- United Kingdom

- /

- Auto Components

- /

- AIM:STG

Strip Tinning Holdings plc (LON:STG) Might Not Be As Mispriced As It Looks

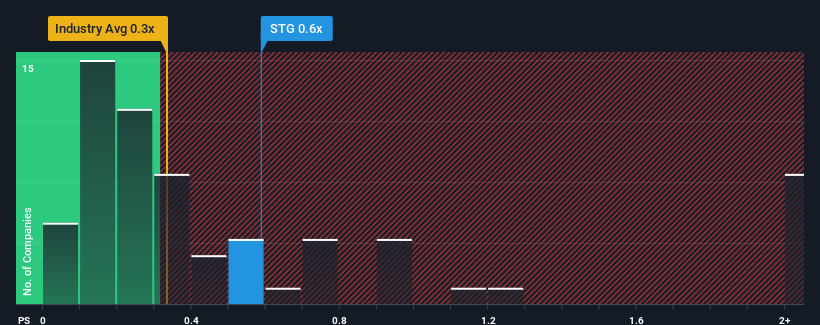

With a median price-to-sales (or "P/S") ratio of close to 1x in the Auto Components industry in the United Kingdom, you could be forgiven for feeling indifferent about Strip Tinning Holdings plc's (LON:STG) P/S ratio of 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Strip Tinning Holdings

How Has Strip Tinning Holdings Performed Recently?

There hasn't been much to differentiate Strip Tinning Holdings' and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Strip Tinning Holdings.Is There Some Revenue Growth Forecasted For Strip Tinning Holdings?

In order to justify its P/S ratio, Strip Tinning Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.8%. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 23% per year over the next three years. That's shaping up to be materially higher than the 4.4% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Strip Tinning Holdings' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Strip Tinning Holdings' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Strip Tinning Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Strip Tinning Holdings (1 is potentially serious!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STG

Strip Tinning Holdings

Manufactures and supplies flexible electrical connectors for heating and antennae systems embedded within automotive glazing and to the connection of the cells within electric vehicle (EV) battery packs in the United Kingdom, rest of Europe, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives