- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Essentra And 2 Other Top Undervalued Small Caps In United Kingdom With Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic challenges. In this environment, identifying undervalued small-cap stocks with insider buying can offer potential opportunities for investors looking to navigate these turbulent times.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.8x | 5.6x | 11.55% | ★★★★★☆ |

| Essentra | 827.8x | 1.6x | 48.46% | ★★★★★☆ |

| GB Group | NA | 3.0x | 32.99% | ★★★★★☆ |

| Norcros | 7.5x | 0.5x | 2.69% | ★★★★☆☆ |

| NWF Group | 9.2x | 0.1x | 31.56% | ★★★★☆☆ |

| CVS Group | 22.3x | 1.2x | 41.00% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.8x | 39.26% | ★★★★☆☆ |

| H&T Group | 8.0x | 0.8x | -2.49% | ★★★☆☆☆ |

| Foxtons Group | 27.8x | 1.3x | 45.42% | ★★★☆☆☆ |

| Franchise Brands | 115.2x | 2.9x | 49.58% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

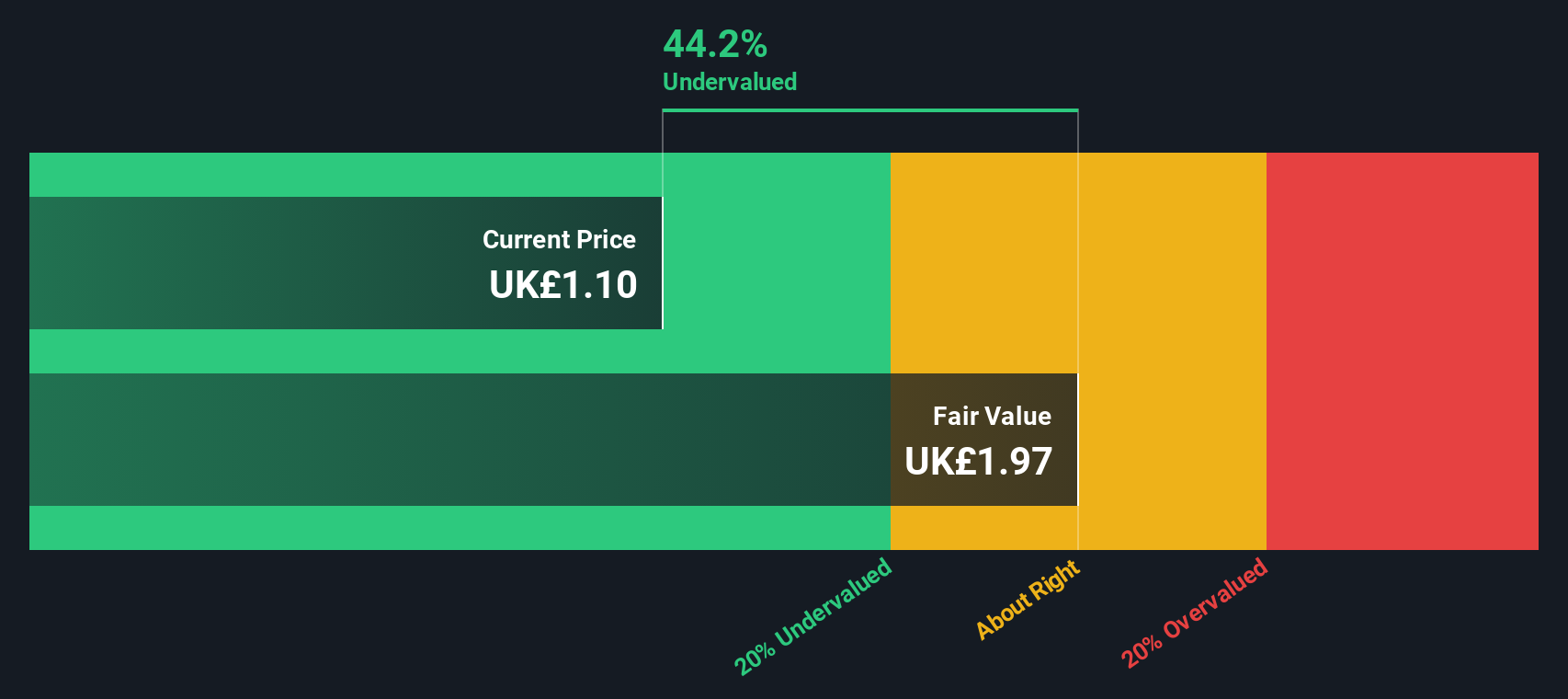

Essentra (LSE:ESNT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Essentra is a global provider of essential components and solutions, specializing in the manufacture and distribution of plastic and fiber products, with a market cap of approximately £0.98 billion.

Operations: Essentra generates revenue primarily from its core business operations, with recent quarterly revenues around £309.70 million. The company's gross profit margin has shown an upward trend, reaching 46.14% in the latest period ending August 2024.

PE: 827.8x

Essentra, a UK-based company, reported half-year sales of £159.7 million in 2024, down from £166.3 million the previous year. Net income dropped to £1.3 million from £6.9 million in the same period. Despite lower earnings per share (EPS), Essentra announced a slight interim dividend increase to 1.25 pence per share, reflecting their commitment to a progressive dividend policy. Insider confidence is evident with recent purchases by executives within the last six months, indicating potential growth and stability despite current financial challenges.

- Click here to discover the nuances of Essentra with our detailed analytical valuation report.

Understand Essentra's track record by examining our Past report.

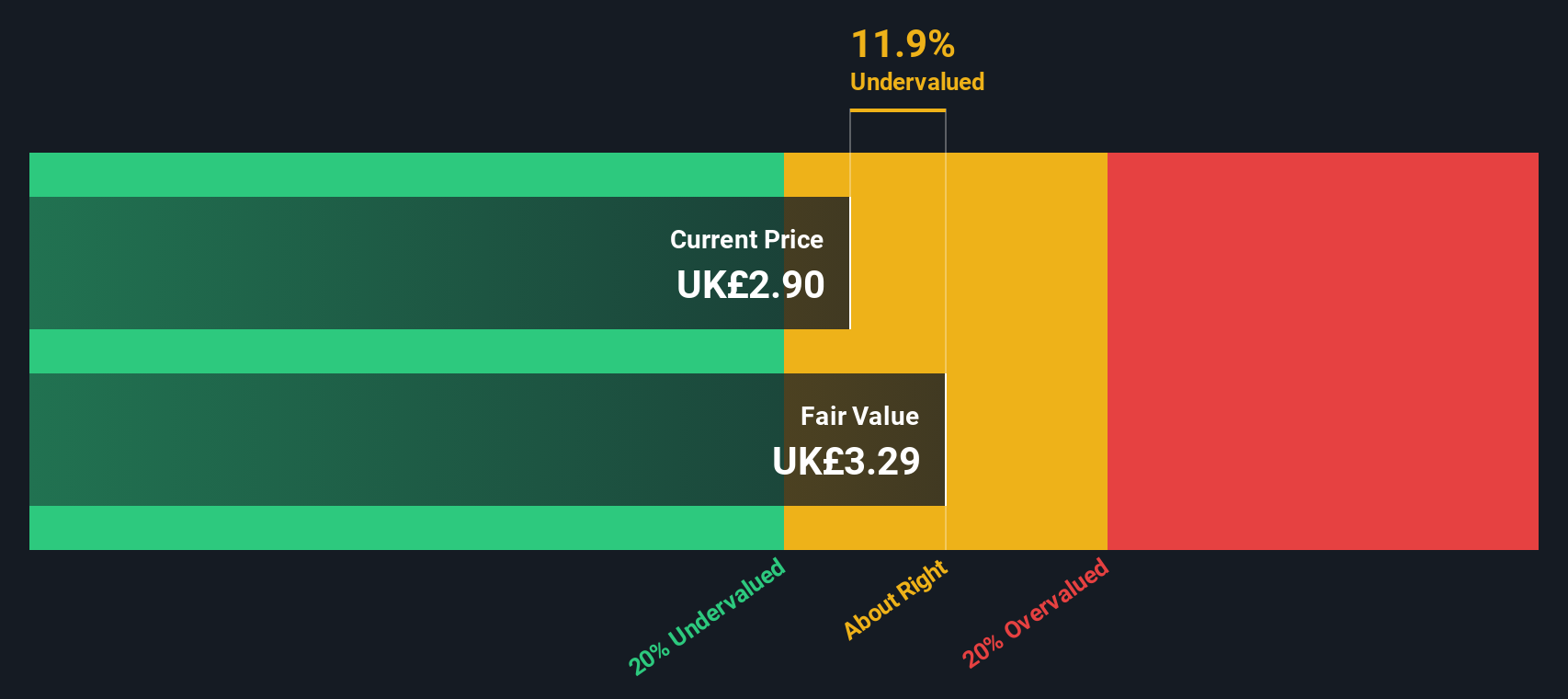

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hammerson is a property development and investment company focused on flagship destinations in the UK, France, and Ireland with a market cap of approximately £1.25 billion.

Operations: Revenue is primarily derived from flagship destinations in the UK, France, and Ireland, with notable contributions from developments. The company's gross profit margin fluctuated between 71.12% and 87.52% over recent periods.

PE: -33.5x

Hammerson, a UK-based real estate investment company, has recently arranged a EUR 350 million non-recourse term loan with PIMCO Prime Real Estate to refinance its existing EUR 570 million facility maturing in September 2024. This move extends the average debt maturity from 2.2 to 2.9 years and maintains their reported LTV at June’s level. Despite reporting a net loss of GBP 516.7 million for H1 2024, insider confidence is evident with recent share purchases by executives, indicating potential future growth and stability in the retail sector.

- Take a closer look at Hammerson's potential here in our valuation report.

Explore historical data to track Hammerson's performance over time in our Past section.

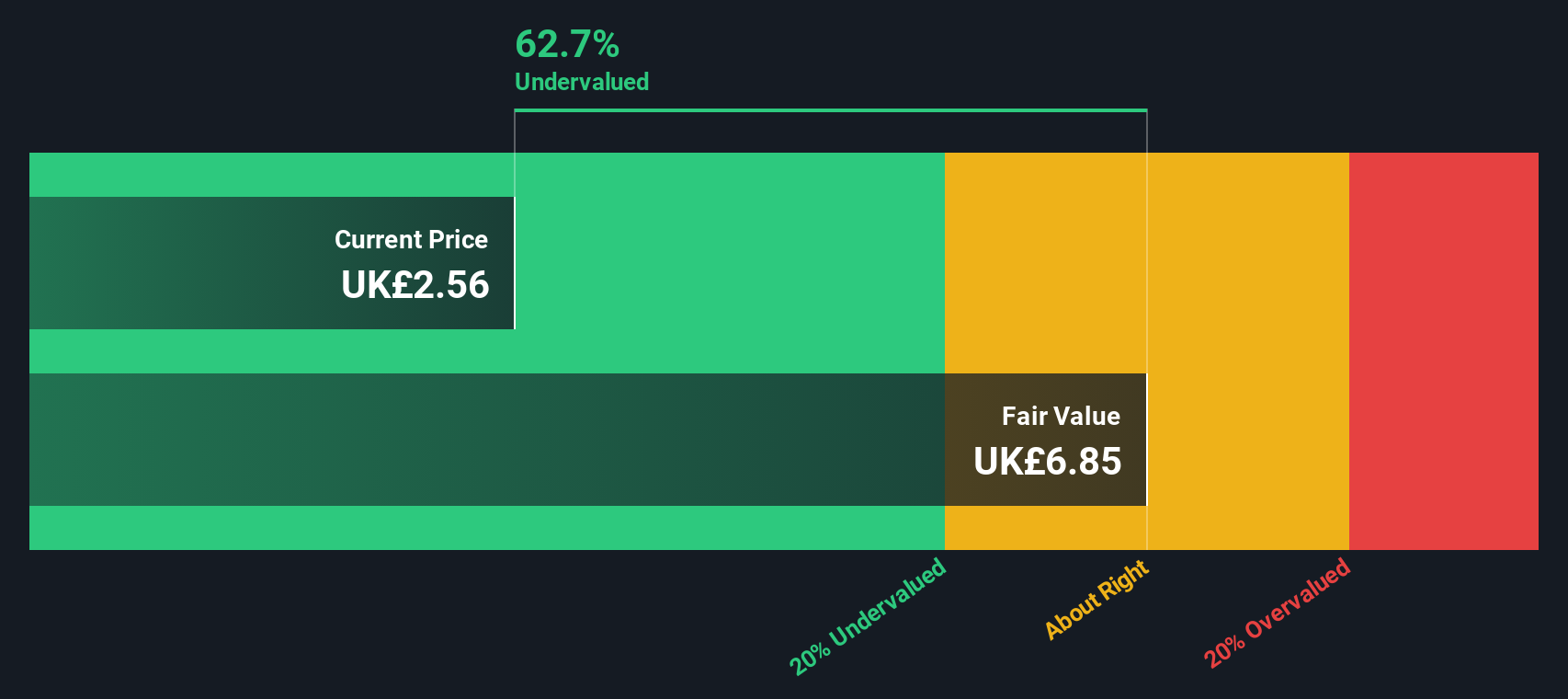

Hochschild Mining (LSE:HOC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, processing, and sale of silver and gold from its operations primarily in Peru and Argentina, with a market cap of approximately £0.55 billion.

Operations: Hochschild Mining generates revenue primarily from its Inmaculada, San Jose, and Pallancata segments, totaling $693.72 million in the most recent period. The company's gross profit margin has varied over time, reaching 26.46% recently. Operating expenses and non-operating expenses have also impacted net income results significantly.

PE: -22.5x

Hochschild Mining, a notable name in the precious metals sector, has recently seen insider confidence with CEO Eduardo Navarro purchasing 148,000 shares worth £235,320. This move increased their holdings by over 52%. Despite facing external borrowing risks for funding, the company’s earnings are projected to grow by 53.78% annually. Recent results show silver production at 5 million ounces and gold at 120 thousand ounces for H1 2024. The firm reaffirmed its annual production guidance of up to 360 thousand gold equivalent ounces.

- Dive into the specifics of Hochschild Mining here with our thorough valuation report.

Evaluate Hochschild Mining's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 28 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

High growth potential and good value.