- United Kingdom

- /

- Consumer Durables

- /

- LSE:SRAD

Restore And 2 Stocks On The UK Exchange That Might Be Undervalued

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China and declining commodity prices. Despite these market pressures, identifying undervalued stocks can present opportunities for investors looking to capitalize on potential growth. In this article, we will explore Restore and two other stocks on the UK exchange that might be undervalued based on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Integrated Diagnostics Holdings (LSE:IDHC) | US$0.374 | US$0.73 | 48.7% |

| Liontrust Asset Management (LSE:LIO) | £6.19 | £12.36 | 49.9% |

| Topps Tiles (LSE:TPT) | £0.4755 | £0.91 | 47.7% |

| AstraZeneca (LSE:AZN) | £131.90 | £246.22 | 46.4% |

| Mercia Asset Management (AIM:MERC) | £0.355 | £0.68 | 48% |

| Ricardo (LSE:RCDO) | £5.10 | £10.14 | 49.7% |

| Velocity Composites (AIM:VEL) | £0.42 | £0.83 | 49.2% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| Foxtons Group (LSE:FOXT) | £0.628 | £1.21 | 48.1% |

| SysGroup (AIM:SYS) | £0.345 | £0.64 | 46.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Restore (AIM:RST)

Overview: Restore plc, with a market cap of £386.13 million, provides services to offices and workplaces in both the public and private sectors primarily in the United Kingdom.

Operations: The company's revenue segments include £104.40 million from Secure Lifecycle Services and £172.50 million from Digital & Information Management.

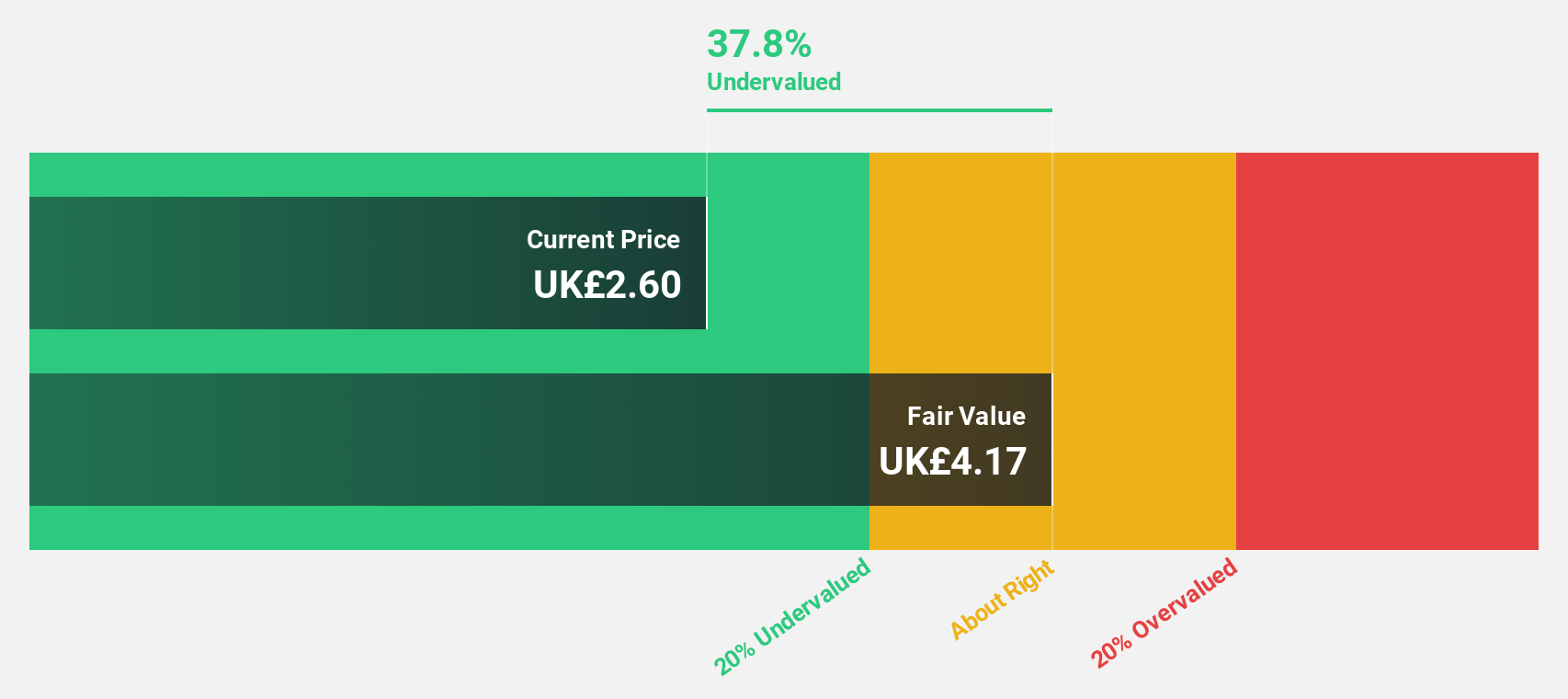

Estimated Discount To Fair Value: 36.8%

Restore plc reported a net income of £6.4 million for H1 2024, reversing a £28.1 million loss from the previous year, and declared an interim dividend increase to 2.00 pence per share. The stock is trading at £2.82, significantly below its estimated fair value of £4.47, suggesting it is undervalued based on discounted cash flow analysis. Despite low forecasted return on equity and interest coverage concerns, earnings are expected to grow 48.67% annually over the next three years.

- The analysis detailed in our Restore growth report hints at robust future financial performance.

- Click here to discover the nuances of Restore with our detailed financial health report.

Young's Brewery (AIM:YNGA)

Overview: Young & Co.'s Brewery, P.L.C. operates and manages pubs and hotels in the United Kingdom, with a market cap of £514.80 million.

Operations: Revenue from managed houses amounts to £388.20 million.

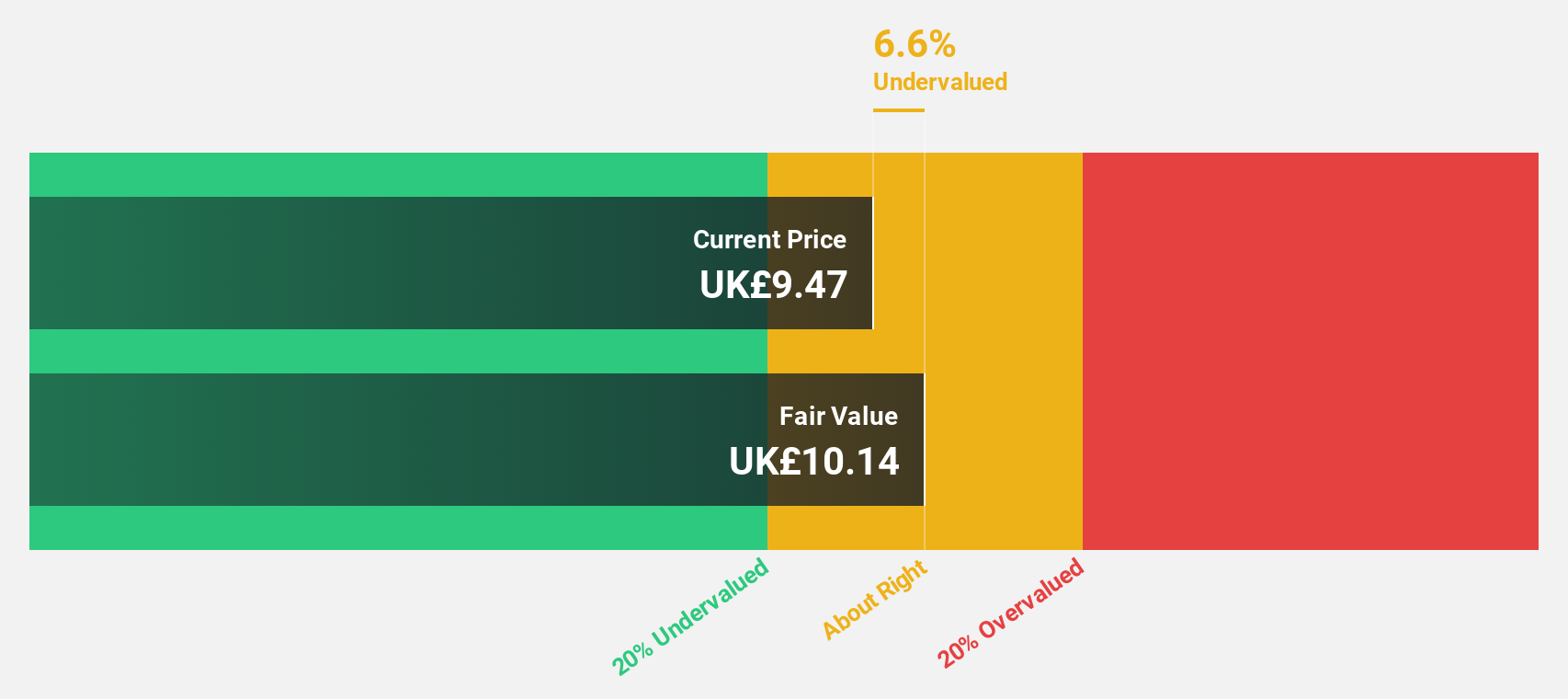

Estimated Discount To Fair Value: 14.0%

Young's Brewery reported full-year sales of £388.8 million, up from £368.9 million last year, but net income dropped to £11.1 million from £29.7 million due to one-off items affecting results. Trading 14% below fair value (£9.42 vs estimated £10.96), the stock shows potential for growth with forecasted earnings expected to rise significantly by 35% per year over the next three years, despite low return on equity and unsustainable dividends at 2.31%.

- In light of our recent growth report, it seems possible that Young's Brewery's financial performance will exceed current levels.

- Dive into the specifics of Young's Brewery here with our thorough financial health report.

Stelrad Group (LSE:SRAD)

Overview: Stelrad Group PLC manufactures and distributes radiators in the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £191.03 million.

Operations: The company generates £294.27 million from the manufacture and distribution of radiators across various regions including the UK, Ireland, Europe, Turkey, and internationally.

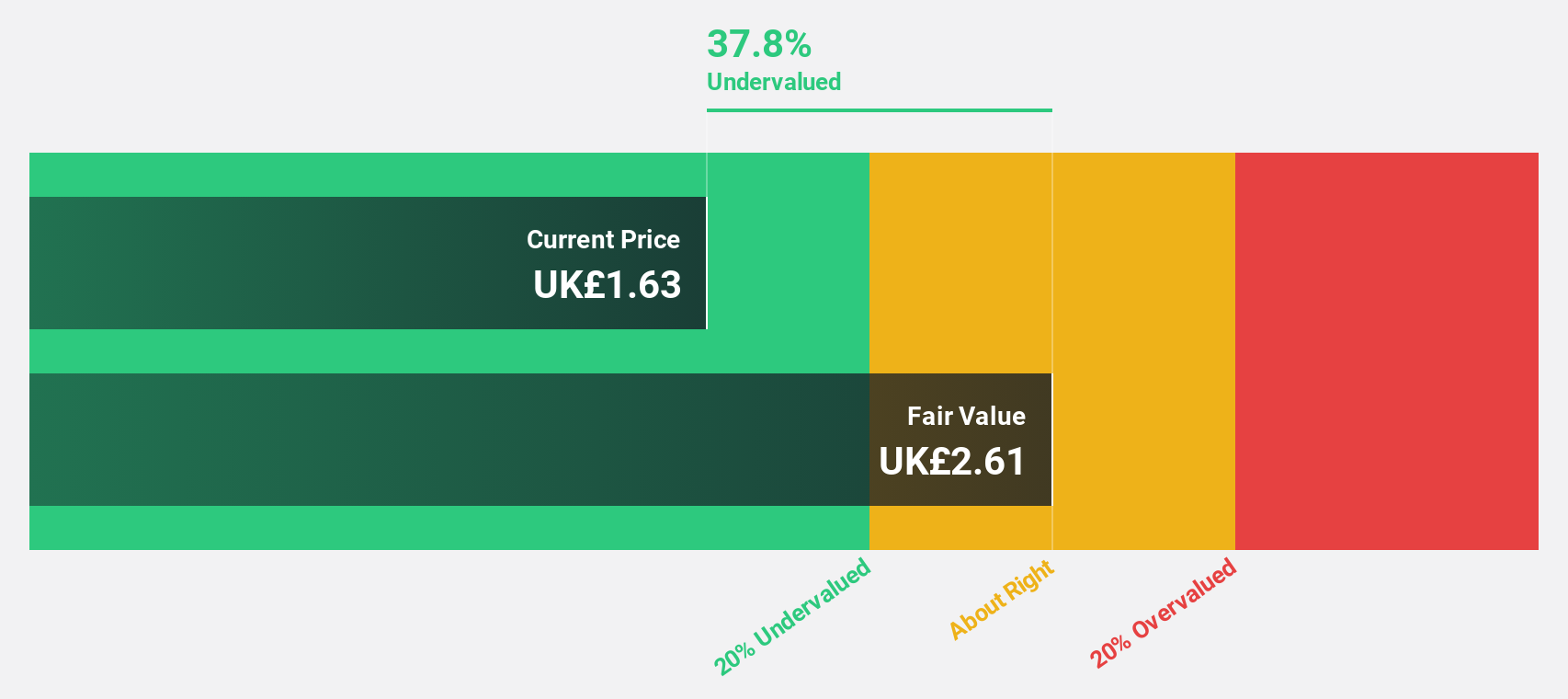

Estimated Discount To Fair Value: 42.1%

Stelrad Group is trading at 42.1% below its estimated fair value (£1.5 vs £2.59), indicating it may be undervalued based on cash flows. Despite a high level of debt and recent insider selling, the company reported stable net income for H1 2024 (£8.02 million) and increased its interim dividend by 2%. Earnings are forecast to grow at 14.52% annually, outpacing the UK market, though revenue growth remains modest at 5.2% per year.

- Our comprehensive growth report raises the possibility that Stelrad Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Stelrad Group.

Make It Happen

- Unlock our comprehensive list of 56 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SRAD

Stelrad Group

Manufactures and distributes radiators in the United Kingdom, Ireland, Europe, Turkey, and internationally.

Undervalued with solid track record.