- United Kingdom

- /

- Hospitality

- /

- LSE:EVOK

Discover 3 UK Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery and its impact on global trade. As investors navigate these challenging conditions, identifying growth companies with significant insider ownership can provide valuable insights into potential resilience and confidence in future prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Foresight Group Holdings (LSE:FSG) | 34% | 25.7% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| Judges Scientific (AIM:JDG) | 10.6% | 25.3% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| PensionBee Group (LSE:PBEE) | 38.8% | 67.7% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Here's a peek at a few of the choices from the screener.

Henry Boot (LSE:BOOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £307.37 million.

Operations: The company's revenue segments are comprised of £87.90 million from construction, £28.37 million from land promotion, and £170.56 million from property investment and development.

Insider Ownership: 31.2%

Earnings Growth Forecast: 25.5% p.a.

Henry Boot demonstrates potential as a growth company with high insider ownership in the UK, despite recent challenges. The company's earnings are forecast to grow significantly at 25.5% annually, outpacing the broader UK market. However, recent financial results showed a decline in sales and net income compared to last year. Trading below estimated fair value by 21.4%, its revenue is expected to grow faster than the market average but remains below high-growth benchmarks.

- Click here to discover the nuances of Henry Boot with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Henry Boot's current price could be inflated.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

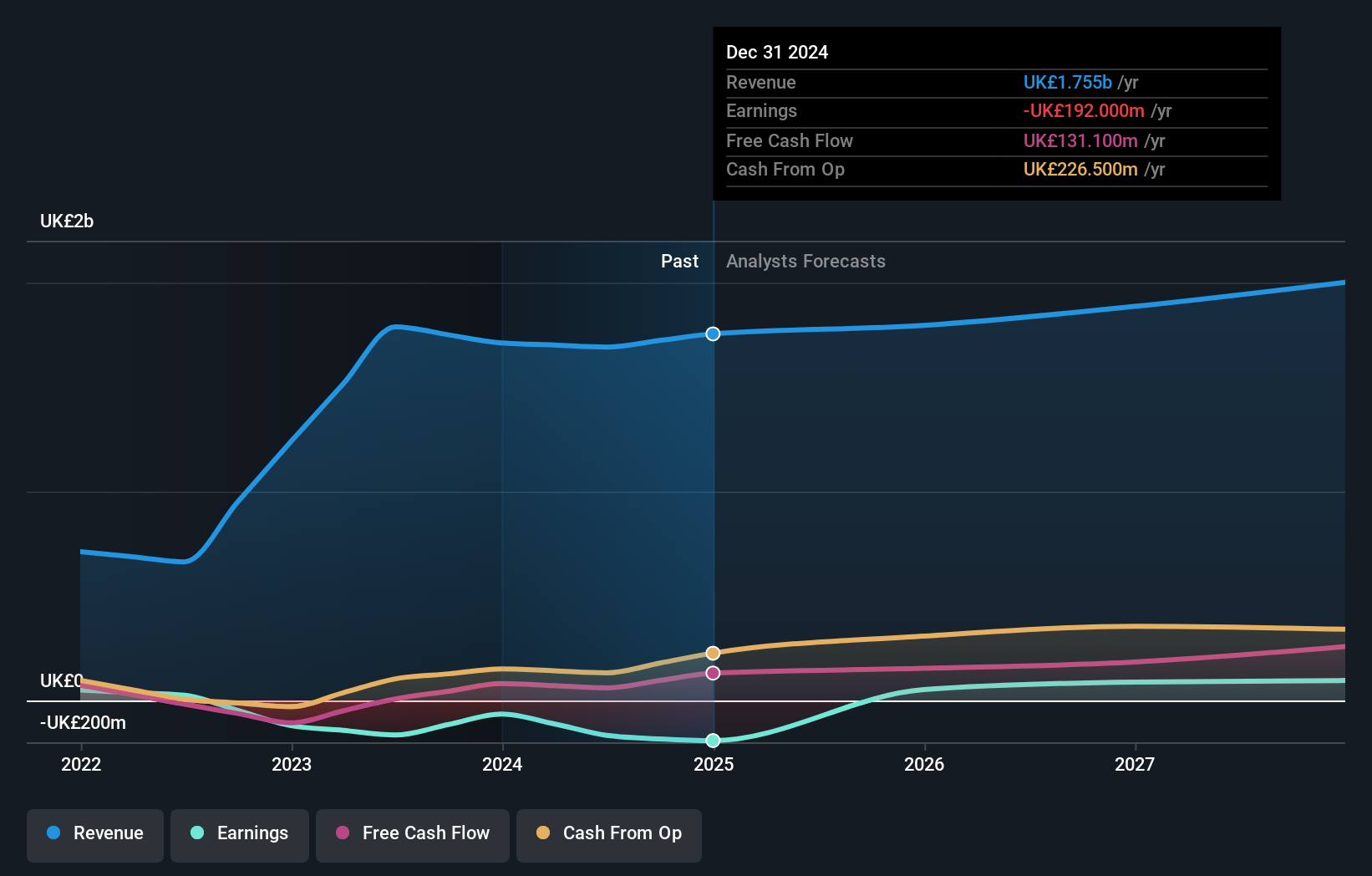

Overview: Evoke plc, with a market cap of £274.88 million, offers online betting and gaming products and solutions across the United Kingdom, Ireland, Italy, Spain, and internationally.

Operations: The company's revenue is primarily derived from three segments: Retail (£514 million), UK&I Online (£661.20 million), and International (£516.10 million).

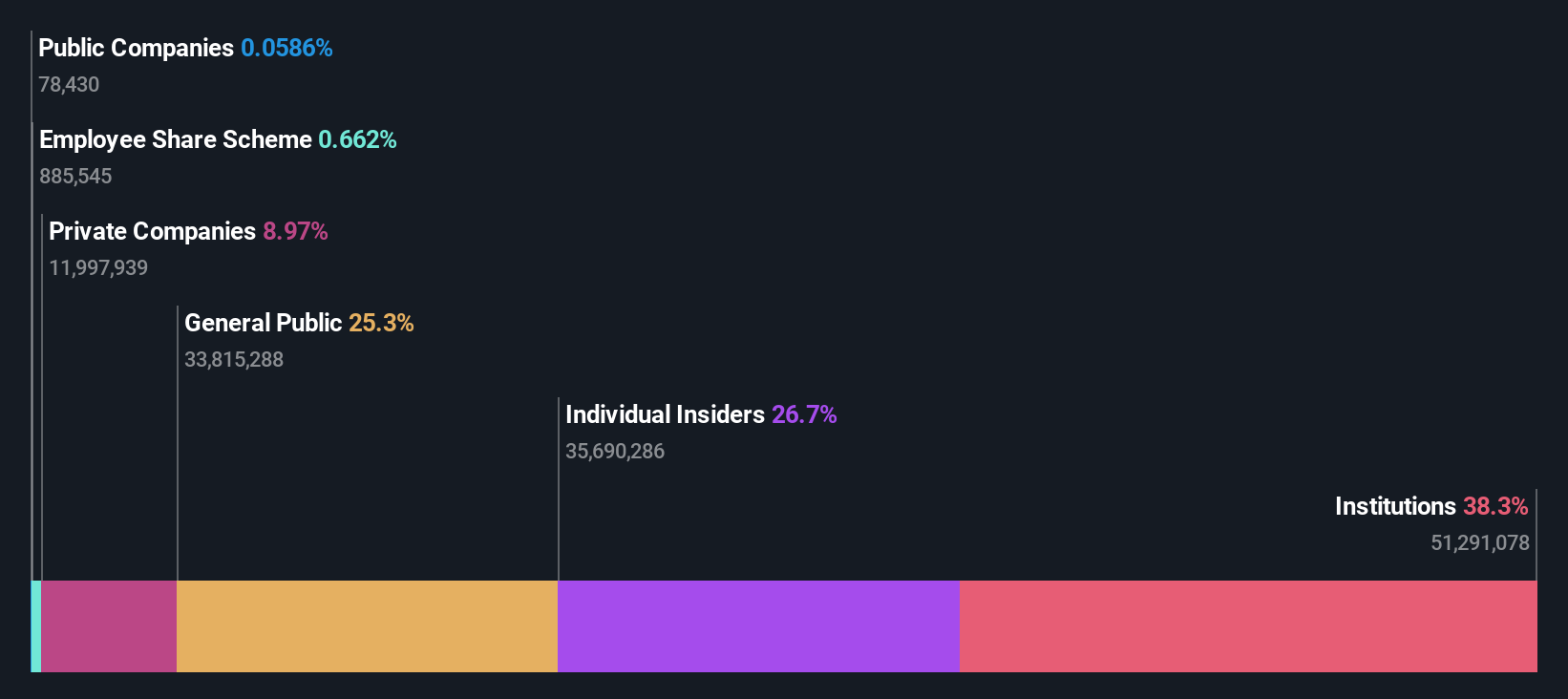

Insider Ownership: 20.5%

Earnings Growth Forecast: 98.3% p.a.

Evoke plc shows potential for growth with high insider ownership, despite a volatile share price and negative shareholders' equity. The company is trading significantly below its estimated fair value and is expected to become profitable in the next three years, with earnings forecasted to grow at 98.35% annually. Recent third-quarter revenue of £417 million marked the first year-over-year growth since early 2022, supported by international market gains.

- Get an in-depth perspective on Evoke's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Evoke shares in the market.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

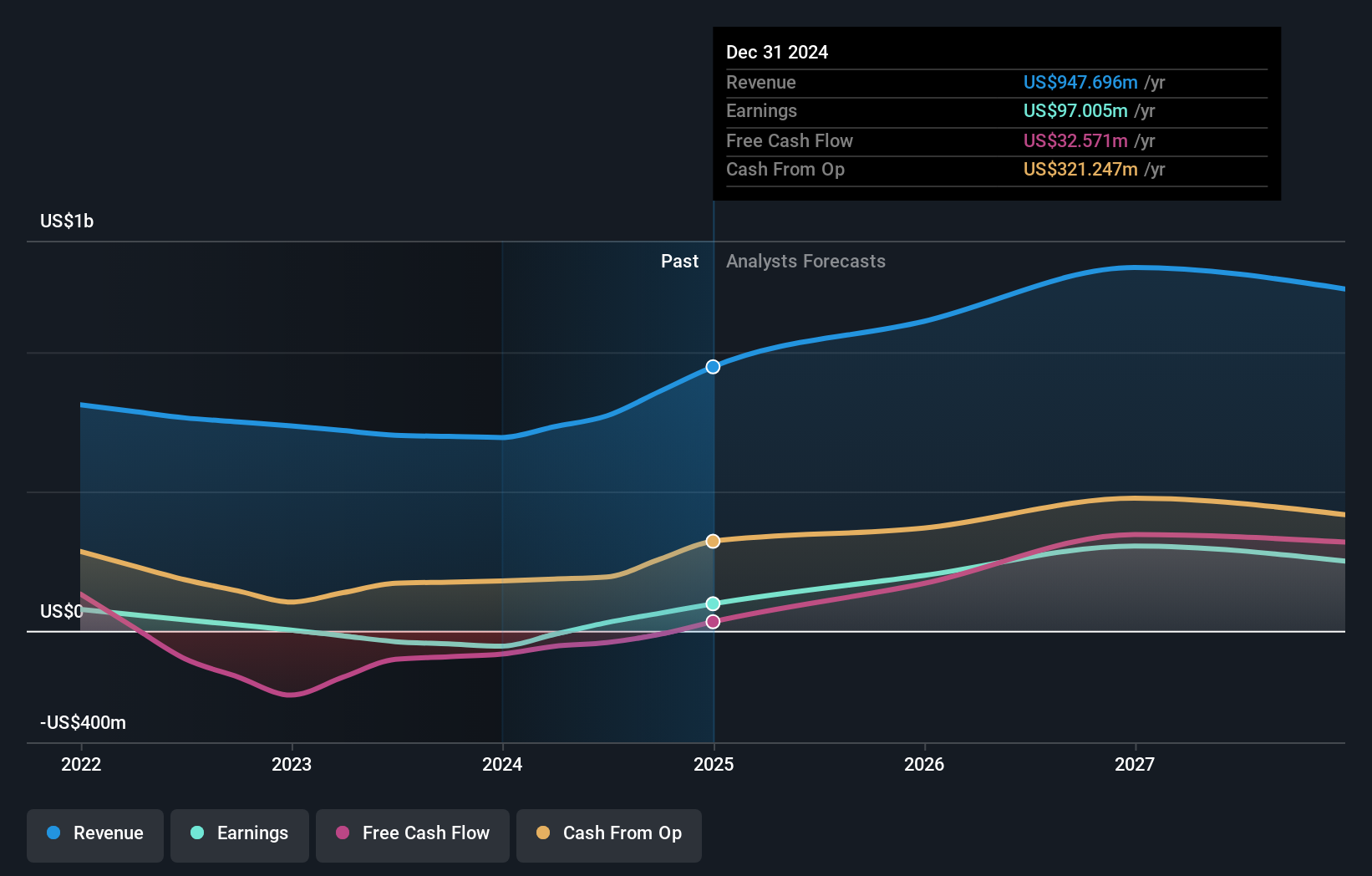

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £1.10 billion.

Operations: The company's revenue is primarily derived from its San Jose segment, contributing $266.70 million, and its Inmaculada segment, which accounts for $451.91 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 52.9% p.a.

Hochschild Mining, with substantial insider ownership, has shown mixed growth signals. The company recently acquired the Monte Do Carmo Project, potentially boosting future prospects. While silver production declined in Q3 2024 compared to last year, gold output increased significantly. Analysts expect earnings to grow at 52.9% annually over the next three years, outpacing UK market averages despite slower revenue growth and high debt levels. Shares trade well below estimated fair value but remain highly volatile.

- Take a closer look at Hochschild Mining's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hochschild Mining's share price might be on the cheaper side.

Seize The Opportunity

- Unlock more gems! Our Fast Growing UK Companies With High Insider Ownership screener has unearthed 61 more companies for you to explore.Click here to unveil our expertly curated list of 64 Fast Growing UK Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Evoke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EVOK

Evoke

Provides online betting and gaming products and solutions in the United Kingdom, Ireland Italy, Spain, and internationally.

Undervalued with high growth potential.