Stock Analysis

- United Kingdom

- /

- Packaging

- /

- AIM:CRU

Coral Products (LON:CRU) Ticks All The Boxes When It Comes To Earnings Growth

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Coral Products (LON:CRU), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Coral Products

How Fast Is Coral Products Growing Its Earnings Per Share?

In the last three years Coral Products' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Coral Products' EPS has risen over the last 12 months, growing from UK£0.012 to UK£0.014. That's a 18% gain; respectable growth in the broader scheme of things.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, Coral Products' EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

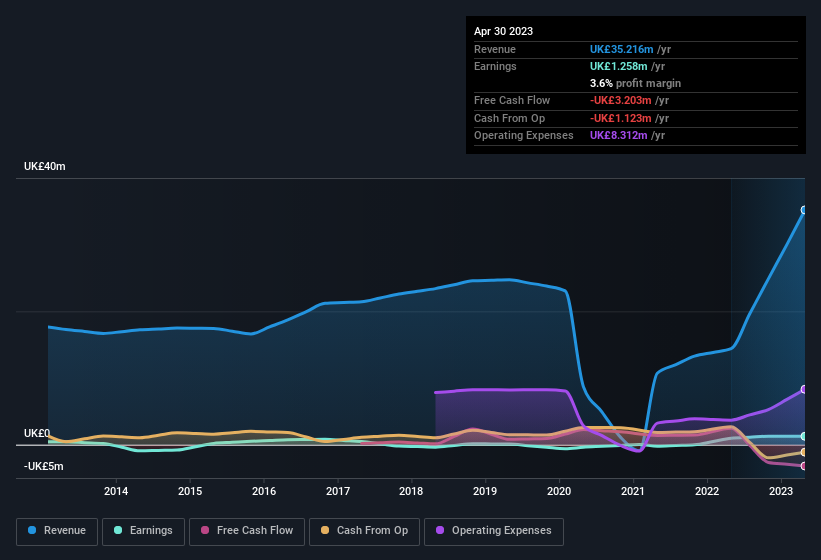

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Coral Products isn't a huge company, given its market capitalisation of UK£12m. That makes it extra important to check on its balance sheet strength.

Are Coral Products Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Coral Products shares, in the last year. Add in the fact that Joseph Grimmond, the Executive Chairman of the company, paid UK£9.2k for shares at around UK£0.18 each. It seems that at least one insider is prepared to show the market there is potential within Coral Products.

On top of the insider buying, we can also see that Coral Products insiders own a large chunk of the company. Actually, with 35% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only UK£12m Coral Products is really small for a listed company. So this large proportion of shares owned by insiders only amounts to UK£4.3m. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Joe Grimmond, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Coral Products, with market caps under UK£158m is around UK£280k.

The Coral Products CEO received UK£150k in compensation for the year ending April 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Coral Products Worth Keeping An Eye On?

One positive for Coral Products is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. What about risks? Every company has them, and we've spotted 4 warning signs for Coral Products (of which 1 is concerning!) you should know about.

The good news is that Coral Products is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Coral Products is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CRU

Coral Products

Coral Products PLC, together with its subsidiaries, manufactures and sells plastic injection and mouldings, extruded and vacuum formed, fabricated products, and cap enclosures in the United Kingdom, rest of Europe, and internationally.

Good value with adequate balance sheet.