European Undervalued Small Caps With Insider Action For September 2025

Reviewed by Simply Wall St

As the European markets experience a modest upswing, with the pan-European STOXX Europe 600 Index rising 1.03% amid anticipation of U.S. Federal Reserve rate cuts, investors are closely watching small-cap stocks for potential opportunities. In this environment, stocks that demonstrate resilience and adaptability to shifting economic conditions often stand out as compelling options for those looking to navigate the evolving landscape of undervalued small caps in Europe.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hoist Finance | 9.6x | 1.9x | 21.69% | ★★★★★☆ |

| Cairn Homes | 13.0x | 1.7x | 20.98% | ★★★★★☆ |

| Bytes Technology Group | 18.3x | 4.6x | 7.26% | ★★★★☆☆ |

| Kitwave Group | 13.0x | 0.3x | 37.12% | ★★★★☆☆ |

| Instabank | 11.1x | 2.9x | 20.58% | ★★★★☆☆ |

| Renold | 10.7x | 0.7x | 2.52% | ★★★★☆☆ |

| Nyab | 22.2x | 1.0x | 35.57% | ★★★☆☆☆ |

| Oxford Instruments | 40.1x | 2.1x | 17.23% | ★★★☆☆☆ |

| CVS Group | 45.1x | 1.3x | 38.07% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.1x | 32.89% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Gofore Oyj (HLSE:GOFORE)

Simply Wall St Value Rating: ★★★☆☆☆

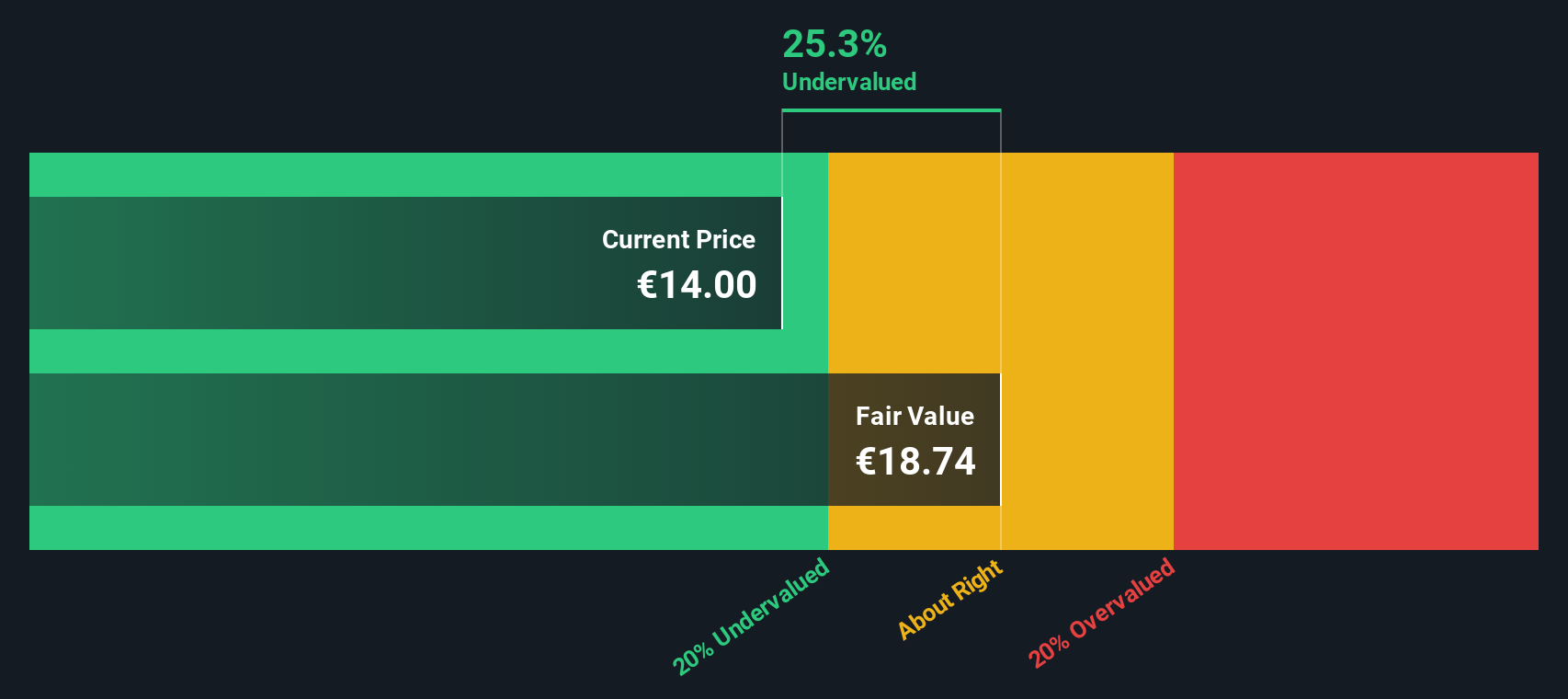

Overview: Gofore Oyj is a Finland-based digital transformation consultancy company specializing in computer services, with a market capitalization of €0.54 billion.

Operations: Gofore Oyj generates revenue primarily through its Computer Services segment, which reached €179.99 million. The company has experienced fluctuations in its gross profit margin, with a recent figure of 19.72%. Operating expenses and non-operating expenses are significant cost components, impacting the net income margin, which was recently reported at 5.01%.

PE: 26.2x

Gofore Oyj, a European tech consultancy, has recently faced challenges with declining sales and net income for the first half of 2025. Despite this, insider confidence is evident as Piia-Noora Kauppi acquired 3,500 shares valued at €50K in August 2025. The company has embarked on a share repurchase program to potentially enhance shareholder value. Although profit margins have shrunk from 9.2% to 5%, future earnings are projected to grow by over 23% annually.

- Get an in-depth perspective on Gofore Oyj's performance by reading our valuation report here.

Examine Gofore Oyj's past performance report to understand how it has performed in the past.

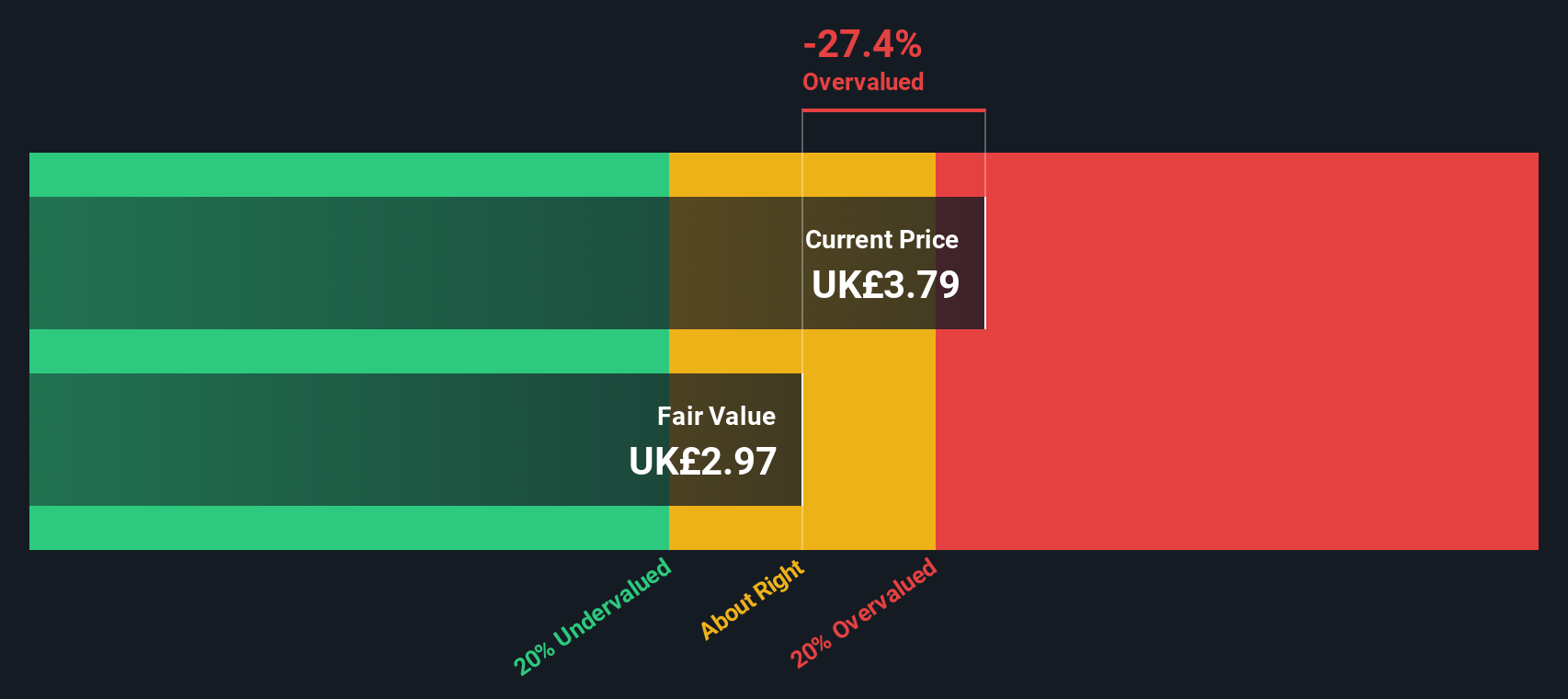

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mears Group is a UK-based company specializing in providing management and maintenance services, with a market cap of approximately £0.42 billion.

Operations: Mears Group derives its revenue primarily from its Management (£533.92 million) and Maintenance (£577.93 million) segments. The company's cost of goods sold (COGS) has consistently been a significant portion of revenue, impacting gross profit margins, which have shown fluctuations over time but recently reached 22.52%. Operating expenses are largely driven by general and administrative costs, which were £172.68 million as of the latest period reported. The net income margin has shown improvement in recent periods, reaching 4.28% as of September 2025.

PE: 5.8x

Mears Group's recent financials reveal a mixed picture, with sales dipping to £559.38 million for the half-year ending June 2025, down from £580.04 million in 2024. However, net income rose to £23.75 million from £22.73 million, and basic earnings per share increased to £0.2862 from £0.2363 last year, reflecting operational efficiency despite revenue challenges. Insider confidence is evident as insiders have been purchasing shares over the past few months, signaling potential value recognition within this small European player amidst external borrowing reliance for funding stability and future growth expectations slightly exceeding market forecasts with anticipated annual revenues of at least £1 billion by year-end 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Mears Group.

Gain insights into Mears Group's past trends and performance with our Past report.

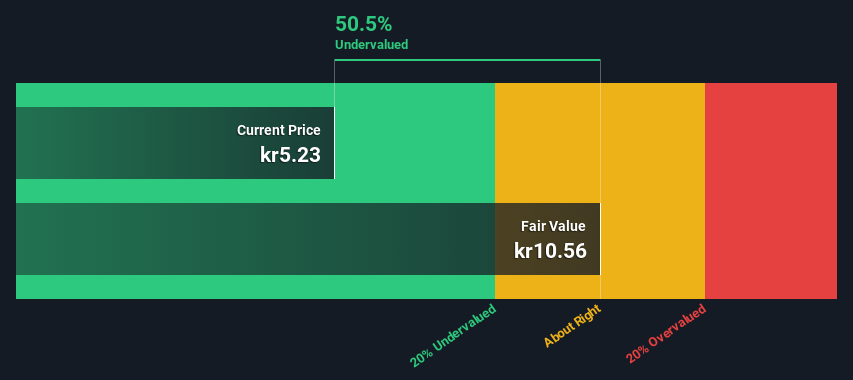

Nyab (OM:NYAB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nyab is a company engaged in providing sustainable infrastructure and construction services, with a market cap of approximately €0.22 billion.

Operations: Nyab's revenue streams have shown significant growth, with a notable increase from €8.39 million in late 2020 to €453.04 million by mid-2025. The company experienced fluctuations in its gross profit margin, peaking at 24.64% in September 2023 and dipping to 21.68% by June 2025, indicating variability in cost management efficiency over the periods observed. Operating expenses have also increased significantly, impacting net income margins which varied from negative figures early on to positive margins later, demonstrating financial volatility and adjustments over time.

PE: 22.2x

Nyab, a European construction player, showcases potential as an undervalued stock with recent insider confidence through share purchases. The company reported strong financial growth in Q2 2025, with sales jumping from €76.1 million to €135.76 million and net income rising to €4.21 million from €1.42 million year-over-year. Recent projects like the Uppsala Tramway and Stockholm subway waterproofing highlight its strategic positioning in urban infrastructure development, although reliance on external borrowing remains a funding risk factor.

- Click here to discover the nuances of Nyab with our detailed analytical valuation report.

Gain insights into Nyab's historical performance by reviewing our past performance report.

Where To Now?

- Get an in-depth perspective on all 47 Undervalued European Small Caps With Insider Buying by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:GOFORE

Gofore Oyj

Provides digital transformation consultancy services for private and public sectors in Finland and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives