- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Top 3 UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has dropped 1.2%. As for the longer term, the market has risen by 7.2% in the last year with earnings expected to grow by 14% per annum over the next few years. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Petrofac (LSE:PFC) | 16.6% | 124% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Underneath we present a selection of stocks filtered out by our screen.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £810.92 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated $189.27 million.

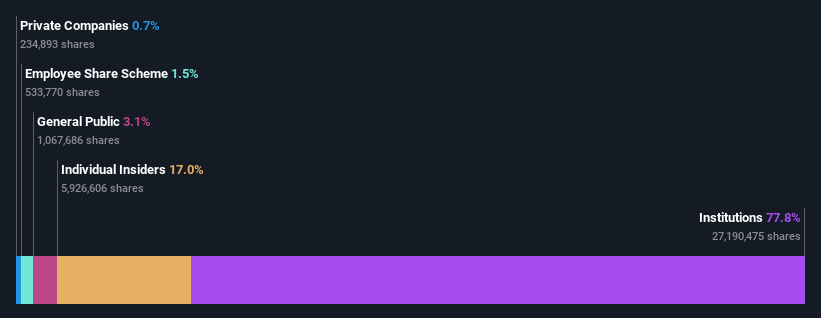

Insider Ownership: 17%

Earnings Growth Forecast: 25.6% p.a.

Craneware, a UK growth company with high insider ownership, is forecast to see annual earnings growth of 25.6% over the next three years, outpacing the broader UK market. Recent earnings reports show revenue increased to US$189.27 million and net income rose to US$11.7 million for the fiscal year ended June 2024. The company is actively seeking acquisitions to bolster its portfolio and recently partnered with Microsoft Azure to enhance its cloud capabilities and AI applications in healthcare analytics.

- Take a closer look at Craneware's potential here in our earnings growth report.

- Our valuation report here indicates Craneware may be overvalued.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £866.35 million.

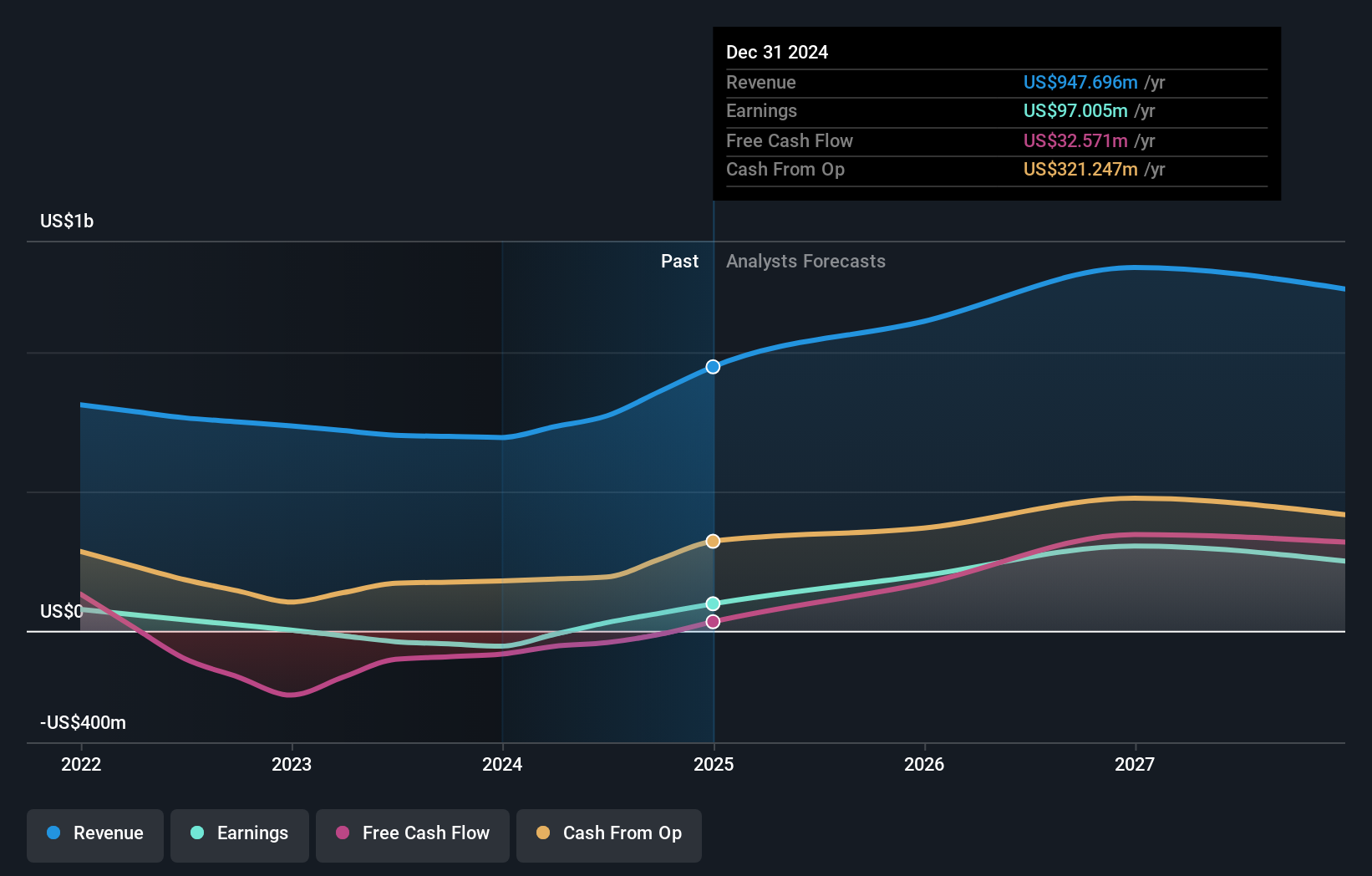

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 43.9% p.a.

Hochschild Mining, with significant insider ownership, has shown a strong turnaround by reporting a net income of US$39.52 million for H1 2024, reversing a loss from the previous year. The company's earnings are forecast to grow at 43.9% annually over the next three years, outpacing the UK market's growth rate. Despite high debt levels and large one-off items affecting financial results, Hochschild's revenue is expected to grow faster than the broader market.

- Get an in-depth perspective on Hochschild Mining's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Hochschild Mining's share price might be on the cheaper side.

Stelrad Group (LSE:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £198.67 million.

Operations: Revenue from the manufacture and distribution of radiators is £294.27 million.

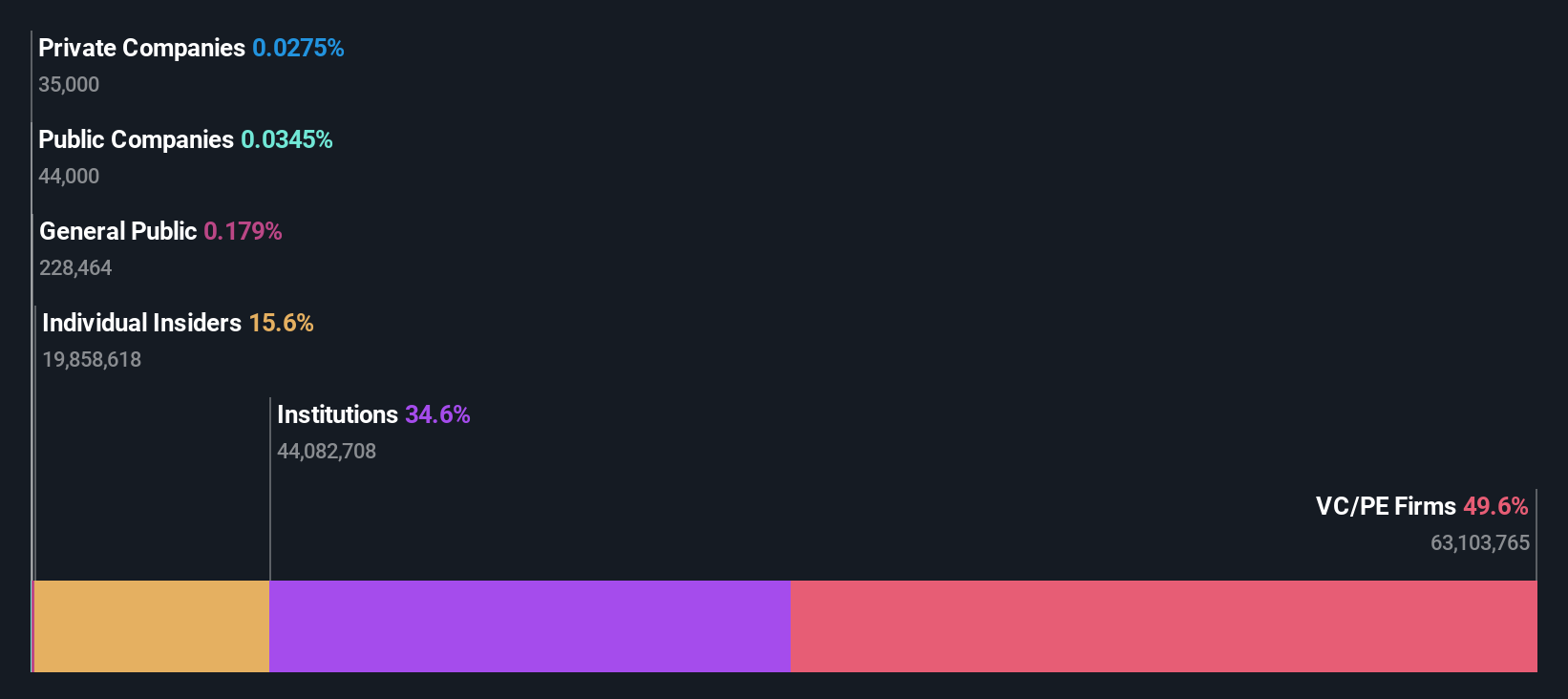

Insider Ownership: 15.6%

Earnings Growth Forecast: 14.5% p.a.

Stelrad Group, with substantial insider ownership, reported H1 2024 earnings of £8.02 million on sales of £143.12 million, showing stable profit amidst a slight revenue decline. Forecasted earnings growth at 14.5% annually outpaces the UK market, though revenue growth is modest at 5.2% per year. Recent executive changes and a dividend increase to 2.98 pence per share highlight ongoing strategic adjustments despite high debt levels and significant insider selling in the past quarter.

- Dive into the specifics of Stelrad Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Stelrad Group is priced lower than what may be justified by its financials.

Where To Now?

- Click here to access our complete index of 64 Fast Growing UK Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.