Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

Uncovering Undiscovered Gems In The United Kingdom August 2024

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with weak trade data from China, reflecting broader global economic challenges, investors are increasingly seeking resilient opportunities within the small-cap sector. Despite recent market volatility, identifying robust companies with strong fundamentals and growth potential can offer promising investment avenues.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc is a company that focuses on the purchase and holding of uranium oxide (U3O8) for long-term capital appreciation, with a market cap of £1.14 billion.

Operations: Yellow Cake plc generates revenue primarily from its holdings of U3O8, amounting to $735.02 million. The company's market cap stands at £1.14 billion.

Yellow Cake plc, a niche player in the uranium market, has turned heads with its recent performance. The company reported revenue of US$735 million for the year ending March 31, 2024, a stark contrast to the negative US$96.9 million from the previous year. Net income surged to US$727 million from a net loss of US$102.94 million last year. Additionally, basic earnings per share jumped to US$3.51 from a loss per share of US$0.56 previously, highlighting significant profitability improvements and potential for future growth despite industry challenges.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited, with a market cap of £510.99 million, is an investment holding company that provides maritime and logistics services in Brazil.

Operations: The company generates revenue primarily from its maritime services in Brazil, amounting to $519.35 million.

Ocean Wilsons Holdings has shown impressive financial performance, with earnings growth of 32.7% over the past year, outpacing the Infrastructure industry’s 16.1%. The company’s debt to equity ratio has improved from 42.7% to 38% in five years, and its interest payments are well covered by EBIT at a ratio of 4.6x. Additionally, Ocean Wilsons' price-to-earnings ratio stands at a favorable 10.9x compared to the UK market average of 17x.

- Unlock comprehensive insights into our analysis of Ocean Wilsons Holdings stock in this health report.

Gain insights into Ocean Wilsons Holdings' past trends and performance with our Past report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc is involved in oil and gas exploration, production, and gas processing across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.09 billion.

Operations: Seplat Energy generates revenue primarily from oil ($815.03 million) and gas ($120.87 million).

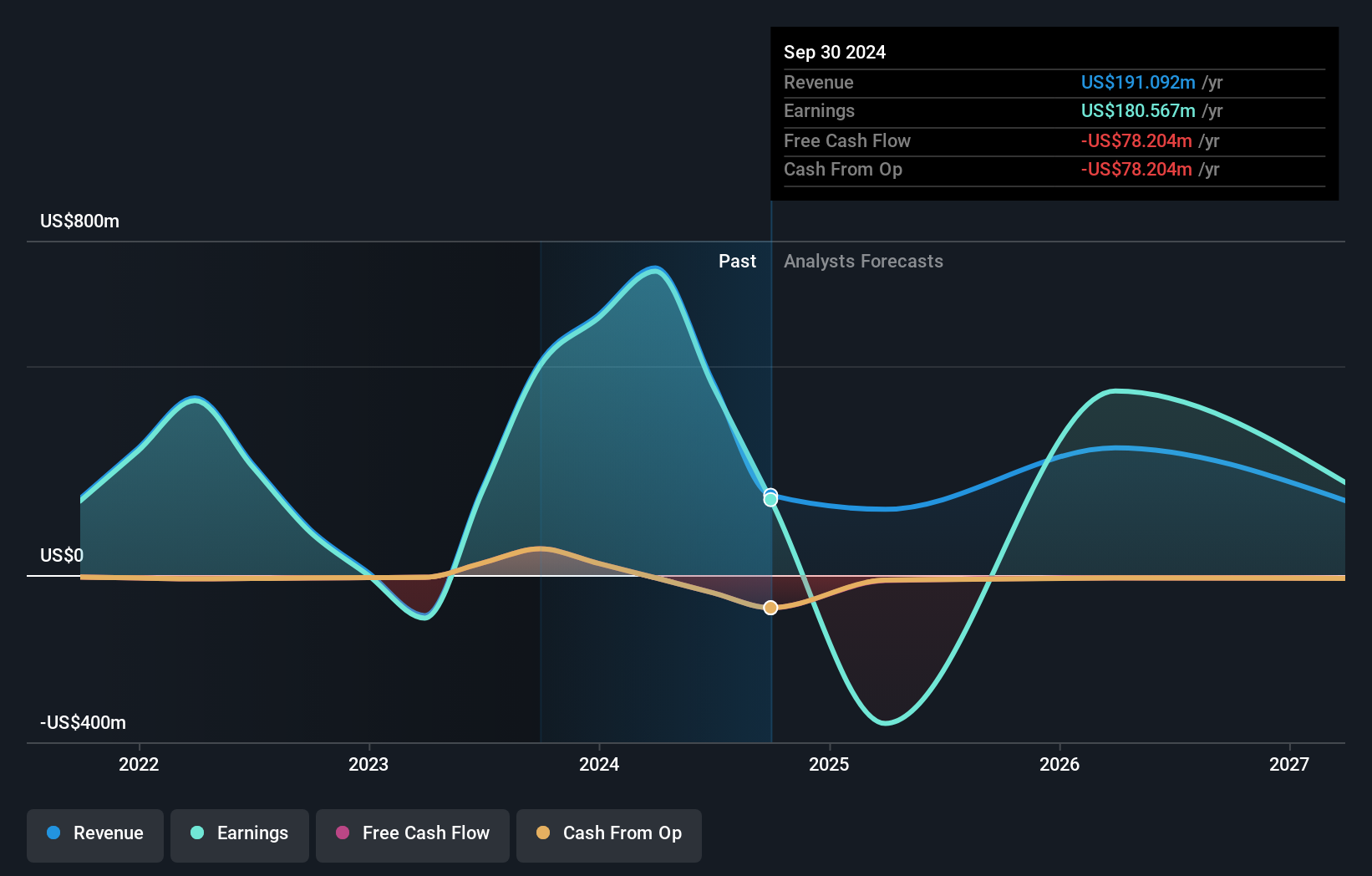

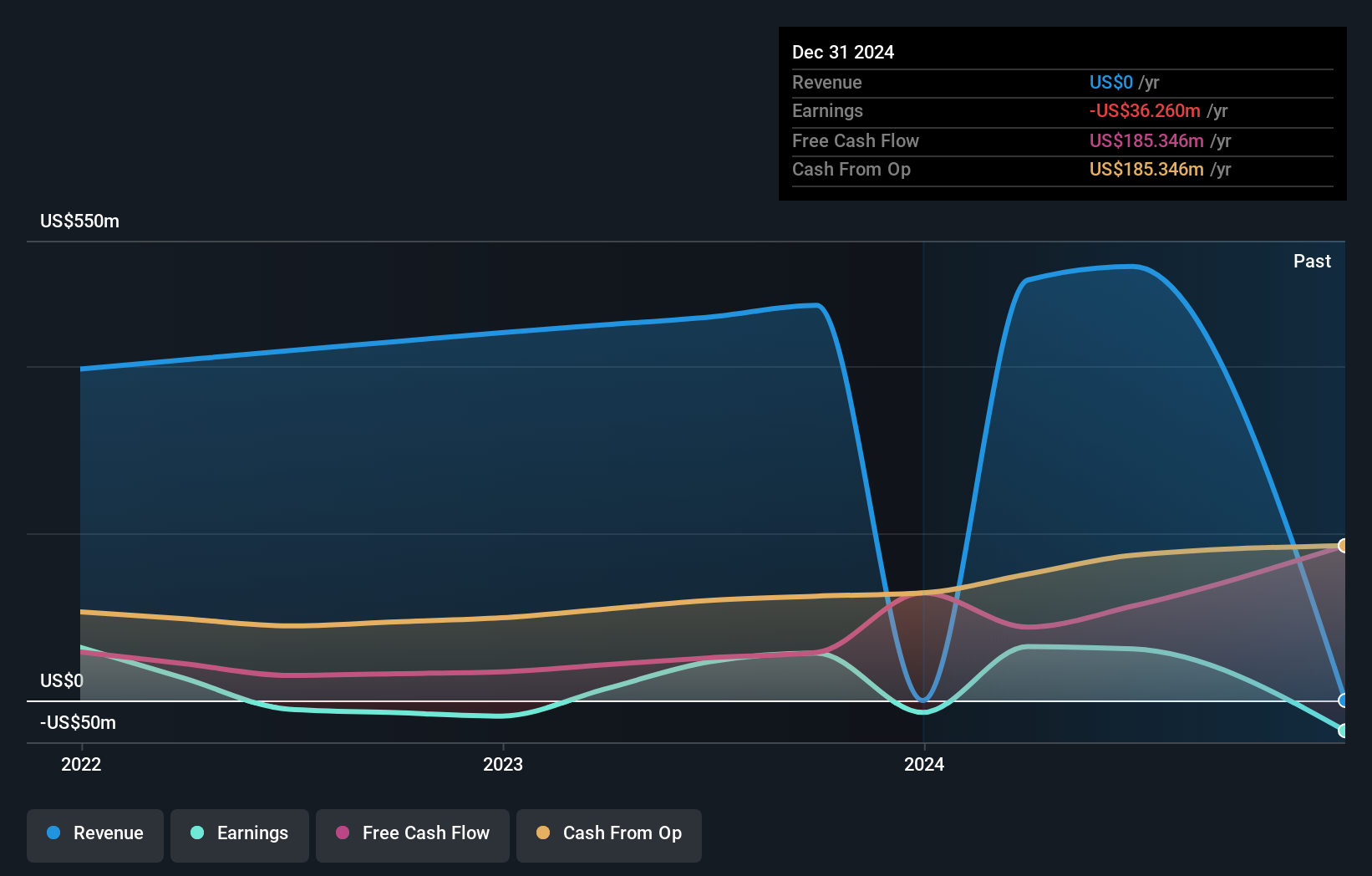

Seplat Energy has shown impressive growth, with earnings soaring by 207.6% over the past year, significantly outpacing the Oil and Gas industry’s -56%. The company's net debt to equity ratio stands at a satisfactory 20.6%, although it has risen from 20.6% to 41.5% over five years. Recent Q2 results revealed sales of US$241.82 million and a net income of US$39.72 million, reversing last year’s net loss of US$14.63 million, highlighting its robust performance amidst volatility in share price and production levels averaging 48,407 boepd for H1 2024 compared to last year's average of 50,805 boepd.

- Click to explore a detailed breakdown of our findings in Seplat Energy's health report.

Understand Seplat Energy's track record by examining our Past report.

Make It Happen

- Discover the full array of 79 UK Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

Engages in the oil and gas exploration and production, and gas processing activities in Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England.