- United Kingdom

- /

- Retail REITs

- /

- LSE:HMSO

3 Undervalued Small Caps In United Kingdom With Insider Action To Enhance Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China. This challenging environment underscores the importance of identifying resilient small-cap stocks that show potential for growth, especially those with insider action signaling confidence in their future performance.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 23.3x | 5.3x | 17.53% | ★★★★★☆ |

| C&C Group | NA | 0.4x | 48.65% | ★★★★★☆ |

| Essentra | 784.5x | 1.5x | 49.38% | ★★★★★☆ |

| GB Group | NA | 2.9x | 36.98% | ★★★★★☆ |

| Norcros | 7.8x | 0.5x | 0.25% | ★★★★☆☆ |

| NWF Group | 8.6x | 0.1x | 36.70% | ★★★★☆☆ |

| H&T Group | 7.5x | 0.7x | 12.02% | ★★★★☆☆ |

| CVS Group | 22.7x | 1.3x | 40.37% | ★★★★☆☆ |

| Sabre Insurance Group | 12.3x | 1.6x | 10.13% | ★★★☆☆☆ |

| Foxtons Group | 25.9x | 1.2x | 48.99% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

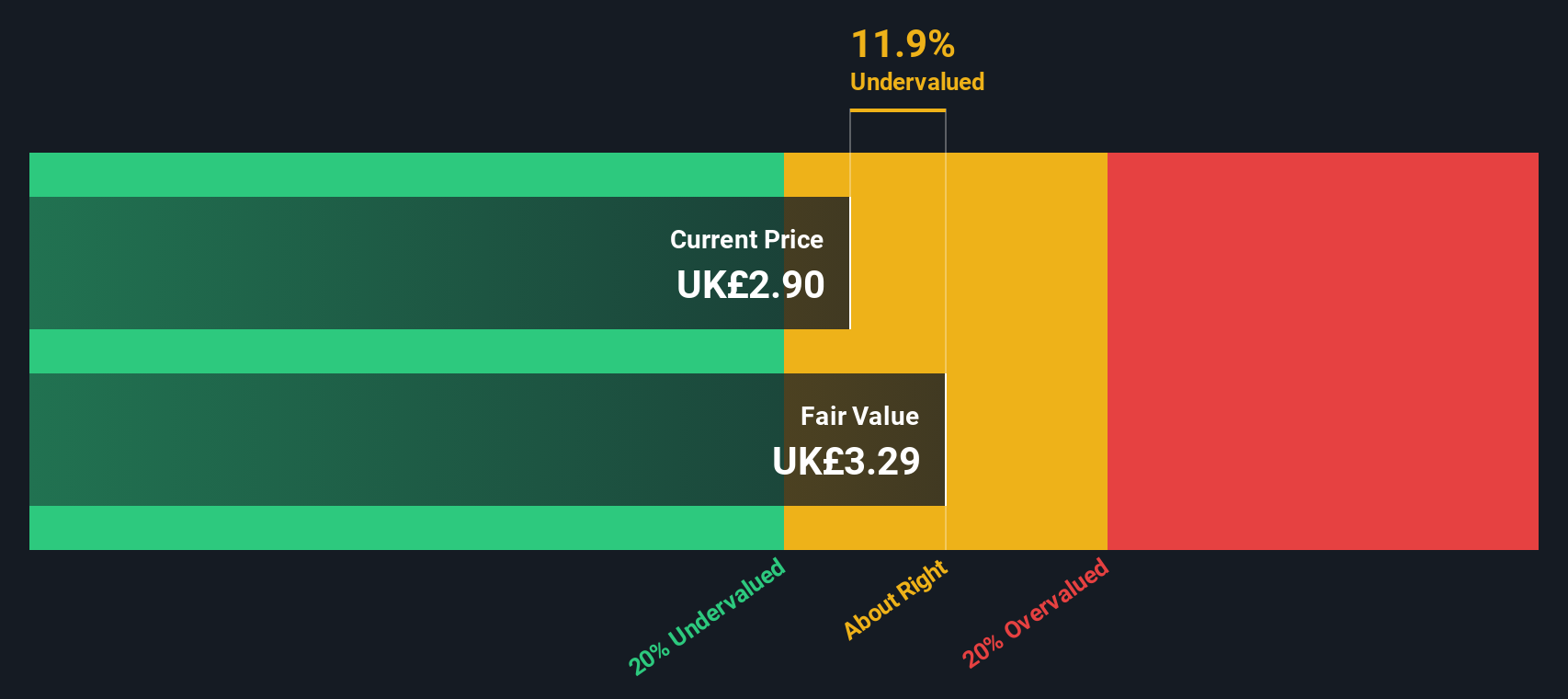

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a property development and investment company focusing on flagship destinations in the UK, France, and Ireland with a market cap of approximately £1.11 billion.

Operations: Hammerson generates revenue primarily from its flagship destinations in the UK, France, and Ireland. The company has experienced fluctuations in net income margin, reaching as high as 1.94% and falling to -7.90%. Gross profit margins have varied between 79.80% and 87.12%.

PE: -34.4x

Hammerson, a small-cap UK stock, has seen insider confidence with recent share purchases in early 2024. The company secured a €350 million non-recourse term loan for Dundrum Town Centre, extending its average debt maturity from 2.2 to 2.9 years at an interest cost of around 5.5%. Despite reporting a net loss of £516.7 million for H1 2024 and sales dropping to £40.1 million, Hammerson declared an interim dividend of £0.00756 per share payable on September 30, 2024.

- Click here to discover the nuances of Hammerson with our detailed analytical valuation report.

Understand Hammerson's track record by examining our Past report.

Rank Group (LSE:RNK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Rank Group operates a portfolio of gaming and betting venues, including Mecca bingo halls, Grosvenor Casinos, Enracha venues in Spain, and digital gaming services with a market cap of approximately £0.54 billion.

Operations: Rank Group generates revenue primarily from its Grosvenor Casinos (£331.3 million), Digital operations (£226 million), Mecca venues (£138.9 million), and Enracha Venues (£38.5 million). The company's net profit margin has shown variability, with a peak of 10.04% in June 2016 and a low of -29.43% in June 2021, reflecting fluctuations in profitability over the periods observed.

PE: 29.7x

Rank Group, a small UK-based company, reported significant financial improvements for the year ending June 30, 2024. Sales increased to £734.7 million from £681.9 million the previous year, and net income rose to £12.5 million from a net loss of £96.2 million. Basic earnings per share improved to £0.027 from a loss of £0.205 last year. Additionally, insider confidence is evident with Richard Harris purchasing 102,100 shares worth approximately £77,637 recently.

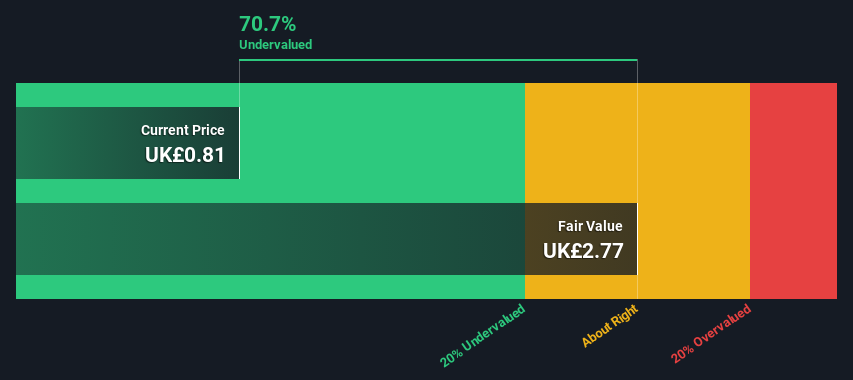

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sirius Real Estate focuses on owning and operating business parks, offices, and industrial complexes across Germany and the UK with a market cap of approximately €1.18 billion.

Operations: Sirius Real Estate generates revenue primarily from property investment, with a gross profit margin of 57.50%. The company's net income margin has shown variability, reaching as high as 97.99% and dipping to 14.76% over the observed periods.

PE: 16.3x

Sirius Real Estate recently completed a £152.5 million follow-on equity offering, issuing 159.6 million shares at £0.94 each, to fund its ongoing acquisition strategy in Germany and the UK. CEO Andrew Coombs highlighted the capital raise as a strong endorsement of their growth strategy and operational track record, with ten consecutive years of rental growth above 5% and dividend increases. The company aims to grow annual FFO to €150 million in the medium term while continuing its expansion efforts.

Seize The Opportunity

- Click here to access our complete index of 30 Undervalued UK Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammerson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HMSO

Hammerson

Hammerson is a cities business. An owner, operator and developer of prime urban real estate, with a portfolio value of £4.7billion (as at 30 June 2023), in some of the fastest growing cities in the UK, Ireland and France.

Fair value with moderate growth potential.