- United Kingdom

- /

- Software

- /

- LSE:SGE

September 2024's UK Stock Picks For Possible Value Investing

Reviewed by Simply Wall St

The United Kingdom's stock market has been facing headwinds, with the FTSE 100 index closing lower due to weak trade data from China and a faltering global economy. Despite these challenges, value investing remains a viable strategy for discerning investors seeking opportunities in undervalued stocks.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.401 | £0.76 | 47.2% |

| GlobalData (AIM:DATA) | £2.06 | £3.72 | 44.6% |

| Tracsis (AIM:TRCS) | £5.50 | £10.01 | 45% |

| Ferrexpo (LSE:FXPO) | £0.479 | £0.94 | 49.3% |

| Informa (LSE:INF) | £8.398 | £16.23 | 48.3% |

| Redcentric (AIM:RCN) | £1.2975 | £2.43 | 46.7% |

| SysGroup (AIM:SYS) | £0.34 | £0.65 | 47.9% |

| Foxtons Group (LSE:FOXT) | £0.622 | £1.18 | 47.3% |

| Hochschild Mining (LSE:HOC) | £1.872 | £3.50 | 46.5% |

| BATM Advanced Communications (LSE:BVC) | £0.20 | £0.36 | 44.9% |

Let's explore several standout options from the results in the screener.

ConvaTec Group (LSE:CTEC)

Overview: ConvaTec Group PLC develops, manufactures, and sells medical products, services, and technologies across Europe, North America, and internationally with a market cap of £4.71 billion.

Operations: The company's revenue from the development, manufacture, and sale of medical products and technologies amounts to $2.20 billion.

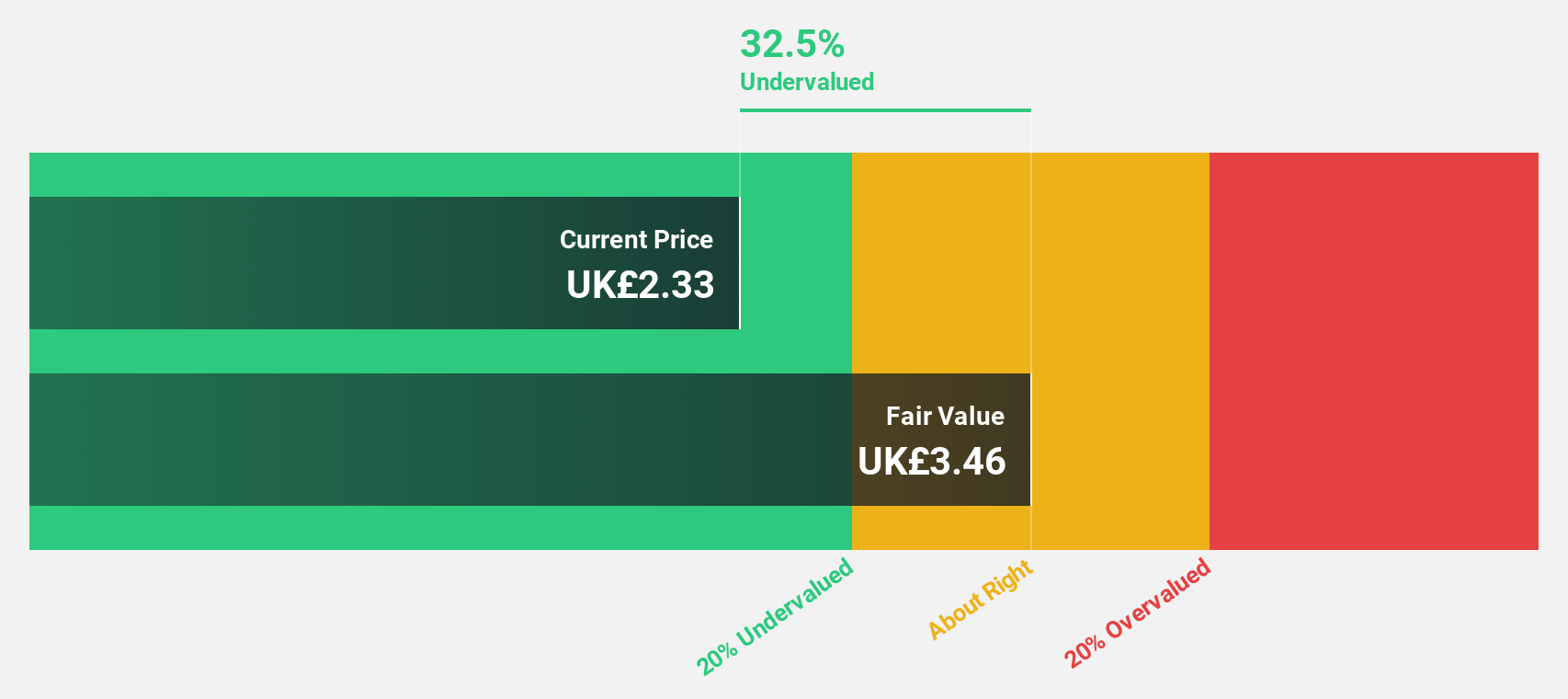

Estimated Discount To Fair Value: 39.5%

ConvaTec Group appears undervalued based on its discounted cash flow (DCF) analysis, trading at £2.3 against an estimated fair value of £3.8. The company recently reported a significant increase in net income to US$78.6 million for H1 2024, up from US$55.7 million a year ago, alongside earnings per share growth from US$0.027 to US$0.038. Despite high debt levels, ConvaTec's earnings are forecasted to grow annually by 21%, outpacing the UK market average of 14.4%.

- Our growth report here indicates ConvaTec Group may be poised for an improving outlook.

- Click here to discover the nuances of ConvaTec Group with our detailed financial health report.

Sage Group (LSE:SGE)

Overview: The Sage Group plc, with a market cap of £10.34 billion, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

Operations: The company's revenue segments include £595 million from Europe, £1.01 billion from North America, and £488 million from the United Kingdom & Ireland.

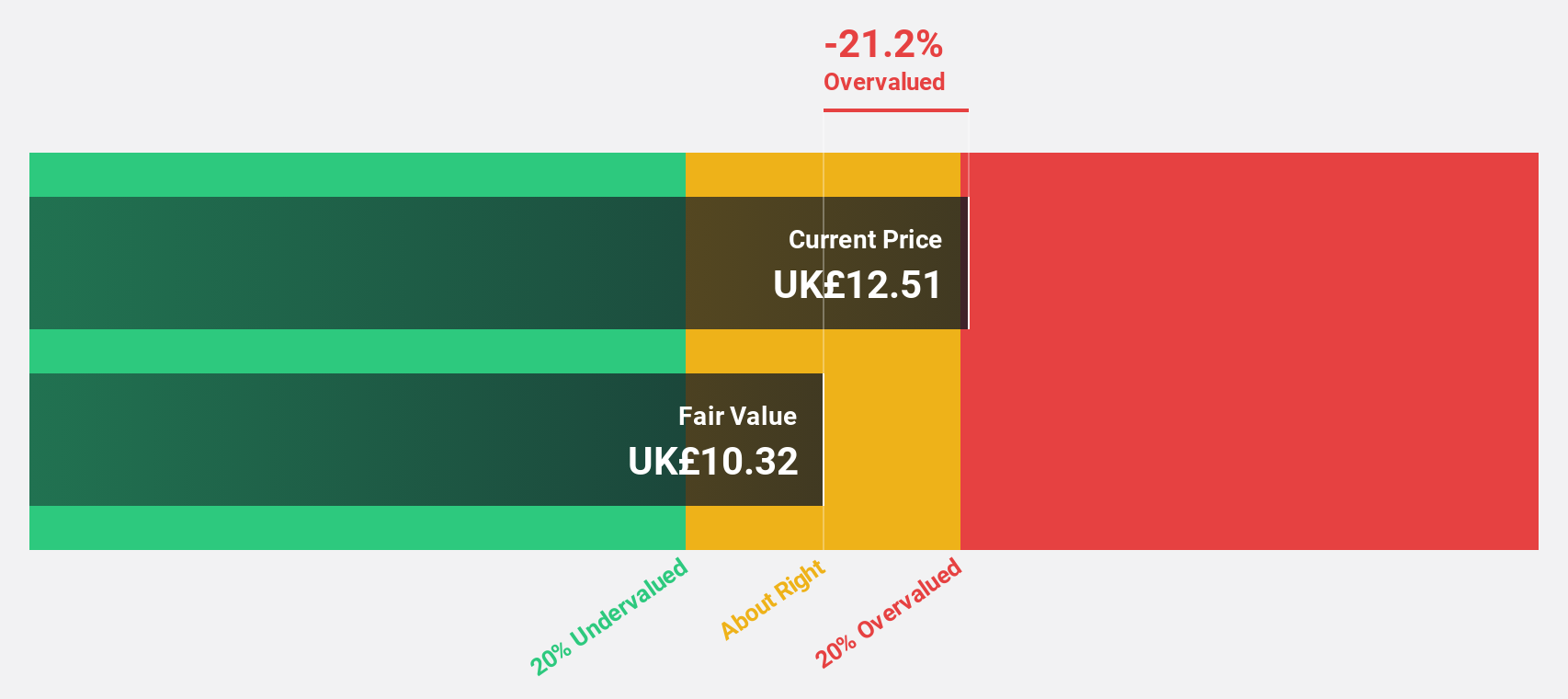

Estimated Discount To Fair Value: 21.1%

Sage Group is trading at £10.37, significantly below its estimated fair value of £13.14, indicating it may be undervalued based on discounted cash flow analysis. The company reported a 9% revenue increase to £585 million for Q3 2024, driven by growth in the Sage Business Cloud portfolio. Despite high debt levels and insider selling, earnings are forecast to grow at 15.1% annually, outpacing the UK market's average growth rate of 14.4%.

- The growth report we've compiled suggests that Sage Group's future prospects could be on the up.

- Dive into the specifics of Sage Group here with our thorough financial health report.

Smith & Nephew (LSE:SN.)

Overview: Smith & Nephew plc, with a market cap of £10.16 billion, develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Operations: The company's revenue is segmented into Orthopaedics ($2.26 billion), Sports Medicine & ENT ($1.77 billion), and Advanced Wound Management (AWM) ($1.61 billion).

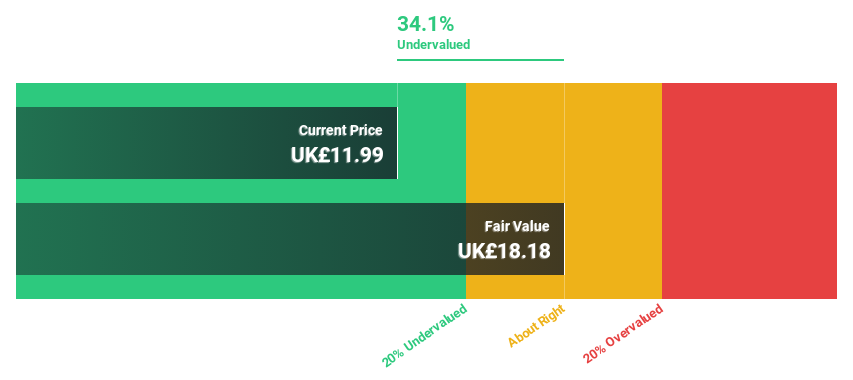

Estimated Discount To Fair Value: 35%

Smith & Nephew is trading at £11.65, well below its estimated fair value of £17.92, suggesting it is undervalued based on discounted cash flow analysis. The company reported H1 2024 sales of $2.83 billion and net income of $214 million, reflecting solid financial performance despite high debt levels. Recent strategic moves include a three-year distribution agreement with InfuSystem Holdings and the appointment of Angie Risley as Senior Independent Director, both potentially enhancing future cash flows and operational efficiency.

- Our comprehensive growth report raises the possibility that Smith & Nephew is poised for substantial financial growth.

- Navigate through the intricacies of Smith & Nephew with our comprehensive financial health report here.

Where To Now?

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Undervalued UK Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SGE

Sage Group

Provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

Reasonable growth potential with proven track record and pays a dividend.