- United Kingdom

- /

- Commercial Services

- /

- AIM:TENG

Ten Lifestyle Group's (LON:TENG) Soft Earnings Don't Show The Whole Picture

The market for Ten Lifestyle Group Plc's (LON:TENG) shares didn't move much after it posted weak earnings recently. We did some digging, and we believe the earnings are stronger than they seem.

View our latest analysis for Ten Lifestyle Group

Examining Cashflow Against Ten Lifestyle Group's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

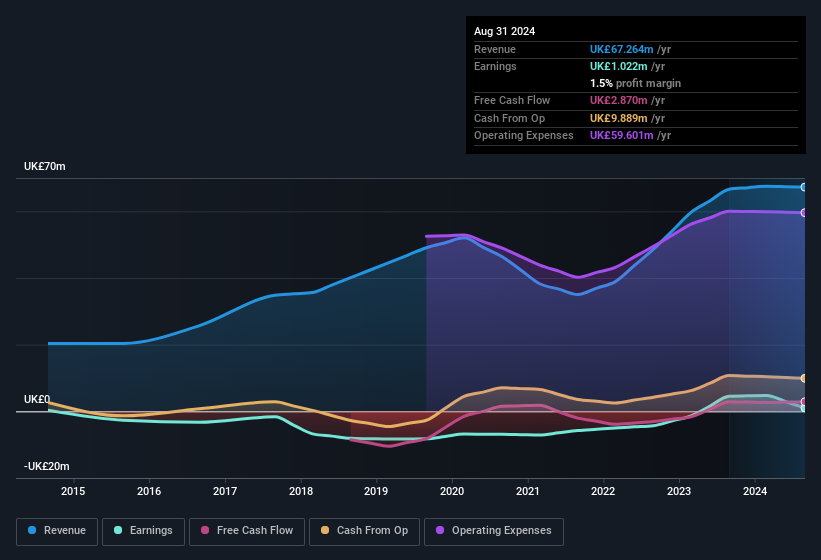

Over the twelve months to August 2024, Ten Lifestyle Group recorded an accrual ratio of -0.14. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of UK£2.9m, well over the UK£1.02m it reported in profit. Over the last year, Ten Lifestyle Group's free cash flow remained steady. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Ten Lifestyle Group expanded the number of shares on issue by 13% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Ten Lifestyle Group's EPS by clicking here.

A Look At The Impact Of Ten Lifestyle Group's Dilution On Its Earnings Per Share (EPS)

Three years ago, Ten Lifestyle Group lost money. And even focusing only on the last twelve months, we see profit is down 78%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 78% in the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Ten Lifestyle Group's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Ten Lifestyle Group's Profit Performance

In conclusion, Ten Lifestyle Group has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. After taking into account all these factors, we think that Ten Lifestyle Group's statutory results are a decent reflection of its underlying earnings power. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 3 warning signs with Ten Lifestyle Group, and understanding them should be part of your investment process.

Our examination of Ten Lifestyle Group has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Ten Lifestyle Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TENG

Ten Lifestyle Group

Offers concierge services to private banks, premium financial services, and high-net-worth individuals in Asia, the Middle East, Africa, and the Americas.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives