Stock Analysis

- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

3 Premier UK Dividend Stocks Delivering From 2.8% Yield

The United Kingdom market has shown a steady demeanor, remaining flat over the last week and experiencing a 4.7% decline from the previous year. Amidst this landscape, earnings are still forecast to grow by 13% annually, highlighting opportunities for investors seeking resilient dividend stocks that can offer stable yields in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 7.88% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.97% | ★★★★★☆ |

| BAE Systems (LSE:BA.) | 2.35% | ★★★★★☆ |

| AstraZeneca (LSE:AZN) | 2.22% | ★★★★★☆ |

| M.T.I Wireless Edge (AIM:MWE) | 6.64% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.38% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 7.32% | ★★★★★☆ |

| Intertek Group (LSE:ITRK) | 2.25% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.73% | ★★★★★☆ |

| Cohort (AIM:CHRT) | 2.56% | ★★★★★☆ |

Click here to see the full list of 53 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc is a UK-based company specializing in the operation, sale, and servicing of instant-service equipment with a market capitalization of approximately £613.02 million.

Operations: ME Group International plc generates £297.66 million in revenue from its personal services segment.

Dividend Yield: 4.5%

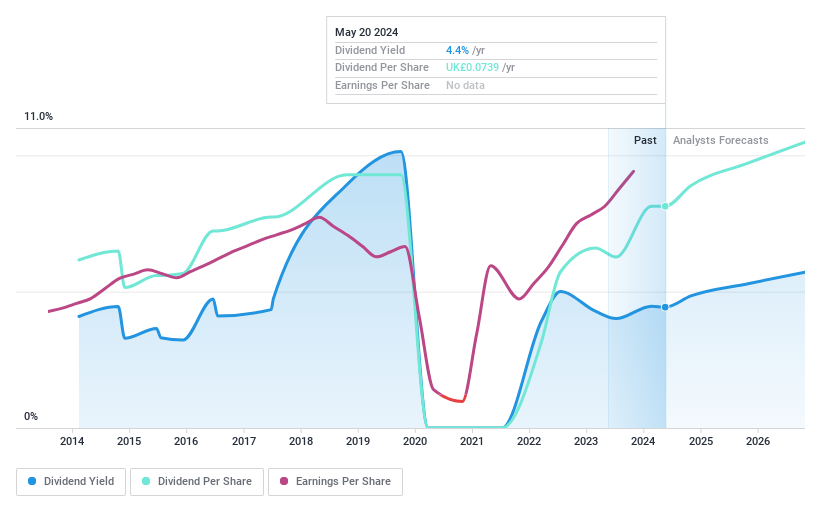

ME Group International's recent earnings show growth, with sales up to £297.66 million and net income at £50.67 million. The firm announced a final dividend of 4.42 pence per share, totaling 7.39 pence annually (£27.9 million), indicating confidence in future revenue and earnings growth for 2024 despite a volatile macro environment. However, the dividend yield is below the UK market's top quartile at 4.53%, reflecting past volatility in payouts despite a reasonable payout ratio of 55.2%. Analysts expect the stock price to increase by 24.3%, suggesting potential undervaluation relative to its fair value estimate which is trading at a significant discount of 60%.

Kaspi.kz (LSE:KSPI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joint Stock Company Kaspi.kz operates as a digital platform in Kazakhstan offering payment solutions, an online marketplace, and various fintech services through its mobile app, with a market cap of approximately $19.88 billion.

Operations: Kaspi.kz generates its revenue primarily from fintech services with ₸1.03 billion, followed by payments at ₸478.68 million, and its marketplace segment contributing ₸448.22 million.

Dividend Yield: 7.2%

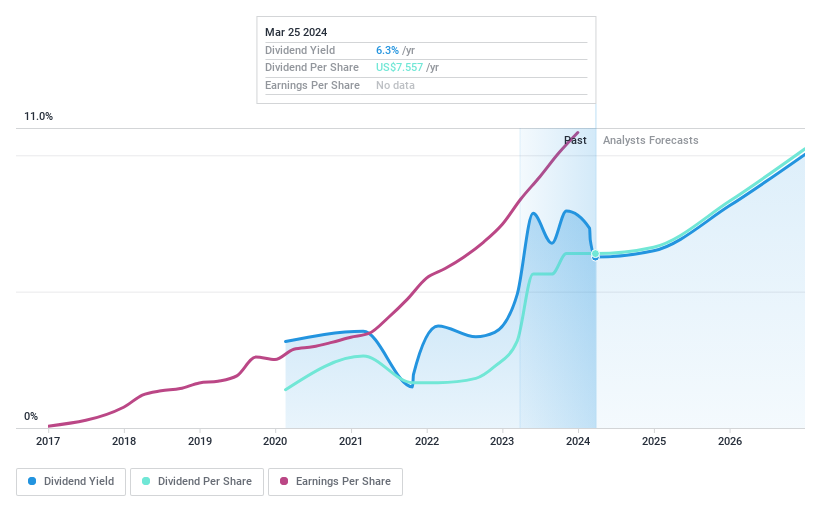

Kaspi.kz reported a robust year with revenue reaching KZT 1.91 billion and net income at KZT 848.77 million, signaling potential for sustainable dividends, proposed at 850 KZT per share. Despite a solid dividend yield of 7.24%, above the UK market average, its dividend history is marked by inconsistency over the past four years. The company's delisting from the London Stock Exchange to concentrate on Nasdaq trading may affect UK-based investors' accessibility but reflects strategic shifts following its recent U.S IPO and NASDAQ Composite Index inclusion.

- Click here to discover the nuances of Kaspi.kz with our detailed analytical dividend report.

-

Our valuation report unveils the possibility Kaspi.kz's shares may be trading at a discount.

Wilmington (LSE:WIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wilmington plc is a company that specializes in delivering information, data, training, and education solutions to professional markets across the UK, Europe, North America, and other global regions with a market capitalization of approximately £317.59 million.

Operations: Wilmington plc generates its revenue through two primary segments: Intelligence, which contributes £57.86 million, and Training & Education, accounting for £67.13 million.

Dividend Yield: 2.9%

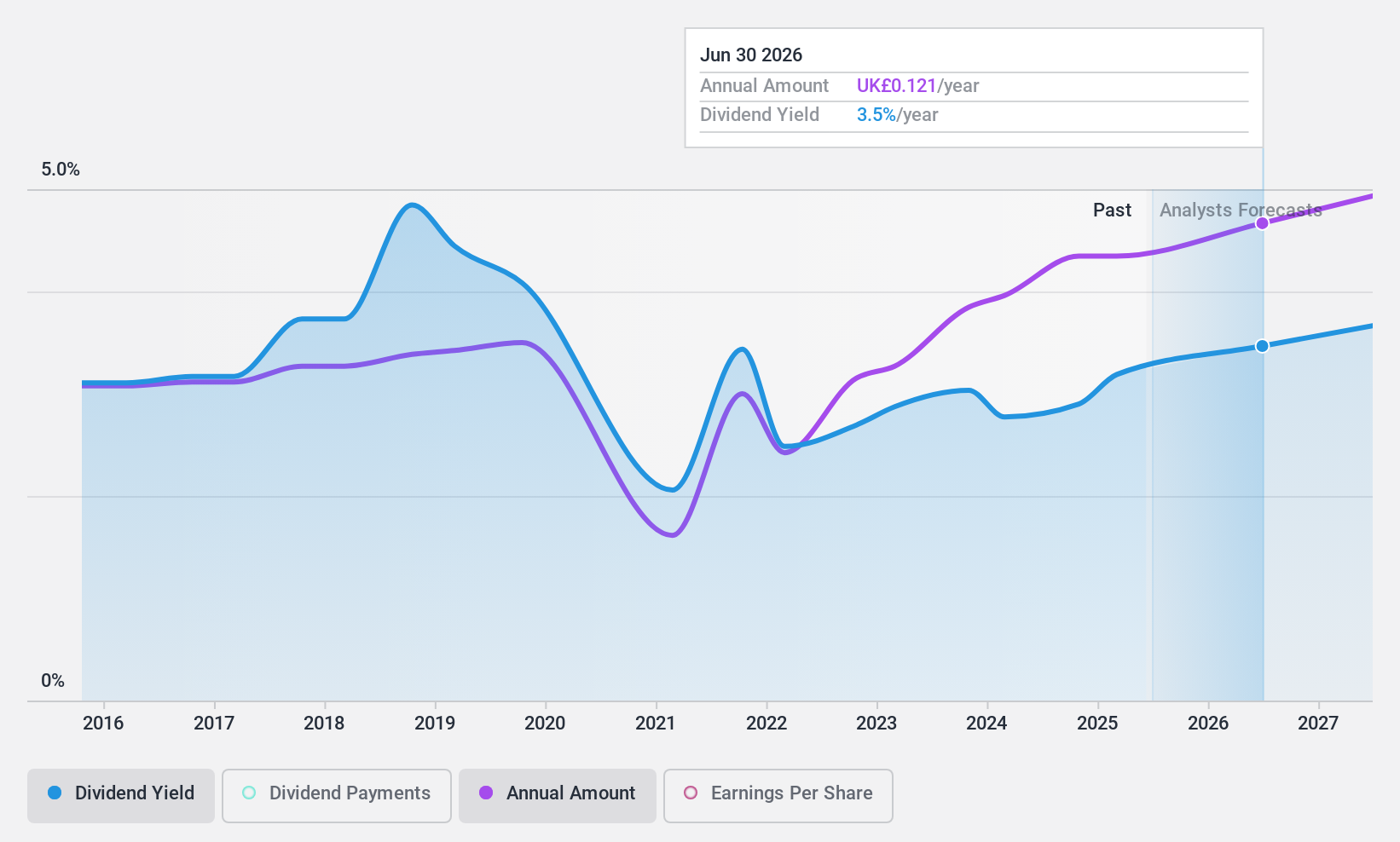

Wilmington's recent earnings report showed a dip in net income to £7.12 million and a decrease in basic EPS, yet it maintains a dividend, recently declared at £0.03 per share. The dividend yield stands at 2.89%, below the UK market's top quartile, and past payments have shown volatility, casting doubt on stability. However, dividends seem sustainable with coverage by earnings (49.6%) and cash flows (35%), though future growth is uncertain with revenue projected to increase by 6.84% annually without a consistent track record of rising dividends or profits.

Where To Now?

- Click this link to deep-dive into the 53 companies within our Top Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether ME Group International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MEGP

ME Group International

ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom.

Very undervalued with outstanding track record and pays a dividend.