Stock Analysis

- United Kingdom

- /

- Metals and Mining

- /

- AIM:ZNWD

November 2024 UK Exchange's Top Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and broader global economic concerns. Despite these headwinds, investors continue to seek opportunities in various segments of the market. Penny stocks, although considered a somewhat outdated term, remain an intriguing area for investment as they often represent smaller or newer companies that can offer growth potential when supported by strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.75 | £372.96M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.15M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £354.36M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.84 | £63.62M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.625 | £189.49M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.316 | £202.97M | ★★★★★☆ |

| Alumasc Group (AIM:ALU) | £3.01 | £108.25M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.60 | £278.36M | ★★★★★★ |

| Billington Holdings (AIM:BILN) | £4.40 | £54.31M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Plexus Holdings (AIM:POS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Plexus Holdings plc, along with its subsidiaries, supplies equipment and services to the oil and gas industry in the UK and Europe, with a market cap of £9.75 million.

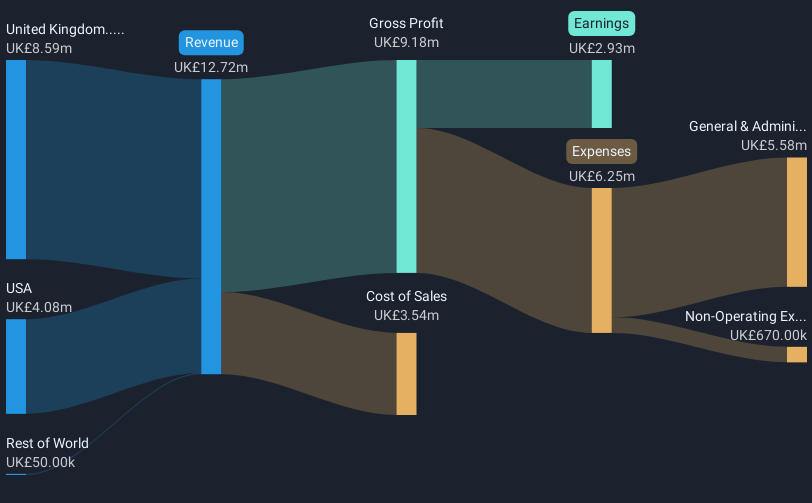

Operations: The company generates revenue of £12.72 million from its Oil Well Equipment & Services segment.

Market Cap: £9.75M

Plexus Holdings has shown significant improvement, transitioning from a net loss to a net income of £2.93 million for the year ended June 30, 2024, with revenues increasing substantially to £12.72 million. Despite its low return on equity at 19%, the company benefits from strong interest coverage and cash flow that exceeds its debt obligations. However, shareholders experienced dilution over the past year and the stock remains highly volatile. The management team is relatively new, which could impact strategic direction in the short term. Earnings are forecasted to decline significantly over the next three years despite recent profitability gains.

- Unlock comprehensive insights into our analysis of Plexus Holdings stock in this financial health report.

- Gain insights into Plexus Holdings' outlook and expected performance with our report on the company's earnings estimates.

Zinc Media Group (AIM:ZIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zinc Media Group plc, along with its subsidiaries, produces television and cross-platform content both in the United Kingdom and internationally, with a market cap of £13.45 million.

Operations: The company generates revenue through its Television segment (£21.35 million) and Content Production segment (£15.27 million).

Market Cap: £13.45M

Zinc Media Group plc, with a market cap of £13.45 million, faces challenges as it remains unprofitable and reported a net loss of £2.61 million for the half year ended June 30, 2024. Despite this, the company has secured significant new production contracts worth £4 million and recommissioned popular series such as "Bargain Loving Brits in the Sun" and "Rob & Rylan's Passage to India," which bolster its revenue prospects across fiscal years 2024 and 2025. Shareholders experienced dilution over the past year; however, Zinc maintains more cash than debt and has a sufficient cash runway for over three years.

- Dive into the specifics of Zinc Media Group here with our thorough balance sheet health report.

- Gain insights into Zinc Media Group's future direction by reviewing our growth report.

Zinnwald Lithium (AIM:ZNWD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zinnwald Lithium Plc is a mineral exploration and development company focused on lithium projects in the United Kingdom and Germany, with a market cap of £37.49 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration and development company.

Market Cap: £37.49M

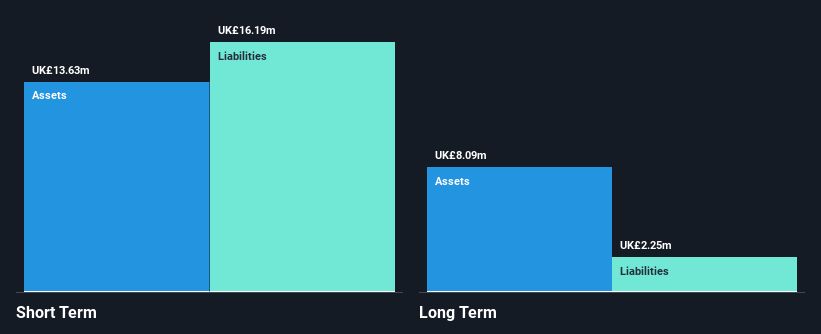

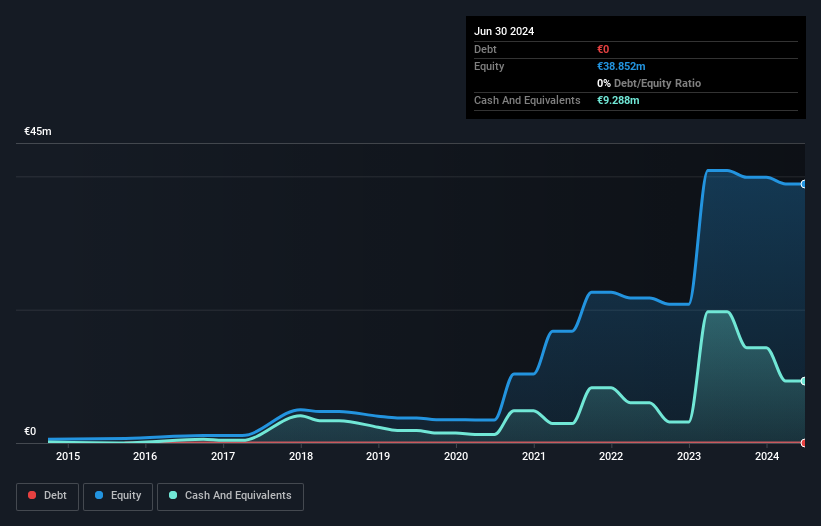

Zinnwald Lithium Plc, with a market cap of £37.49 million, is pre-revenue and remains unprofitable, reporting a net loss of €1.23 million for the half year ended June 30, 2024. The company has no debt and its short-term assets (€9.8M) exceed both short- and long-term liabilities significantly. However, it faces challenges with less than a year of cash runway if current free cash flow trends persist. Despite these hurdles, Zinnwald's revenue is forecast to grow at over 40% annually, indicating potential future growth as it develops its lithium projects in the UK and Germany.

- Click here to discover the nuances of Zinnwald Lithium with our detailed analytical financial health report.

- Learn about Zinnwald Lithium's future growth trajectory here.

Key Takeaways

- Access the full spectrum of 466 UK Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zinnwald Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ZNWD

Zinnwald Lithium

Operates as a mineral exploration and development company in the United Kingdom and Germany.