- United Kingdom

- /

- Specialty Stores

- /

- LSE:HFD

Some Halfords Group (LON:HFD) Shareholders Have Copped A Big 64% Share Price Drop

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. To wit, the Halfords Group plc (LON:HFD) share price managed to fall 64% over five long years. That is extremely sub-optimal, to say the least. And it's not just long term holders hurting, because the stock is down 30% in the last year.

See our latest analysis for Halfords Group

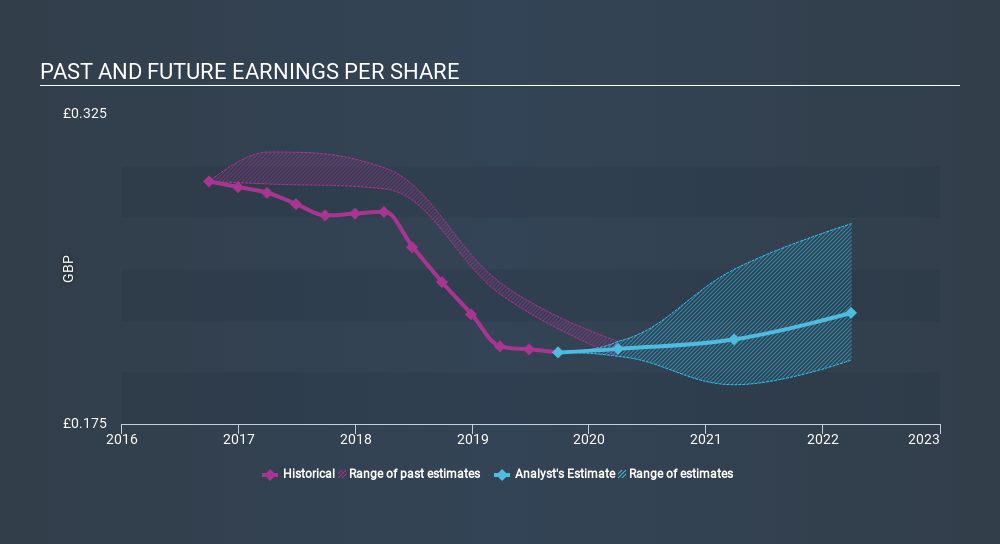

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Halfords Group's share price and EPS declined; the latter at a rate of 7.7% per year. This reduction in EPS is less than the 18% annual reduction in the share price. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 7.81.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Halfords Group's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Halfords Group the TSR over the last 5 years was -50%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Halfords Group shareholders are down 22% for the year (even including dividends) , but the market itself is up 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Halfords Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Halfords Group .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:HFD

Halfords Group

Through its subsidiaries, provides motoring and cycling products and services in the United Kingdom.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives