- United Kingdom

- /

- Chemicals

- /

- LSE:ZTF

3 UK Stocks Including Benchmark Holdings That Might Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the last week, the United Kingdom market has remained flat, yet it has seen a 7.5% increase over the past year with expectations of 14% annual earnings growth in the coming years. In this context, identifying stocks that may be trading below their estimated value can provide opportunities for investors looking to capitalize on potential future gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £1.985 | £3.72 | 46.6% |

| Informa (LSE:INF) | £8.196 | £16.13 | 49.2% |

| CAB Payments Holdings (LSE:CABP) | £1.21 | £2.23 | 45.7% |

| Redcentric (AIM:RCN) | £1.25 | £2.41 | 48.2% |

| Mpac Group (AIM:MPAC) | £4.50 | £8.99 | 49.9% |

| Videndum (LSE:VID) | £2.41 | £4.52 | 46.7% |

| BATM Advanced Communications (LSE:BVC) | £0.195 | £0.37 | 47.1% |

| Foxtons Group (LSE:FOXT) | £0.648 | £1.21 | 46.2% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 50% |

| Genel Energy (LSE:GENL) | £0.779 | £1.50 | 48.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Benchmark Holdings (AIM:BMK)

Overview: Benchmark Holdings plc, along with its subsidiaries, provides technical services, products, and specialist knowledge to support the development of food and farming industries, with a market cap of £302.20 million.

Operations: The company's revenue segments include Health (£16.27 million), Genetics (£57.06 million), and Advanced Nutrition (£74.31 million).

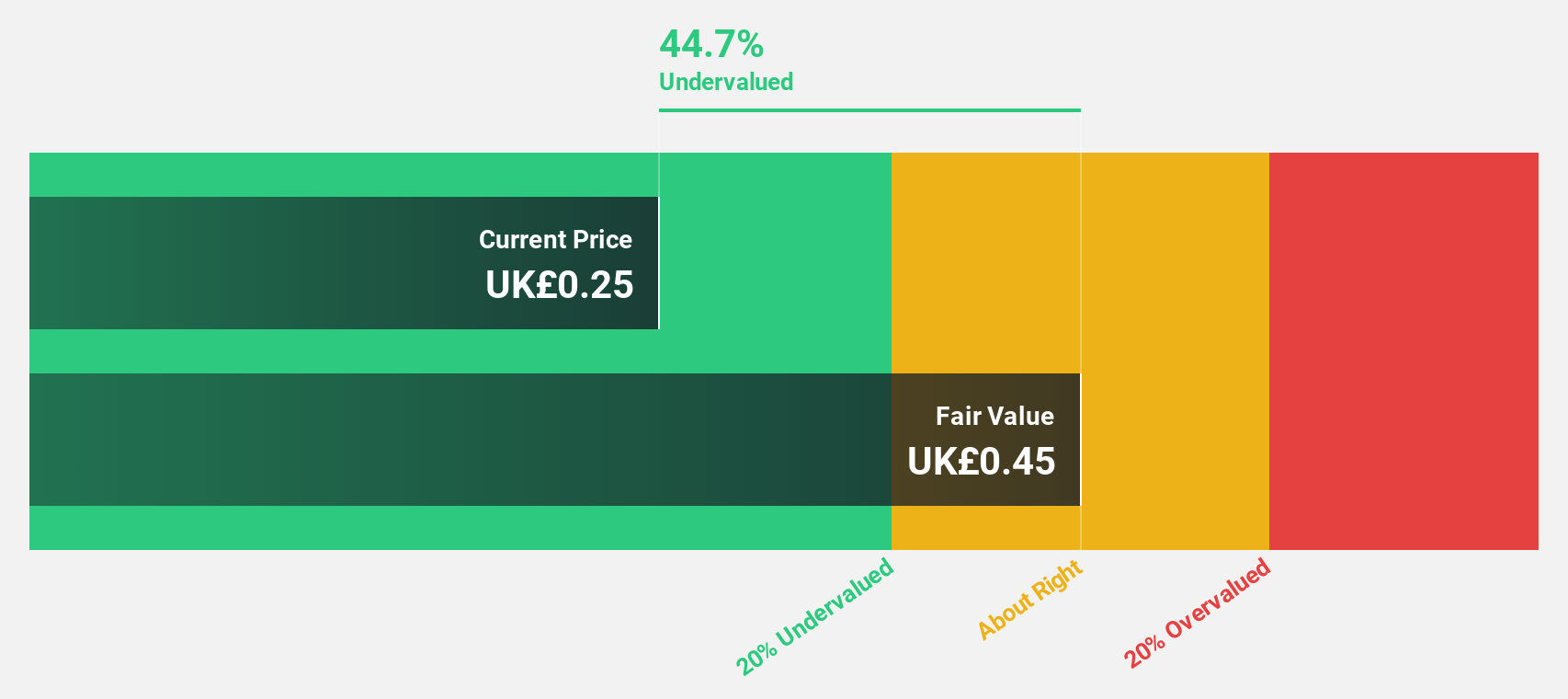

Estimated Discount To Fair Value: 36.5%

Benchmark Holdings is trading at £0.41, significantly below its estimated fair value of £0.64, suggesting it may be undervalued based on cash flows. Despite a challenging financial performance with increased net losses and declining sales in recent reports, the company is forecast to achieve profitability within three years and has a projected revenue growth rate of 14.2% annually, outpacing the UK market's average growth rate of 3.5%.

- According our earnings growth report, there's an indication that Benchmark Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Benchmark Holdings stock in this financial health report.

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc operates in franchising and related activities across the United Kingdom, North America, and Europe, with a market cap of £290.46 million.

Operations: The company's revenue segments include Azura (£0.81 million), Pirtek (£60.78 million), B2C Division (£5.95 million), Filta International (£25.64 million), and Water & Waste Services (£49.17 million).

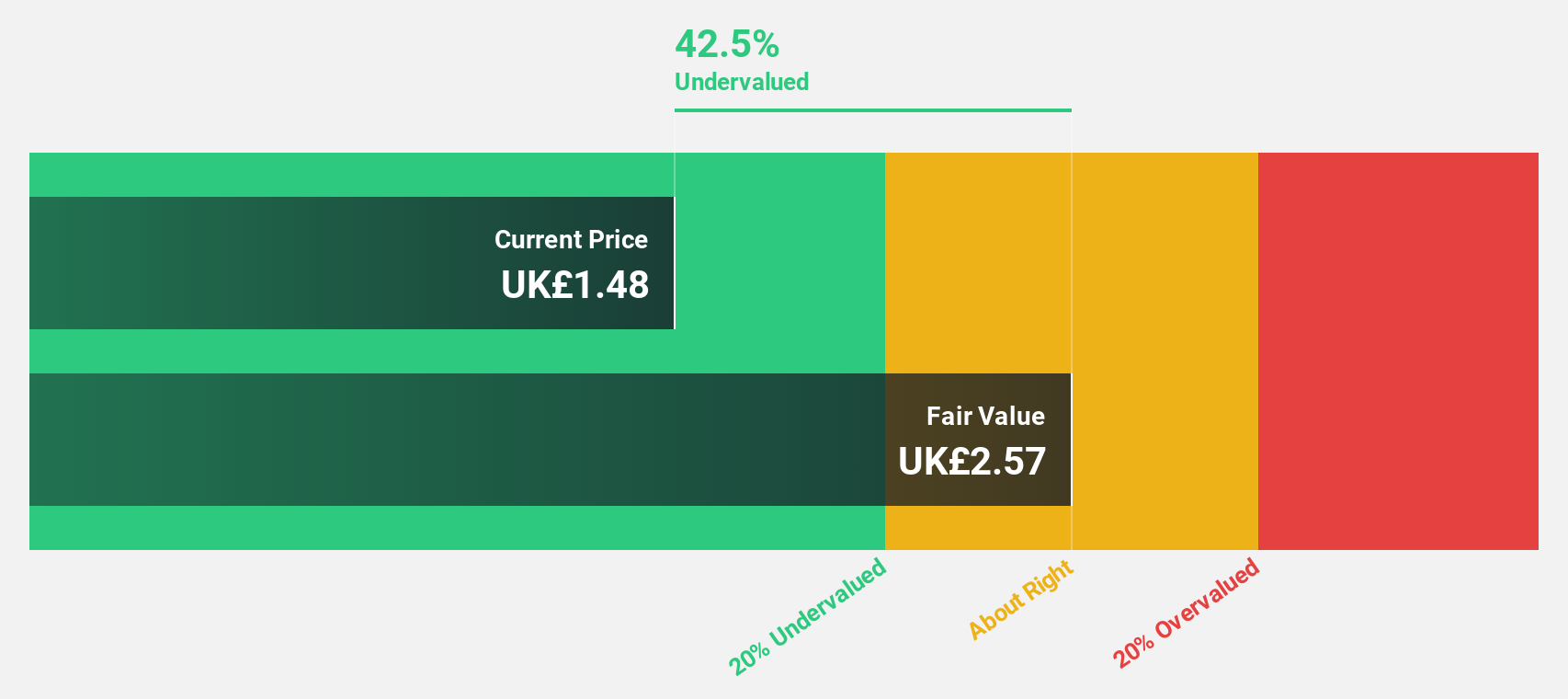

Estimated Discount To Fair Value: 42.8%

Franchise Brands is trading at £1.51, significantly below its estimated fair value of £2.64, highlighting potential undervaluation based on cash flows. Recent earnings showed a turnaround with net income of £3.62 million against a prior loss, and an interim dividend increase to 1.1 pence per share was announced. However, significant insider selling and large one-off items impacting financial results warrant caution despite forecasts of strong annual earnings growth exceeding 44%.

- Our comprehensive growth report raises the possibility that Franchise Brands is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Franchise Brands.

Zotefoams (LSE:ZTF)

Overview: Zotefoams plc, with a market cap of £200.75 million, manufactures, distributes, and sells polyolefin block foams across the United Kingdom, Europe, North America, and other international markets.

Operations: The company's revenue is primarily derived from three segments: Polyolefin Foams (£64.39 million), Mucell Extrusion LLC (MEL) (£1.21 million), and High-Performance Products (HPP) (£67.81 million).

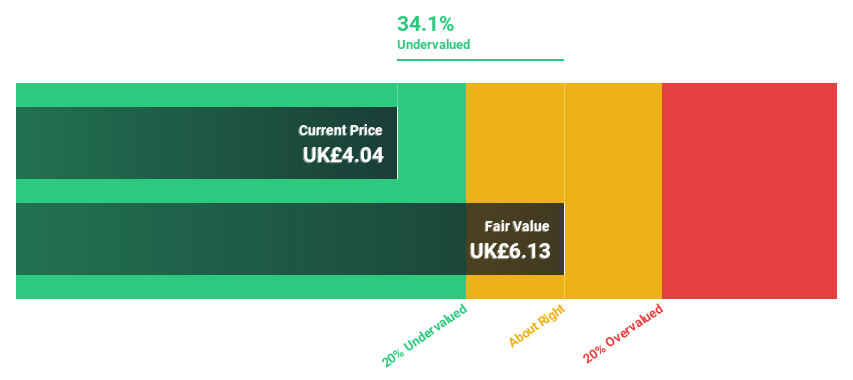

Estimated Discount To Fair Value: 32.8%

Zotefoams is trading at £4.13, below its estimated fair value of £6.15, suggesting undervaluation based on cash flows. Recent earnings reported sales of £71.06 million and net income of £6.28 million, showing growth over the previous year. An interim dividend increase to 2.38 pence per share was announced, reflecting financial stability. Forecasts indicate revenue and earnings growth exceeding market averages, with annual profit growth expected to be significant at over 20%.

- Our earnings growth report unveils the potential for significant increases in Zotefoams' future results.

- Dive into the specifics of Zotefoams here with our thorough financial health report.

Summing It All Up

- Click through to start exploring the rest of the 58 Undervalued UK Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zotefoams might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ZTF

Zotefoams

Manufactures, distributes, and sells polyolefin block foams in the United Kingdom, rest of Europe, North America, and internationally.

Excellent balance sheet and good value.