Stock Analysis

Whilst it may not be a huge deal, we thought it was good to see that the Restore plc (LON:RST) CFO & Director, Dan Baker, recently bought UK£52k worth of stock, for UK£2.06 per share. Although the purchase is not a big one, by either a percentage standpoint or absolute value, it can be seen as a good sign.

View our latest analysis for Restore

Restore Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Non-Executive Chair Jameson Hopkins bought UK£99k worth of shares at a price of UK£2.17 per share. That implies that an insider found the current price of UK£2.19 per share to be enticing. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. In this case we're pleased to report that the insider purchases were made at close to current prices.

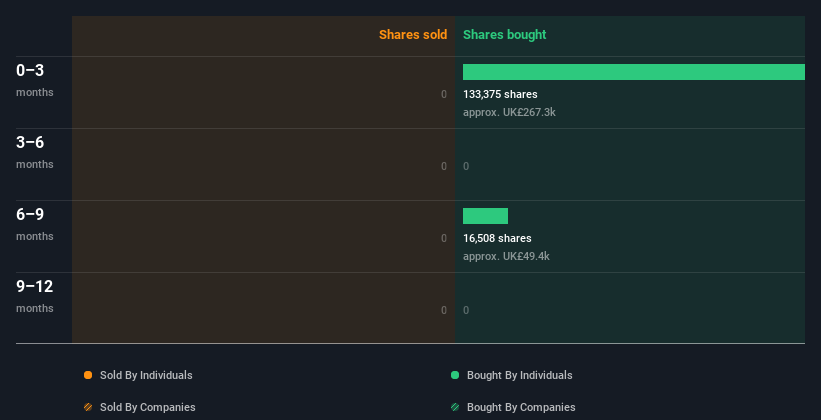

Restore insiders may have bought shares in the last year, but they didn't sell any. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our information indicates that Restore insiders own about UK£352k worth of shares. It's always possible we are missing something but from our data, it looks like insider ownership is minimal.

So What Does This Data Suggest About Restore Insiders?

The recent insider purchases are heartening. We also take confidence from the longer term picture of insider transactions. But on the other hand, the company made a loss during the last year, which makes us a little cautious. While the overall levels of insider ownership are below what we'd like to see, the history of transactions imply that Restore insiders are reasonably well aligned, and optimistic for the future. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For instance, we've identified 2 warning signs for Restore (1 can't be ignored) you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're helping make it simple.

Find out whether Restore is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RST

Restore

Provides services to offices and workplaces in the public and private sectors primarily in the United Kingdom.

Reasonable growth potential and fair value.