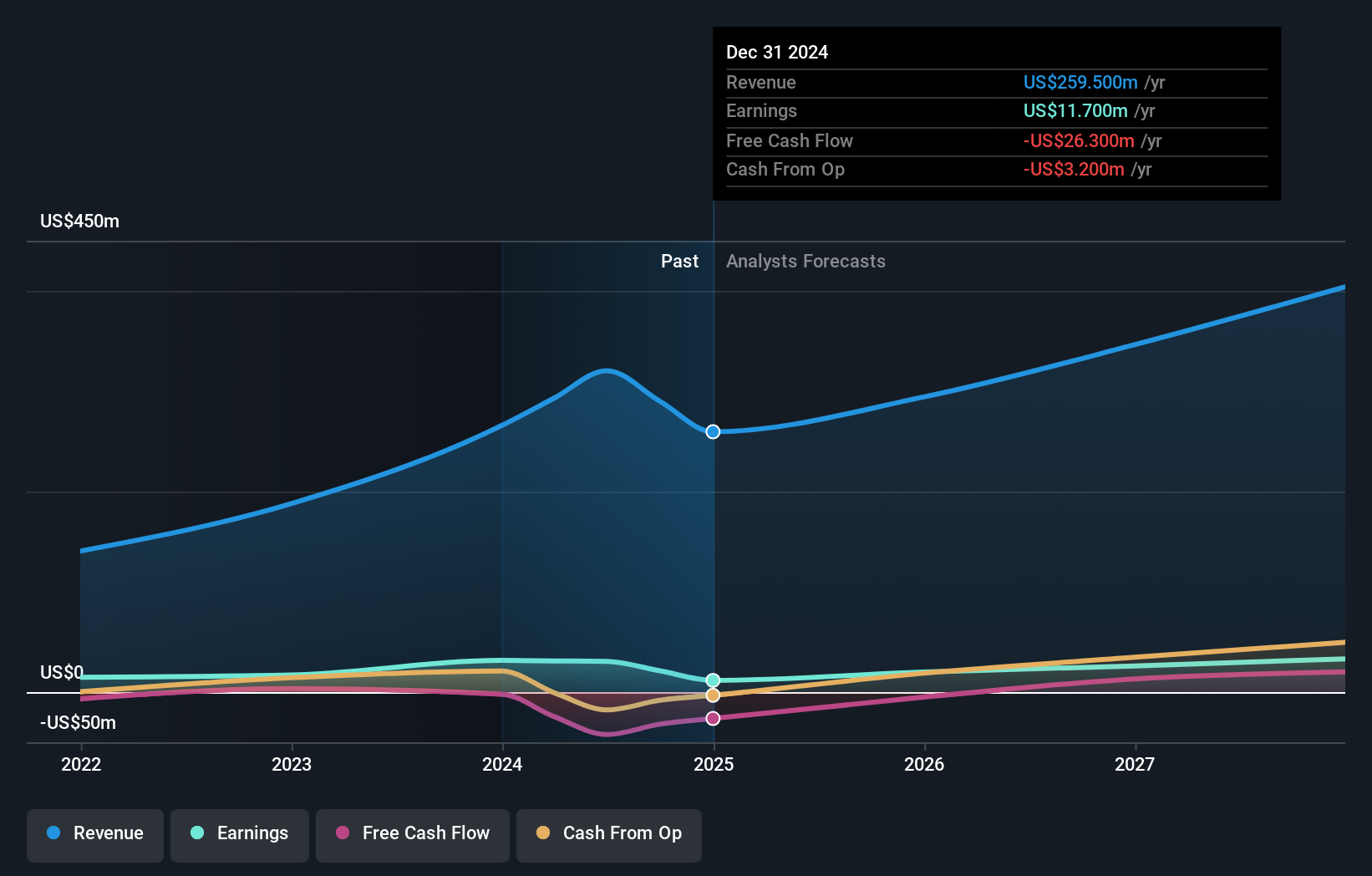

Raspberry Pi Holdings is navigating a transformative phase, with the recent launch of its Raspberry Pi 500+ targeting enterprise needs for secure, cost-effective computing solutions. This innovation aligns with the shift towards cloud-based environments, crucial as Windows 10 support concludes and many businesses face security and compatibility challenges. Despite a downturn in earnings reported in June 2025, where sales dropped to $135.5 million from $144 million the previous year and net income fell to $5.4 million from $7.6 million, the company's strategic focus on R&D is robust, fostering significant advancements like the LEAF OS partnership which enhances endpoint security and operational efficiency for enterprises. This strategic pivot not only addresses immediate market gaps but positions Raspberry Pi Holdings to capitalize on sustained demand for integrated tech solutions in a post-Windows 10 landscape.

- Dive into the specifics of Raspberry Pi Holdings here with our thorough health report.

Assess Raspberry Pi Holdings' past performance with our detailed historical performance reports.

Next Steps

- Explore the 14 names from our UK High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kainos Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KNOS

Kainos Group

Engages in the provision of digital technology services in the United Kingdom, Ireland, the Americas, Central Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives