- United Kingdom

- /

- Industrials

- /

- LSE:SMIN

Smiths Group (LSE:SMIN) Leverages John Crane and AI for Growth, Eyes Market Value Upside

Reviewed by Simply Wall St

Smiths Group (LSE:SMIN) continues to solidify its market position through its foundational business unit, John Crane, and recent significant contract wins, as highlighted by CFO Clare Scherrer and CEO Roland Carter. The company's investment in innovative technologies, such as x-ray diffraction, and its proactive growth initiatives, including AI and automation, position it well for future expansion. However, operational inefficiencies and economic headwinds present challenges that require strategic attention. The company report covers key areas, including financial performance, market dynamics, operational strategies, and competitive pressures.

Dive into the specifics of Smiths Group here with our thorough analysis report.

Unique Capabilities Enhancing Smiths Group's Market Position

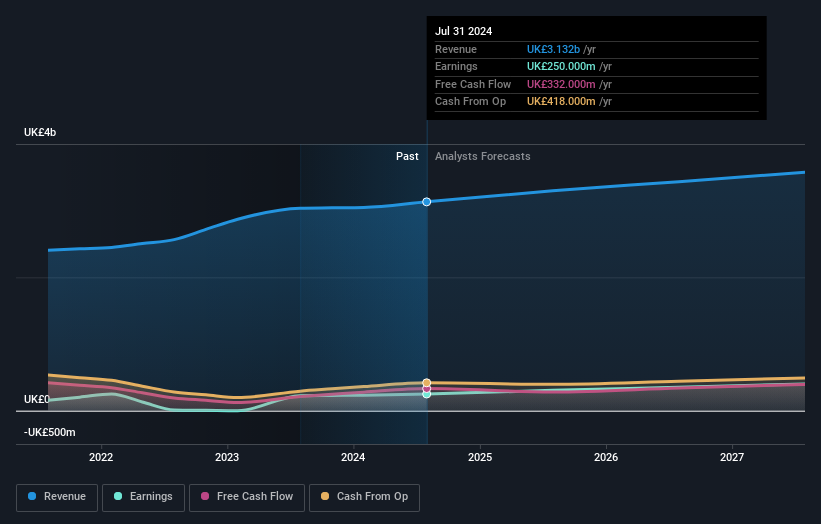

Smiths Group's strong market position is underscored by its foundational business unit, John Crane, as noted by Scherrer. This foundation supports the company's stability and solid market presence. The group has successfully secured significant contracts, contributing to its positive financial performance, as highlighted by CEO Roland Carter. These achievements reflect the company's ability to thrive in competitive environments. Moreover, the company's investment in innovative technologies, such as x-ray diffraction, enhances its product offerings, providing a competitive edge. Earnings growth over the past year at 11.1% surpasses the industry average, reinforcing its financial health. Currently trading at £16.97, below the estimated fair value of £30.94, the company's valuation suggests potential for market appreciation.

Vulnerabilities Impacting Smiths Group

Operational inefficiencies present challenges, with COO Lushanthan Mahendrarajah acknowledging slower-than-expected processes. These inefficiencies could hinder customer demand fulfillment and financial targets. Additionally, the competitive environment is intensifying, requiring swift adaptation, as noted by Clare Scherrer. The company's return on equity at 11.1% falls below the benchmark, indicating room for improvement in generating shareholder value. Despite improving net profit margins to 8%, cost management remains a concern, with areas identified for efficiency improvements by Roland Carter.

Areas for Expansion and Innovation for Smiths Group

Exploring new product lines aligned with market demand represents a proactive growth initiative, as stated by Clare Scherrer. Investments in AI and automation are expected to enhance operational efficiency, reducing costs and boosting competitiveness. Revamped customer acquisition strategies aim to capture a larger market share, crucial for long-term growth. The company's trading discount to its estimated fair value indicates potential for price appreciation if growth rates exceed forecasts.

Competitive Pressures and Market Risks Facing Smiths Group

Economic headwinds pose risks, with potential downturns affecting sales, as highlighted by Roland Carter. Compliance with complex and costly new regulations adds to operational challenges, impacting profitability. Supply chain disruptions, acknowledged by Lushanthan Mahendrarajah, emphasize the need for diversified supplier relationships to mitigate production and delivery risks.

Conclusion

Smiths Group's strategic foundation, bolstered by its John Crane unit and innovative technologies, positions it well for continued market success, as evidenced by its strong contract wins and earnings growth surpassing industry averages. However, operational inefficiencies and competitive pressures highlight areas needing improvement, particularly in enhancing shareholder value and cost management. The company's proactive initiatives in AI, automation, and customer acquisition strategies present opportunities for growth and efficiency gains. Trading at £16.97, significantly below the estimated fair value of £30.94, suggests a potential for price appreciation, provided the company successfully navigates its operational challenges and capitalizes on its innovation-driven expansion strategies.

Summing It All Up

- Got skin in the game with Smiths Group? Elevate how you manage them by using Simply Wall St's portfolio , where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:SMIN

Smiths Group

Operates as an industrial technology company in Americas, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives