Stock Analysis

- United Kingdom

- /

- Oil and Gas

- /

- AIM:CASP

Caspian Sunrise (LON:CASP) adds UK£9.0m to market cap in the past 7 days, though investors from a year ago are still down 55%

This week we saw the Caspian Sunrise plc (LON:CASP) share price climb by 17%. But that's not enough to compensate for the decline over the last twelve months. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 55% in that time. It's not that amazing to see a bounce after a drop like that. You could argue that the sell-off was too severe.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Caspian Sunrise

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Caspian Sunrise managed to increase earnings per share from a loss to a profit, over the last 12 months.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. But we may find different metrics more enlightening.

Caspian Sunrise's dividend seems healthy to us, so we doubt that the yield is a concern for the market. We'd be more worried about the fact that revenue fell 15% year on year. So it seems likely that the weak revenue is making the market more cautious about the stock.

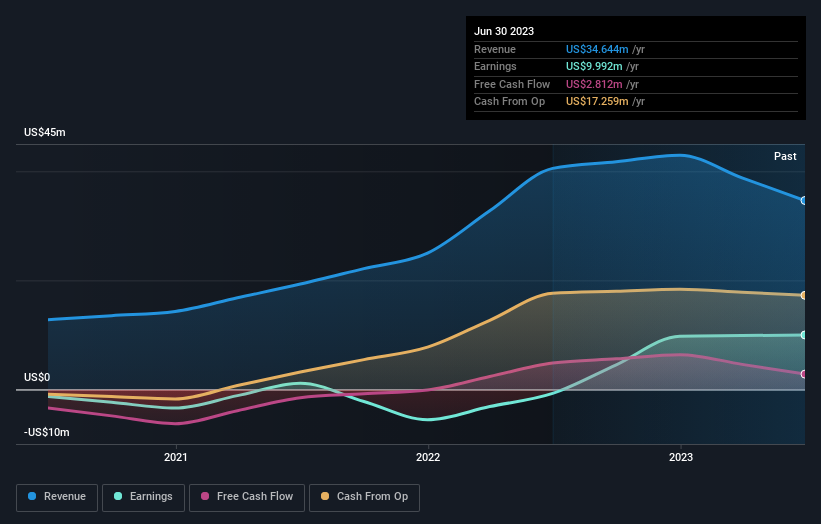

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Caspian Sunrise's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 5.3% in the last year, Caspian Sunrise shareholders lost 55% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Caspian Sunrise has 3 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Caspian Sunrise is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CASP

Acceptable track record with mediocre balance sheet.