Stock Analysis

- United Kingdom

- /

- Semiconductors

- /

- AIM:KMK

Investors in Kromek Group (LON:KMK) from five years ago are still down 73%, even after 22% gain this past week

While it may not be enough for some shareholders, we think it is good to see the Kromek Group plc (LON:KMK) share price up 24% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 73% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained.

On a more encouraging note the company has added UK£7.5m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Check out our latest analysis for Kromek Group

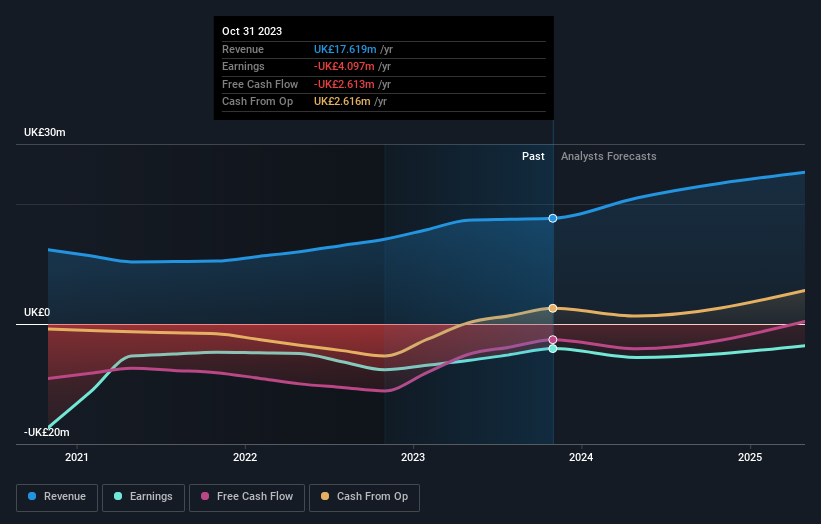

Kromek Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, Kromek Group grew its revenue at 4.0% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 12%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Kromek Group has rewarded shareholders with a total shareholder return of 21% in the last twelve months. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Kromek Group (including 1 which shouldn't be ignored) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Kromek Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KMK

Kromek Group

Kromek Group plc, together with its subsidiaries, develops, manufactures, and sells radiation detection components and devices for the medical imaging, civil nuclear, CBRNe security, and safety screening markets.

Adequate balance sheet and slightly overvalued.