Stock Analysis

- United Kingdom

- /

- Software

- /

- AIM:IGP

Intercede Group (LON:IGP) jumps 11% this week, taking five-year gains to 592%

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. Just think about the savvy investors who held Intercede Group plc (LON:IGP) shares for the last five years, while they gained 592%. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 20% in about a quarter. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the stock has added UK£6.4m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Intercede Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

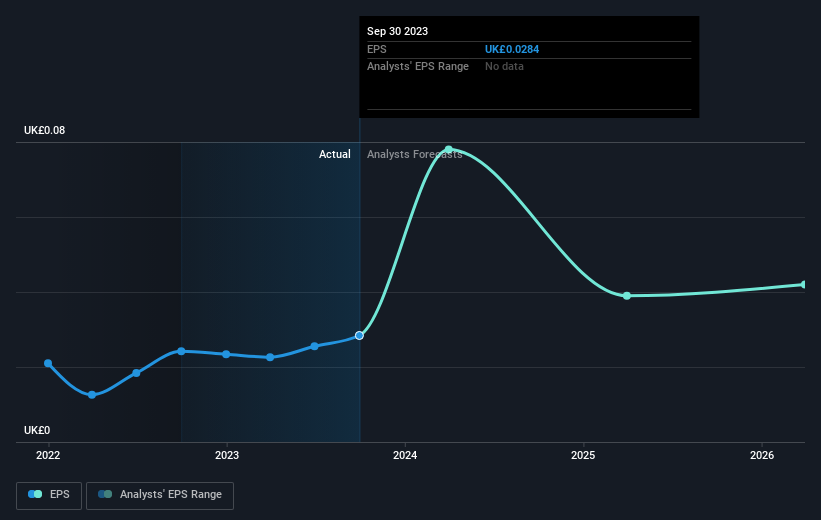

During the last half decade, Intercede Group became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Intercede Group share price is up 22% in the last three years. Meanwhile, EPS is up 4.3% per year. Notably, the EPS growth has been slower than the annualised share price gain of 7% over three years. So one can reasonably conclude the market is more enthusiastic about the stock than it was three years ago.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Intercede Group's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Intercede Group has rewarded shareholders with a total shareholder return of 80% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 47% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Intercede Group (1 is concerning) that you should be aware of.

Intercede Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Intercede Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IGP

Intercede Group

A cybersecurity company, engages in identity and credential management business to enable digital trust in the United Kingdom, rest of Europe, the United States, and internationally.

Outstanding track record with flawless balance sheet.