- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

Yellow Cake And 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, but it is up 12% over the past year with earnings forecast to grow by 14% annually. In this environment, identifying stocks with strong potential and solid fundamentals becomes crucial for investors seeking to capitalize on future growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector, focusing on holding U3O8 for long-term capital appreciation, with a market cap of £1.18 billion.

Operations: Yellow Cake plc generates revenue primarily from holding U3O8 for long-term capital appreciation, amounting to $735.02 million.

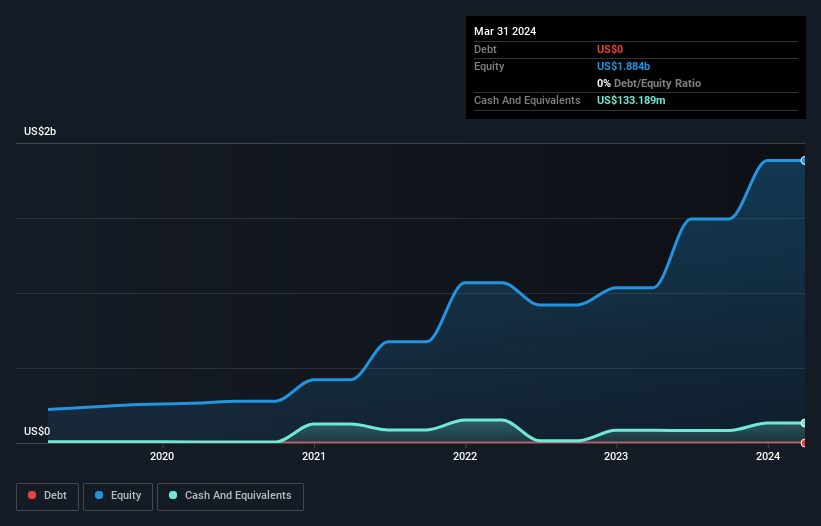

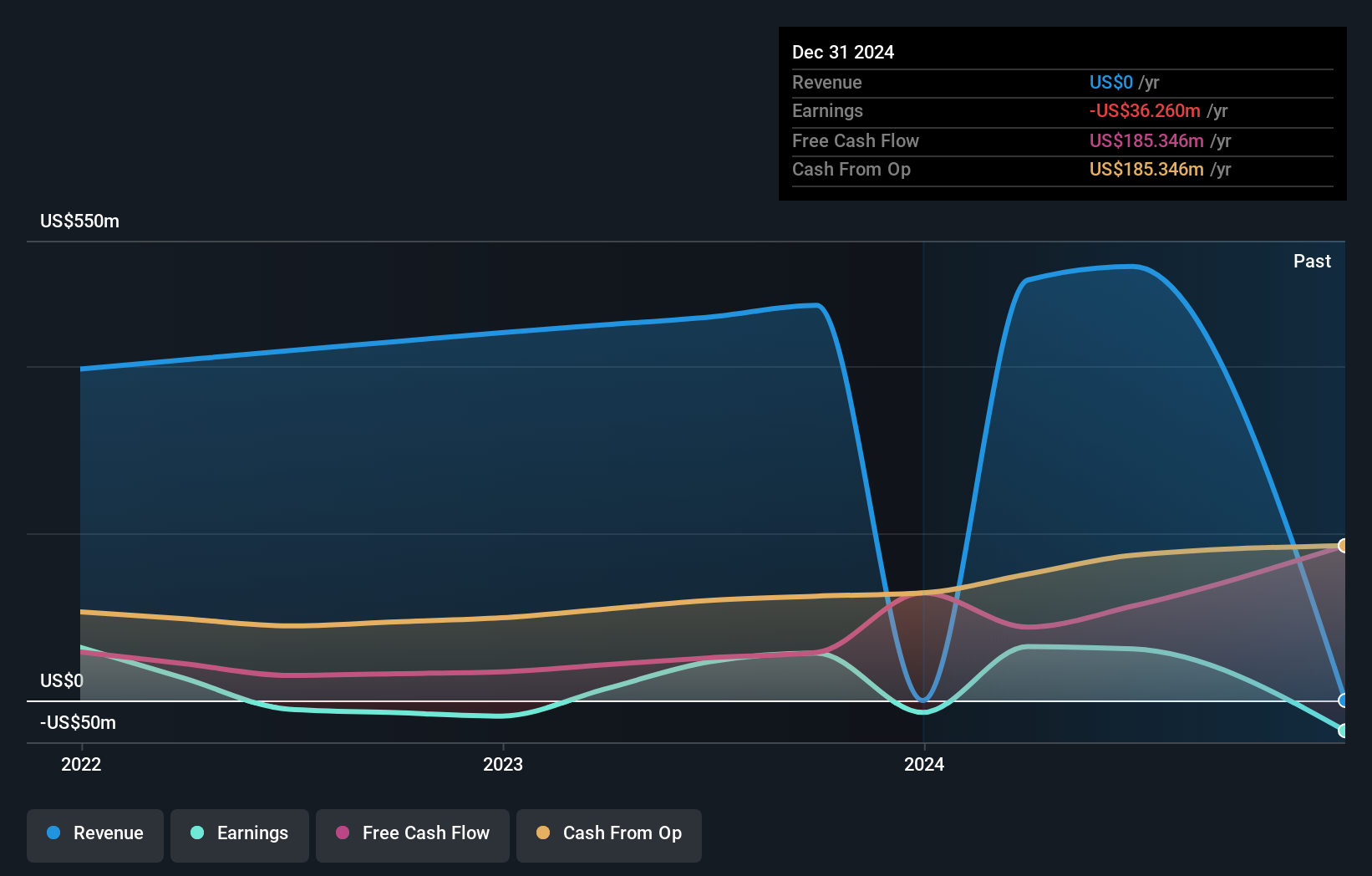

Yellow Cake, a UK-based uranium investment company, has recently turned profitable with net income of US$727.01 million for the year ending March 31, 2024. This marks a significant turnaround from a net loss of US$102.94 million the previous year. The company is debt-free and boasts an attractive price-to-earnings ratio of 2.1x, well below the UK market average of 16.9x. However, shareholders faced dilution over the past year despite high levels of non-cash earnings contributing to their recent success.

- Take a closer look at Yellow Cake's potential here in our health report.

Evaluate Yellow Cake's historical performance by accessing our past performance report.

Costain Group (LSE:COST)

Simply Wall St Value Rating: ★★★★★★

Overview: Costain Group PLC provides smart infrastructure solutions for the transportation, energy, water, and defense markets in the United Kingdom and has a market cap of £292.39 million.

Operations: Costain Group PLC generates revenue primarily from its Transportation and Natural Resources segments, amounting to £900.30 million and £406.60 million, respectively.

Costain Group, a notable player in the UK's construction sector, has demonstrated impressive financial health. With no debt compared to a 50.3% debt-to-equity ratio five years ago, Costain's earnings surged by 39.3% over the past year, outpacing the industry average of 10.3%. Recently reported half-year sales were £639.3 million with net income climbing to £13.5 million from £5.1 million last year. Additionally, Costain trades at nearly half its estimated fair value and anticipates annual earnings growth of 13.6%.

- Click here and access our complete health analysis report to understand the dynamics of Costain Group.

Assess Costain Group's past performance with our detailed historical performance reports.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited, with a market cap of £516.30 million, is an investment holding company that provides maritime and logistics services in Brazil.

Operations: The company's primary revenue stream comes from its maritime services in Brazil, generating $519.35 million.

Ocean Wilsons Holdings has been making waves with a price-to-earnings ratio of 11x, notably below the UK market's 16.9x. The company’s debt to equity ratio has improved from 42.7% to 38% over the last five years, showcasing prudent financial management. Recent earnings growth of 32.7% outpaced the infrastructure industry’s 20.5%. Discussions about selling its subsidiary, Wilson Sons S.A., could further impact its strategic direction and valuation in the near term.

Next Steps

- Access the full spectrum of 80 UK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, offers maritime and logistics services in Brazil.

Flawless balance sheet established dividend payer.