- United Kingdom

- /

- Commercial Services

- /

- LSE:MER

Exploring European Undervalued Small Caps With Insider Buying In November 2025

Reviewed by Simply Wall St

As European markets experience a pullback due to concerns about overvaluation in artificial intelligence-related stocks, the pan-European STOXX Europe 600 Index ended 1.24% lower, reflecting broader market sentiment. Amid these conditions, investors often look for opportunities in small-cap stocks that may be undervalued and exhibit potential growth indicators such as insider buying, which can suggest confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.1x | 3.9x | 24.44% | ★★★★★☆ |

| Foxtons Group | 10.1x | 0.9x | 42.11% | ★★★★★☆ |

| Cairn Homes | 12.3x | 1.6x | 28.82% | ★★★★★☆ |

| Boozt | 18.6x | 0.8x | 45.76% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.07% | ★★★★★☆ |

| Nyab | 17.4x | 0.7x | 38.83% | ★★★★☆☆ |

| Senior | 25.0x | 0.8x | 24.72% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 37.39% | ★★★★☆☆ |

| Fastighets AB Trianon | 9.7x | 4.7x | -21.27% | ★★★★☆☆ |

| Pexip Holding | 30.7x | 4.9x | 27.18% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

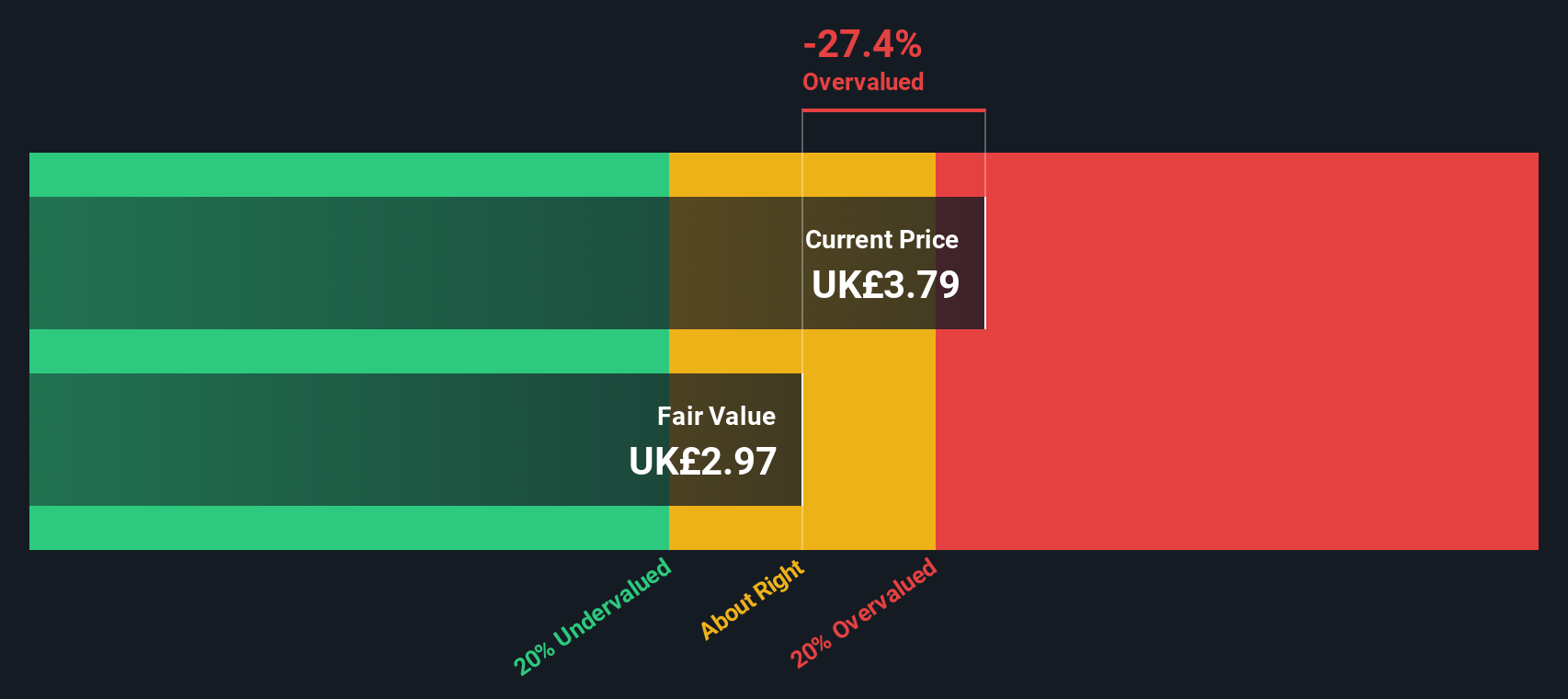

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mears Group is a UK-based company specializing in management and maintenance services, with a market cap of approximately £0.37 billion.

Operations: The company's revenue streams are primarily derived from management (£533.92 million) and maintenance (£577.93 million) services. Over recent periods, the gross profit margin has shown an upward trend, reaching 22.52% as of June 2025, indicating improved efficiency in managing costs relative to revenue generation.

PE: 6.5x

Mears Group, a small player in the European market, has caught attention due to insider confidence with share purchases over the past year. Despite earnings projected to decline by 13% annually for the next three years, this company shows potential for those seeking undervalued opportunities. However, all liabilities stem from external borrowing, highlighting financial risk. As of now, no recent events have significantly impacted its valuation or outlook.

- Navigate through the intricacies of Mears Group with our comprehensive valuation report here.

Gain insights into Mears Group's past trends and performance with our Past report.

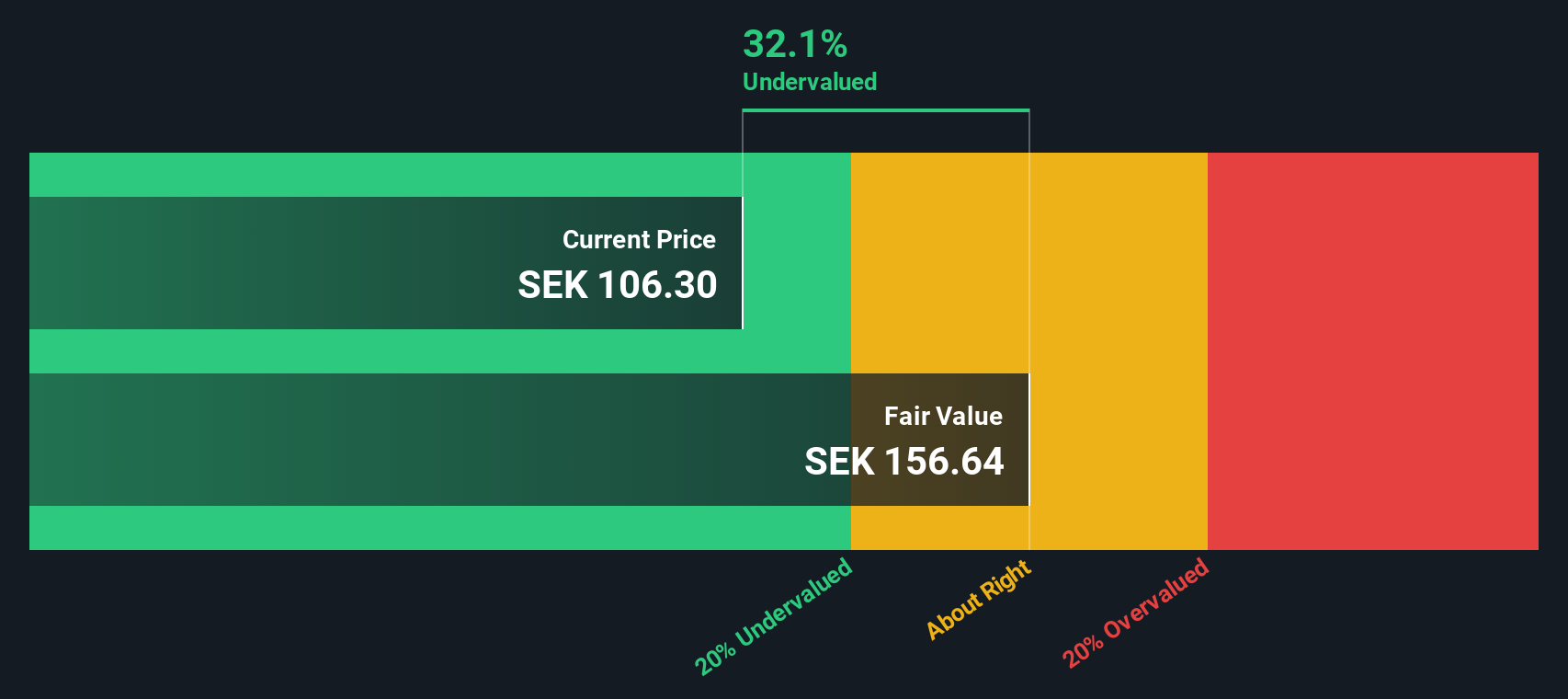

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BioGaia is a Swedish biotechnology company specializing in the development and sale of probiotic products for pediatric and adult health, with a market capitalization of approximately SEK 9.18 billion.

Operations: The company's revenue primarily comes from its Pediatrics segment, followed by Adult Health. Over the years, it has experienced fluctuations in its net income margin, with a notable peak of 34.86% in Q1 2023. Operating expenses have consistently been a significant portion of costs, with Sales & Marketing being the largest component within this category.

PE: 32.8x

BioGaia, a small European company, shows potential with its innovative probiotic products like Prodentis FRESH BREATH and the identification of serotonin-producing bacteria strains. Recent earnings reveal a sales increase to SEK 326.64 million for Q3 2025, up from SEK 303.97 million the previous year, while net income rose to SEK 65.88 million. Insider confidence is evident through recent share purchases by executives in October 2025. The company's strategic expansion into Germany and Austria further supports future growth prospects in the probiotics market.

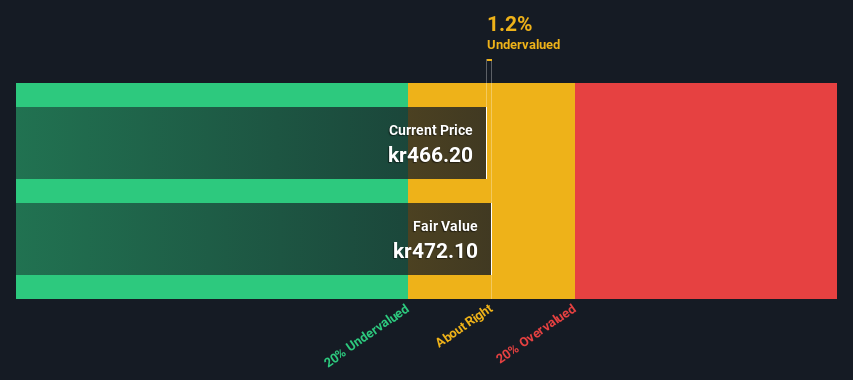

Vitec Software Group (OM:VIT B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitec Software Group is a company specializing in software and programming, with a market cap of SEK 11.84 billion.

Operations: Vitec Software Group generates revenue primarily from its software and programming segment, amounting to SEK 3.58 billion. The company's cost of goods sold (COGS) is SEK 1.87 billion, resulting in a gross profit margin of 47.66%. Operating expenses are significant, with general and administrative expenses accounting for a considerable portion at SEK 405.88 million.

PE: 32.3x

Vitec Software Group, a player in the software sector, recently reported third-quarter sales of SEK 773.22 million, up from SEK 717.76 million last year. Despite increased revenue to SEK 854.84 million, net income slightly dipped to SEK 112.15 million from SEK 108.42 million previously, reflecting some financial challenges amidst growth prospects with an anticipated earnings increase of nearly 19% annually. Insider confidence is evident with recent share purchases by company insiders in September and October 2025, suggesting potential value recognition despite high external debt reliance for funding.

- Click to explore a detailed breakdown of our findings in Vitec Software Group's valuation report.

Understand Vitec Software Group's track record by examining our Past report.

Taking Advantage

- Reveal the 59 hidden gems among our Undervalued European Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MER

Mears Group

Provides various outsourced services to the public and private sectors in the United Kingdom.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives