- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN): Unpacking Valuation After Strong Share Price Gains and Long-Term Growth Signals

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) shares have continued to attract attention this week. The stock has shown steady gains over the past month, rising about 5%, supported by consistent revenue and earnings growth over recent quarters.

See our latest analysis for AstraZeneca.

AstraZeneca’s share price momentum has turned heads lately, as the stock climbed strongly over the past three months and posted a 26.7% share price return year-to-date. With a one-year total shareholder return of 37.7%, recent gains are adding to a solid long-term track record, suggesting investors see both growth potential and resilience here.

If healthcare’s strength has you looking for more, the full list of major players is just a click away. Explore See the full list for free.

But with shares nearing analyst price targets and a strong year-to-date rally, investors face a familiar question: is AstraZeneca still undervalued, or has the market already priced in its future growth potential?

Most Popular Narrative: 6.7% Undervalued

AstraZeneca’s current market price of £134.66 sits below the narrative’s fair value estimate, suggesting room for upside if growth targets are met. This sets up a critical question: can the company deliver on ambitious projections reflected in this valuation?

The company's robust and diversified late-stage pipeline, particularly in oncology, rare diseases, and cardiovascular/metabolic therapies, is set to deliver multiple blockbuster launches over the next several years. Management estimates these new medicines could generate $10+ billion in peak risk-adjusted revenue, directly supporting both long-term high-margin revenue growth and future earnings expansion.

Curious about which pipeline breakthroughs and future financial leaps drive this bold price target? Beneath the surface, a mix of aggressive earnings projections and premium multiples underpin the narrative’s confidence. Uncover the numbers behind the hype and see what makes this fair value so compelling.

Result: Fair Value of $144.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Pressures from looming patent expiries and intensifying biosimilar competition could quickly challenge AstraZeneca's impressive recent momentum.

Find out about the key risks to this AstraZeneca narrative.

Another View: The Multiples Approach

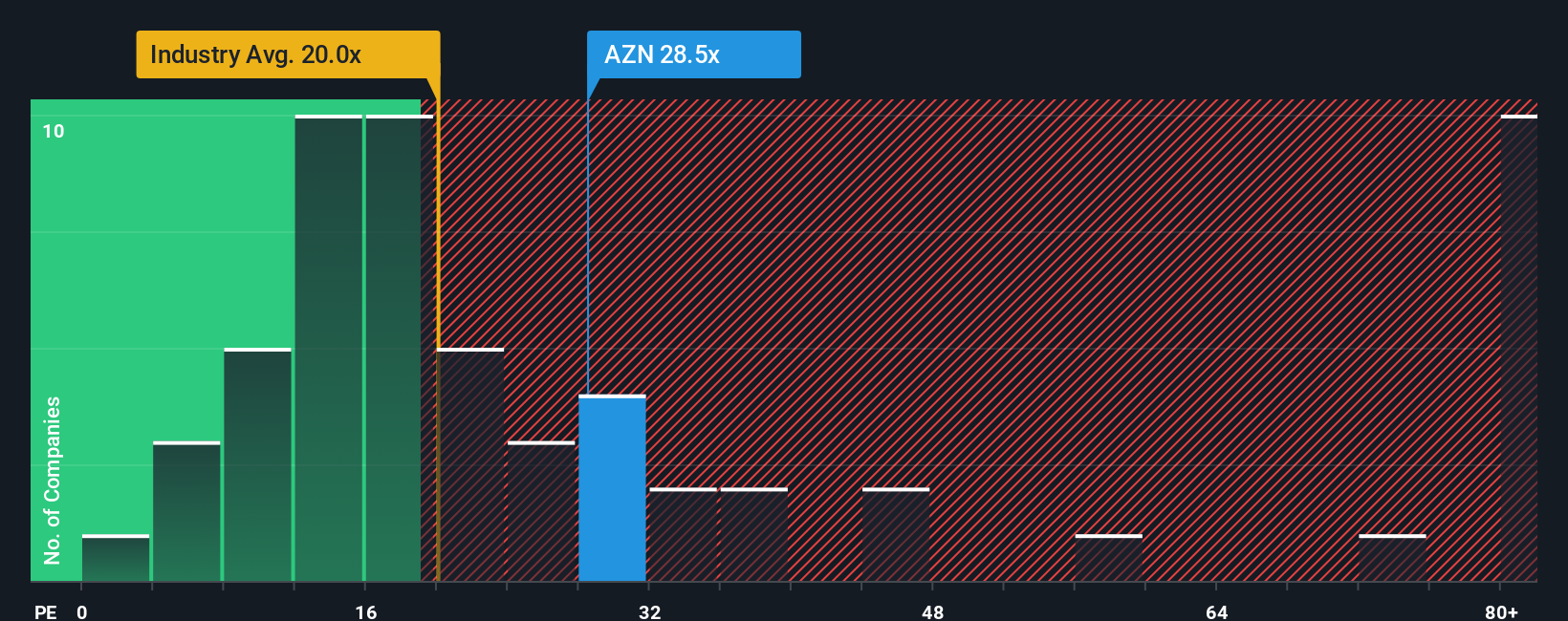

While narrative-based valuation paints AstraZeneca as undervalued, the market's go-to price-to-earnings ratio tells a different story. AstraZeneca trades at 28.5 times earnings, significantly higher than the peer average of 13x and the European industry’s 23.6x. This premium signals investor confidence, but it also raises the risk that expectations are already built in, and the shares may be expensive at current levels. Could the fair ratio of 31.3x suggest room for further upside, or should investors be wary of paying too much for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AstraZeneca Narrative

If you see things differently or want to dive into the numbers on your own, it’s easy to craft your personal AstraZeneca narrative in just minutes. Do it your way

A great starting point for your AstraZeneca research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let other smart opportunities pass you by. Take control of your investing game and uncover standout stocks that match your goals right now.

- Tap into big future trends and check out these 24 AI penny stocks, setting the pace for artificial intelligence innovation.

- Target high yields and secure consistent returns as you browse these 16 dividend stocks with yields > 3%, paying over 3% annually.

- Catch undervalued businesses trading below intrinsic value with these 871 undervalued stocks based on cash flows before the rest of the market notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives