- United Kingdom

- /

- Professional Services

- /

- AIM:KEYS

The Keystone Law Group (LON:KEYS) Share Price Has Gained 148%, So Why Not Pay It Some Attention?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. To wit, the Keystone Law Group plc (LON:KEYS) share price has flown 148% in the last three years. Most would be happy with that.

See our latest analysis for Keystone Law Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last three years, Keystone Law Group failed to grow earnings per share, which fell 71% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

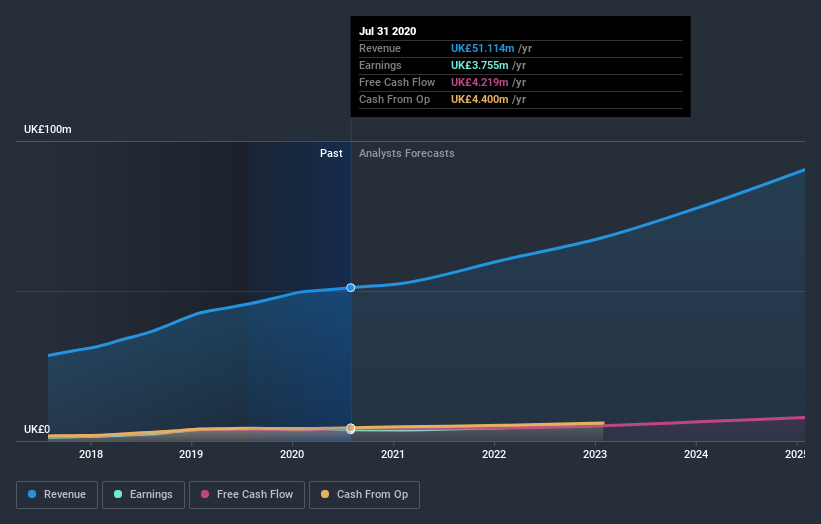

The modest 1.4% dividend yield is unlikely to be propping up the share price. It may well be that Keystone Law Group revenue growth rate of 20% over three years has convinced shareholders to believe in a brighter future. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Keystone Law Group stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Keystone Law Group's TSR for the last 3 years was 163%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Keystone Law Group shareholders are down 10.0% for the year (even including dividends), falling short of the market return. Meanwhile, the broader market slid about 7.4%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 38% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Keystone Law Group has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Keystone Law Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Keystone Law Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:KEYS

Keystone Law Group

Provides conventional legal services in the United Kingdom.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives