- United Kingdom

- /

- Renewable Energy

- /

- AIM:YU.

Discovering Hidden UK Stock Gems In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has dropped 1.2%, while the Utilities sector has gained 3.5%. Despite this recent dip, the market has risen by 7.2% over the past year, with earnings forecast to grow by 14% annually. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding. This article will explore three such hidden gems in the UK stock market for September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

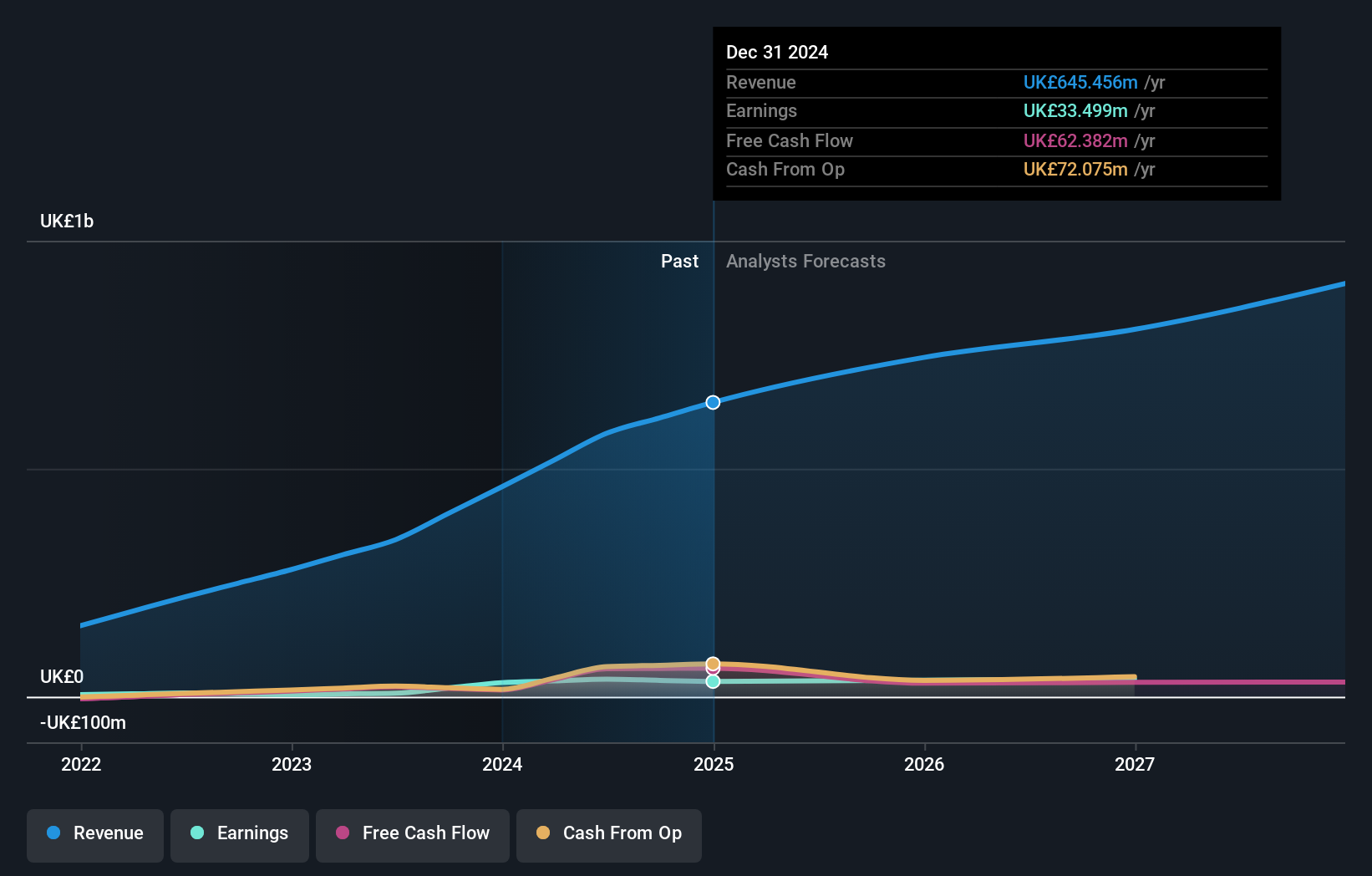

Overview: Yü Group PLC, with a market cap of £265.19 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: The company's primary revenue streams include Retail (£459.80 million) and Smart (£5.56 million), with a minor contribution from Metering Assets (£0.08 million).

Yü Group, a small cap player in the UK, has seen earnings grow by 547.1% over the past year, outpacing the Renewable Energy sector's -13.6%. Trading at 66.7% below its estimated fair value, it offers good relative value compared to peers and industry standards. The debt-to-equity ratio increased from 0% to 0.8% over five years, but with more cash than total debt and positive free cash flow, financial stability seems strong despite recent share price volatility.

Alfa Financial Software Holdings (LSE:ALFA)

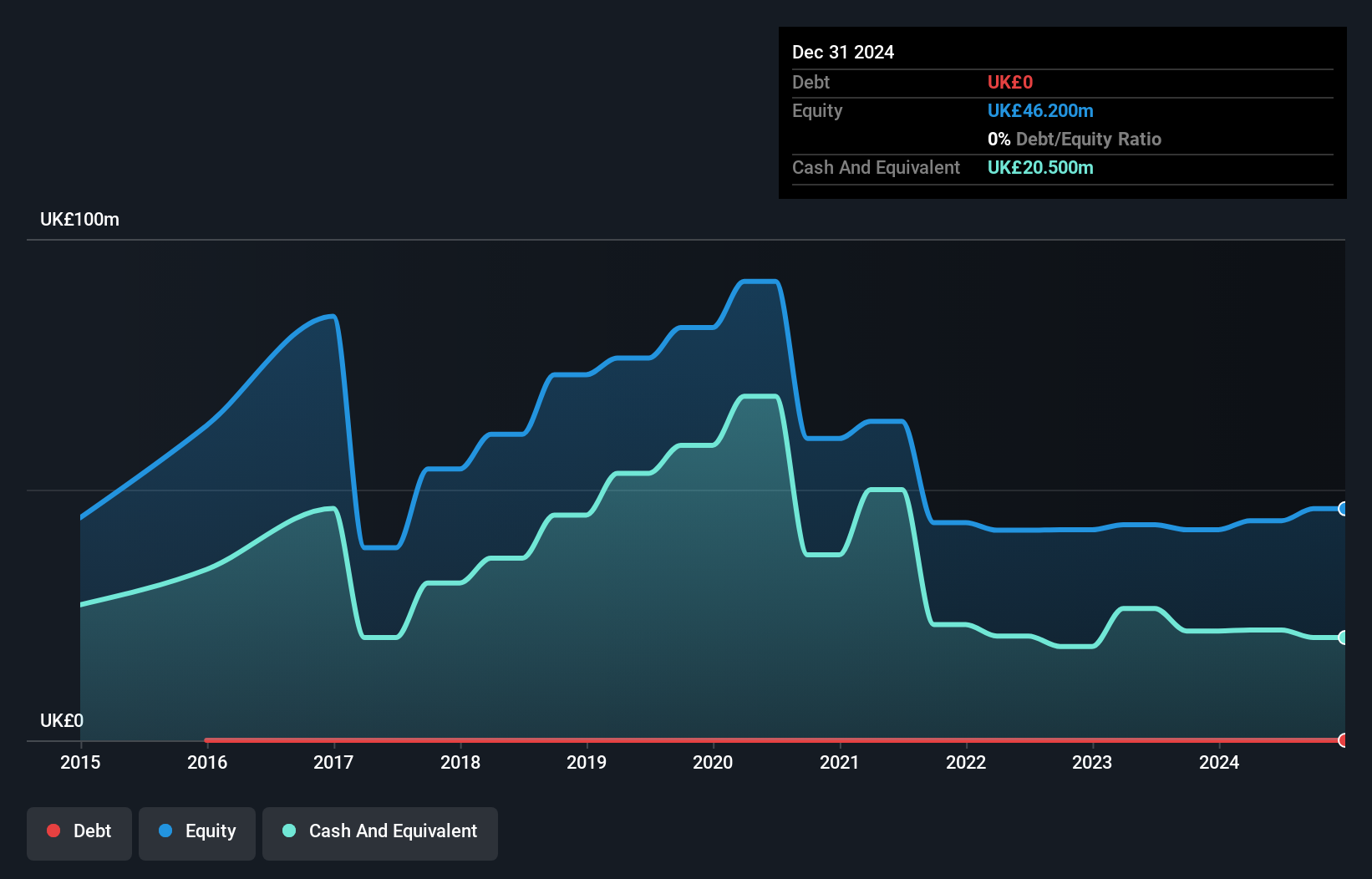

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC, with a market cap of £658.11 million, provides software and consultancy services to the auto and equipment finance industry across the United Kingdom, the United States, Europe, the Middle East, Africa, and internationally.

Operations: Alfa Financial Software Holdings generates revenue primarily from the sale of software and related services, totaling £101.40 million.

Alfa Financial Software Holdings, a debt-free entity, trades at a price-to-earnings ratio of 29.8x, below the industry average of 37.4x. Despite high-quality past earnings, recent performance shows net income of GBP 11.9 million for H1 2024 compared to GBP 13.3 million last year and basic earnings per share dropping to GBP 0.0405 from GBP 0.0452. Notably, Alfa declared a special dividend of 4.2 pence per share recently and is forecasted to grow earnings by around 6% annually.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

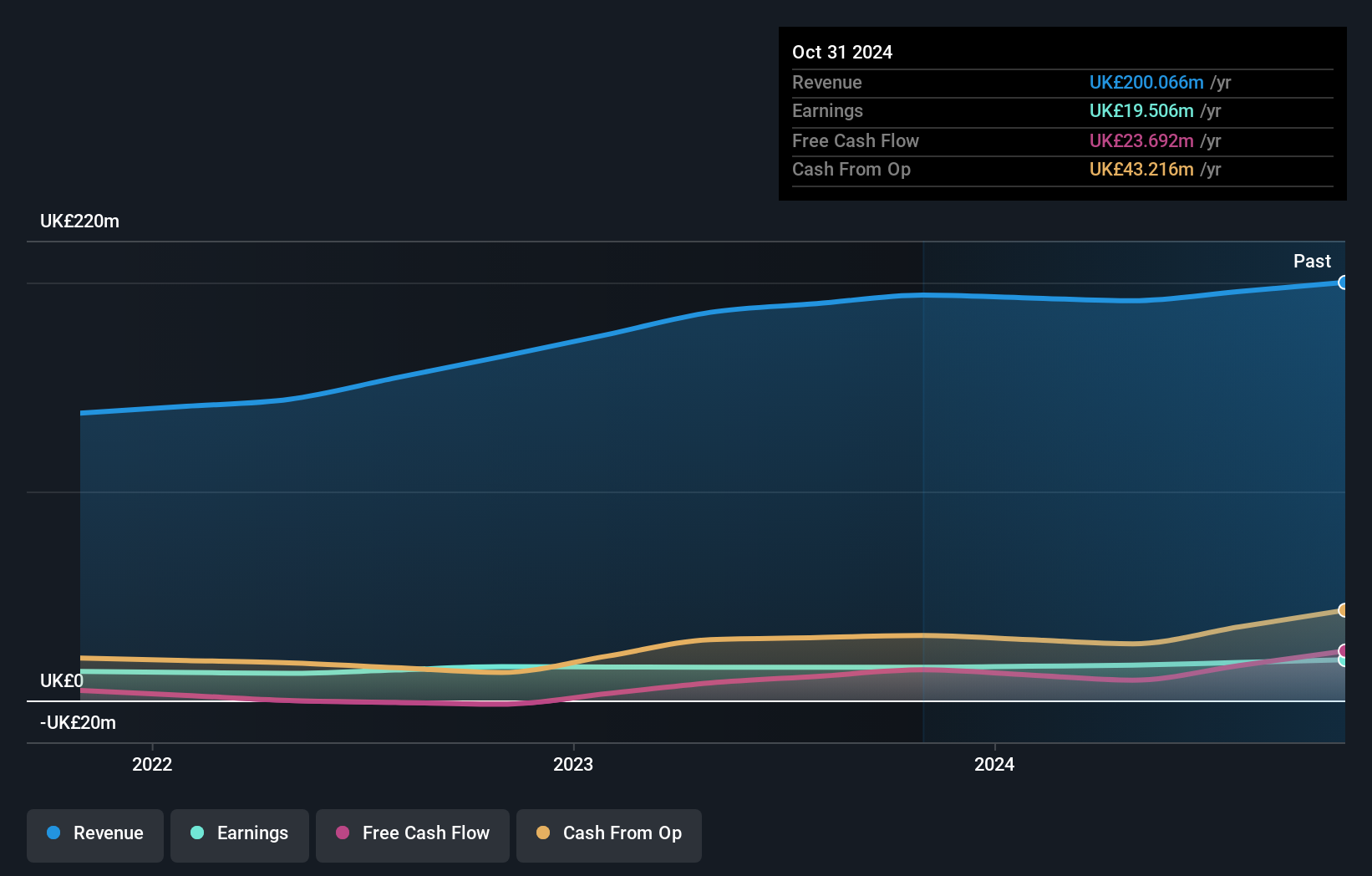

Overview: Goodwin PLC, with a market cap of £569.23 million, provides mechanical and refractory engineering solutions primarily in the United Kingdom, rest of Europe, the United States, the Pacific Basin, and internationally.

Operations: Goodwin PLC generates revenue primarily from its Mechanical Engineering segment (£156.94 million) and Refractory Engineering segment (£75.86 million).

Goodwin has shown solid performance, with earnings growing by 6.3% over the past year, outpacing the Machinery industry’s -4.7%. The company's net debt to equity ratio stands at a satisfactory 25.9%, although it has increased from 26.2% to 52.2% over five years. Interest payments are well covered by EBIT at a multiple of 9.8x, indicating financial stability despite recent share price volatility and its addition to several FTSE indices in July 2024 suggests market confidence in its future prospects.

- Click to explore a detailed breakdown of our findings in Goodwin's health report.

Evaluate Goodwin's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 82 UK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YU.

Yü Group

Through its subsidiaries, supplies energy and utility solutions primarily in the United Kingdom.

Outstanding track record and undervalued.