Stock Analysis

- United Kingdom

- /

- Beverage

- /

- AIM:CDGP

Chapel Down Group And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Amid such fluctuations, investors often seek opportunities in lesser-known areas of the market where potential growth can be found. Penny stocks, though an outdated term, still represent a segment where smaller or newer companies might offer unique value propositions backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.85 | £467.47M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.74 | £202.9M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.415 | £347M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.9644 | £394.28M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.328 | £204.82M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.13M | ★★★★★★ |

| Character Group (AIM:CCT) | £2.80 | £52.57M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4745 | $275.84M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Chapel Down Group (AIM:CDGP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chapel Down Group Plc, with a market cap of £66.89 million, is involved in the production and sale of alcoholic beverages both in the United Kingdom and internationally through its subsidiaries.

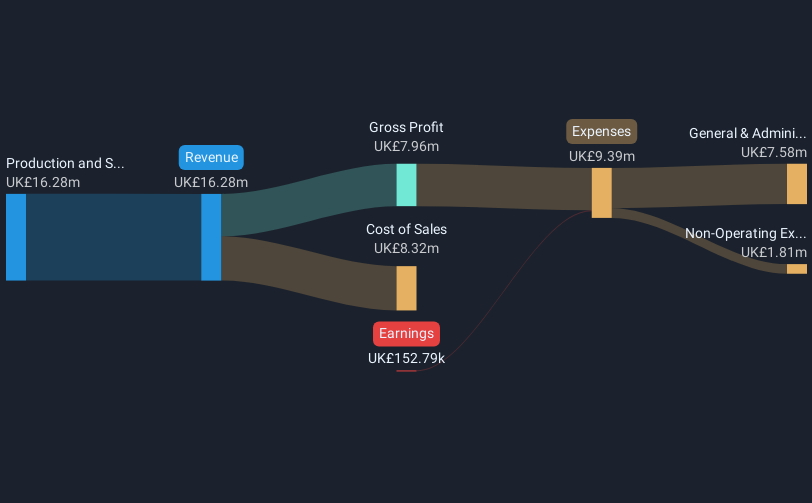

Operations: The company's revenue is derived from the production and sale of alcoholic beverages, amounting to £16.28 million.

Market Cap: £66.89M

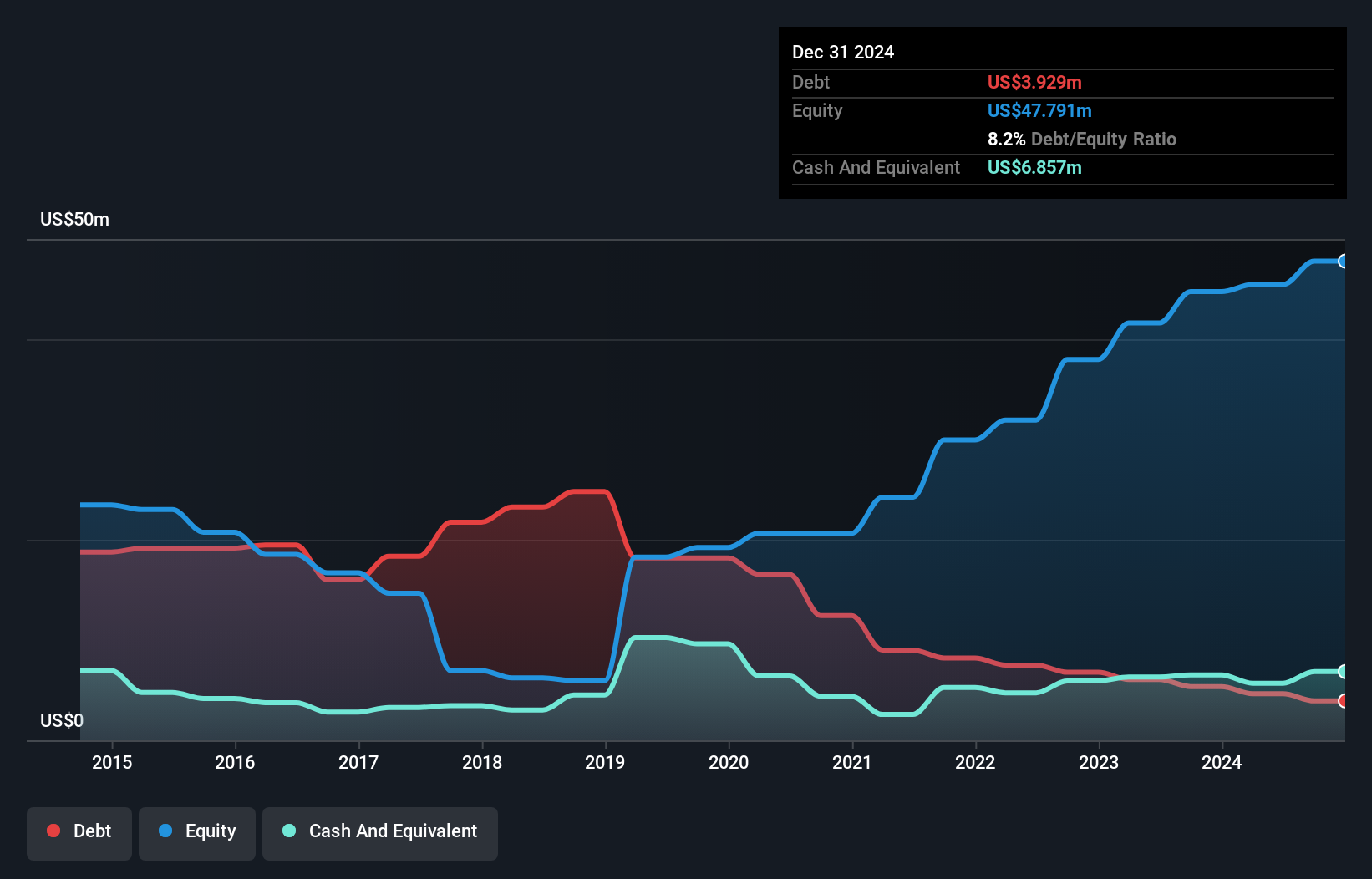

Chapel Down Group Plc, with a market cap of £66.89 million, is experiencing significant volatility and remains unprofitable despite reducing losses over the past five years. The company has a strong brand presence in English wine, with 42% awareness and substantial distribution channels. Recent strategic reviews concluded no superior alternatives to remaining independent, highlighting confidence in the English wine industry's growth potential. However, revenue for H1 2024 decreased to £7.12 million from £8.04 million year-on-year, reflecting operational challenges amid leadership changes as CEO Andrew Carter steps down by mid-2025 after boosting market capitalisation during his tenure.

- Navigate through the intricacies of Chapel Down Group with our comprehensive balance sheet health report here.

- Understand Chapel Down Group's earnings outlook by examining our growth report.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Diaceutics PLC is a diagnostic commercialisation company offering data, data analytics, and implementation services to pharmaceutical companies globally, with a market cap of £102.64 million.

Operations: The company's revenue is derived from its Medical Labs & Research segment, which generated £26.10 million.

Market Cap: £102.64M

Diaceutics PLC, with a £102.64 million market cap, is unprofitable but shows potential for revenue growth through strategic enhancements and partnerships. The company's recent contract wins in rare-disease diagnostics and the PMx suite for precision medicine highlight its capability to address complex market needs. Despite a net loss of £2.58 million for H1 2024, sales increased to £12.32 million from the previous year’s £9.92 million, indicating positive momentum in revenue generation. Recent board changes bring experienced leadership to support its growth trajectory while maintaining financial stability with no debt liabilities exceeding assets.

- Unlock comprehensive insights into our analysis of Diaceutics stock in this financial health report.

- Review our growth performance report to gain insights into Diaceutics' future.

Iofina (AIM:IOF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iofina plc, along with its subsidiaries, is engaged in the exploration, development, and production of iodine and halogen-based specialty chemical derivatives from oil and gas operations in the United States and the United Kingdom, with a market cap of £37.41 million.

Operations: The company generates $51.71 million in revenue from its Halogen Derivatives and Iodine segment.

Market Cap: £37.41M

Iofina plc, with a market cap of £37.41 million, is navigating the penny stock landscape through strategic expansions and financial prudence. The company recently commissioned its IO#10 plant and plans to open IO#11 in Oklahoma, leveraging its IOsorb® technology to enhance iodine production. Despite a dip in net income to US$0.607 million for H1 2024 from US$3.56 million last year, Iofina maintains strong liquidity with short-term assets exceeding liabilities and robust interest coverage (29.6x). The seasoned management team supports stable operations, while debt reduction efforts have significantly improved the balance sheet over five years.

- Take a closer look at Iofina's potential here in our financial health report.

- Evaluate Iofina's prospects by accessing our earnings growth report.

Make It Happen

- Click here to access our complete index of 471 UK Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CDGP

Chapel Down Group

Through its subsidiaries, engages in the production and sale of alcoholic beverages in the United Kingdom and internationally.