UK Stocks Trading At Estimated Discounts: A Trio Of Value Opportunities

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and a broader global economic slowdown. As investors navigate these uncertain conditions, identifying undervalued stocks becomes crucial for those seeking potential value opportunities amidst the current market turbulence.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| On the Beach Group (LSE:OTB) | £2.25 | £4.47 | 49.7% |

| Dr. Martens (LSE:DOCS) | £0.6565 | £1.22 | 46.4% |

| Gaming Realms (AIM:GMR) | £0.372 | £0.67 | 44.7% |

| Legal & General Group (LSE:LGEN) | £2.447 | £4.86 | 49.6% |

| Victrex (LSE:VCT) | £9.24 | £18.17 | 49.1% |

| Deliveroo (LSE:ROO) | £1.362 | £2.46 | 44.7% |

| Likewise Group (AIM:LIKE) | £0.195 | £0.37 | 47.7% |

| Calnex Solutions (AIM:CLX) | £0.555 | £1.01 | 45.2% |

| Optima Health (AIM:OPT) | £1.825 | £3.34 | 45.3% |

| Melrose Industries (LSE:MRO) | £6.41 | £12.22 | 47.5% |

Let's explore several standout options from the results in the screener.

Gamma Communications (AIM:GAMA)

Overview: Gamma Communications plc, with a market cap of £1.26 billion, offers technology-based communications and software services to businesses of various sizes across the United Kingdom and Europe.

Operations: The company's revenue segments include £78.50 million from European operations, £373.10 million from Gamma Business, and £119.90 million from Gamma Enterprise.

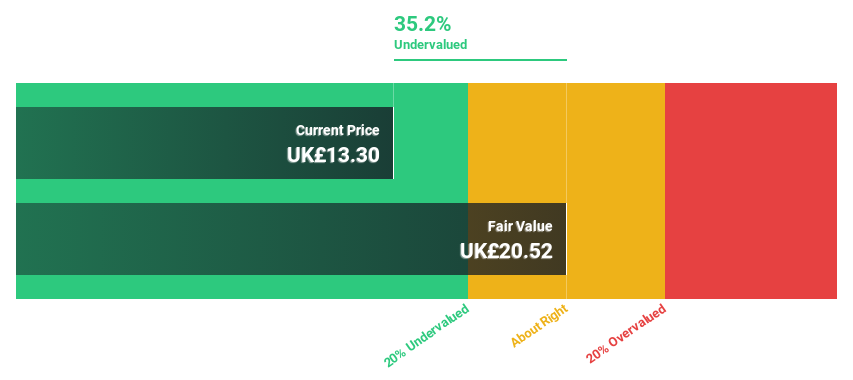

Estimated Discount To Fair Value: 35.7%

Gamma Communications is trading at £13.2, significantly below its estimated fair value of £20.52, presenting a potential undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow at 14.16% annually, outpacing the UK market's growth rate of 14%. While revenue growth is moderate at 6.7% per year, it surpasses the broader market's forecasted revenue increase of 3.8%. Analysts expect a stock price rise by approximately 40%.

- In light of our recent growth report, it seems possible that Gamma Communications' financial performance will exceed current levels.

- Get an in-depth perspective on Gamma Communications' balance sheet by reading our health report here.

Savills (LSE:SVS)

Overview: Savills plc is a global real estate services provider operating across the United Kingdom, Continental Europe, Asia Pacific, Africa, North America, and the Middle East with a market cap of £1.41 billion.

Operations: The company's revenue segments include Consultancy (£464.80 million), Transaction Advisory (£803.60 million), Investment Management (£100.50 million), and Property and Facilities Management (£920.90 million).

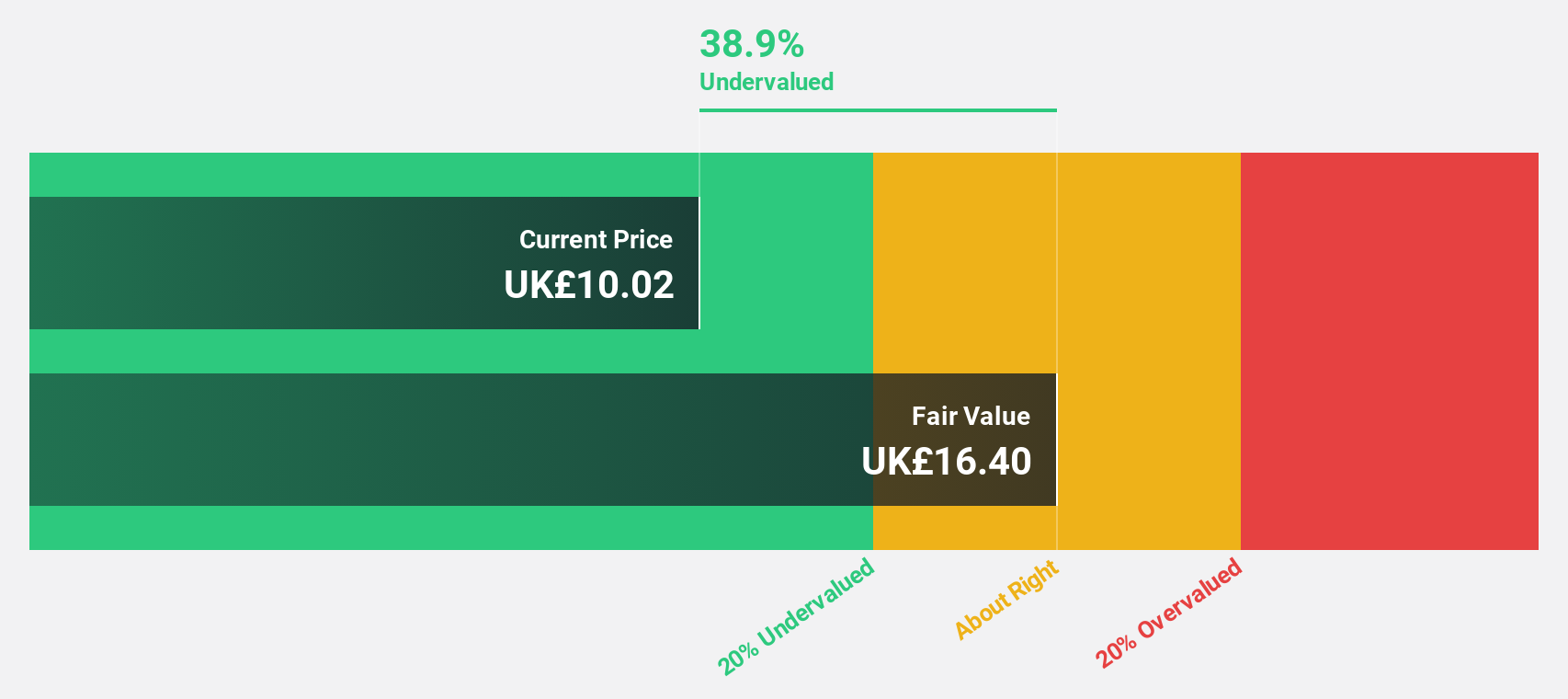

Estimated Discount To Fair Value: 13.2%

Savills is trading at £10.4, slightly below its estimated fair value of £11.98, indicating a modest undervaluation based on cash flows. Earnings are forecast to grow significantly at 32.66% annually, well above the UK market average of 14%, though revenue growth remains moderate at 5.1% per year. Recent executive changes with experienced hires like James Hiatt may enhance investment opportunities in central London, potentially impacting future cash flow positively despite an unstable dividend history and lower profit margins compared to last year.

- Our growth report here indicates Savills may be poised for an improving outlook.

- Navigate through the intricacies of Savills with our comprehensive financial health report here.

Vp (LSE:VP.)

Overview: Vp plc offers equipment rental and associated services both in the United Kingdom and internationally, with a market cap of £220.98 million.

Operations: The company's revenue segments include £339.21 million from the United Kingdom and £43.35 million from international operations.

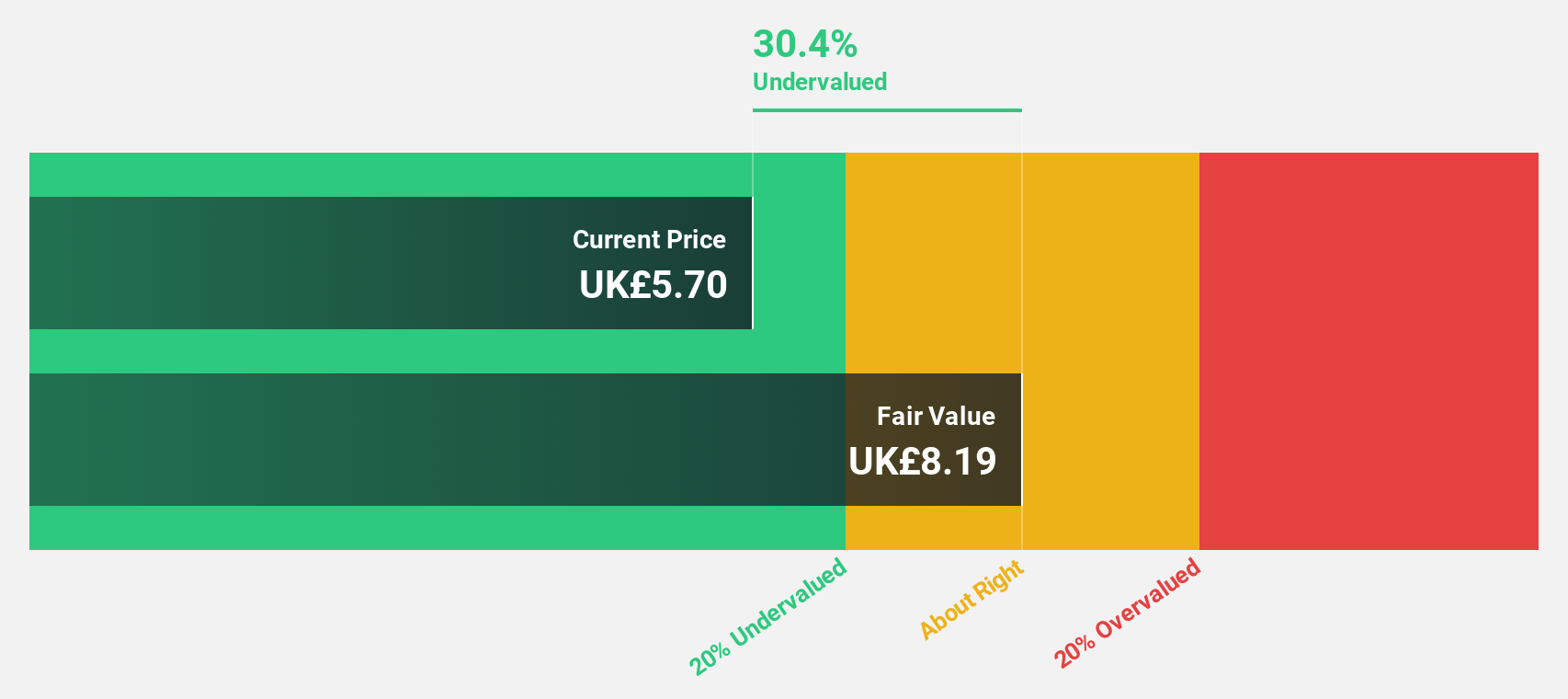

Estimated Discount To Fair Value: 41%

Vp is trading at £5.6, significantly below its estimated fair value of £9.5, presenting a strong undervaluation based on cash flows. Despite its high debt levels and unsustainable 6.96% dividend, Vp is expected to achieve profitability within three years with earnings projected to grow at 55.72% annually, surpassing market averages. The recent appointment of Richard Smith as a non-executive director may bolster strategic oversight as he brings substantial growth experience from his tenure at Unite Group plc.

- Our expertly prepared growth report on Vp implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Vp.

Turning Ideas Into Actions

- Delve into our full catalog of 57 Undervalued UK Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GAMA

Gamma Communications

Provides technology-based communications and software services to small, medium, and large-sized organizations in the United Kingdom, rest of Europe, and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives