- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

Supreme Plc (LON:SUP) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

Supreme Plc (LON:SUP) shares have had a horrible month, losing 27% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 12% in the last year.

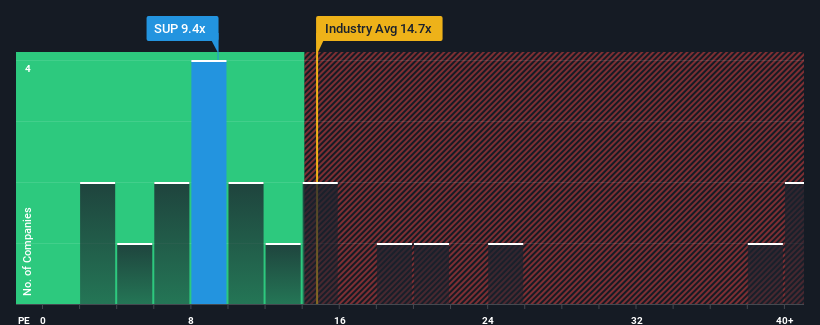

In spite of the heavy fall in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Supreme as an attractive investment with its 9.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Supreme could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Supreme

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Supreme's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 5.3% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 10% growth forecast for the broader market.

In light of this, it's understandable that Supreme's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Supreme's recently weak share price has pulled its P/E below most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Supreme's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Supreme, and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SUP

Supreme

Owns, manufactures, and distributes fast-moving branded and discounted consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives