- France

- /

- Infrastructure

- /

- ENXTPA:GET

What Getlink (ENXTPA:GET)'s Mixed October Traffic and Rising Capex Means For Shareholders

Reviewed by Sasha Jovanovic

- Getlink SE recently reported mixed operating results for October 2025, with LeShuttle Freight truck traffic down 7% year-over-year and LeShuttle passenger vehicle numbers up 4% compared to the same month last year.

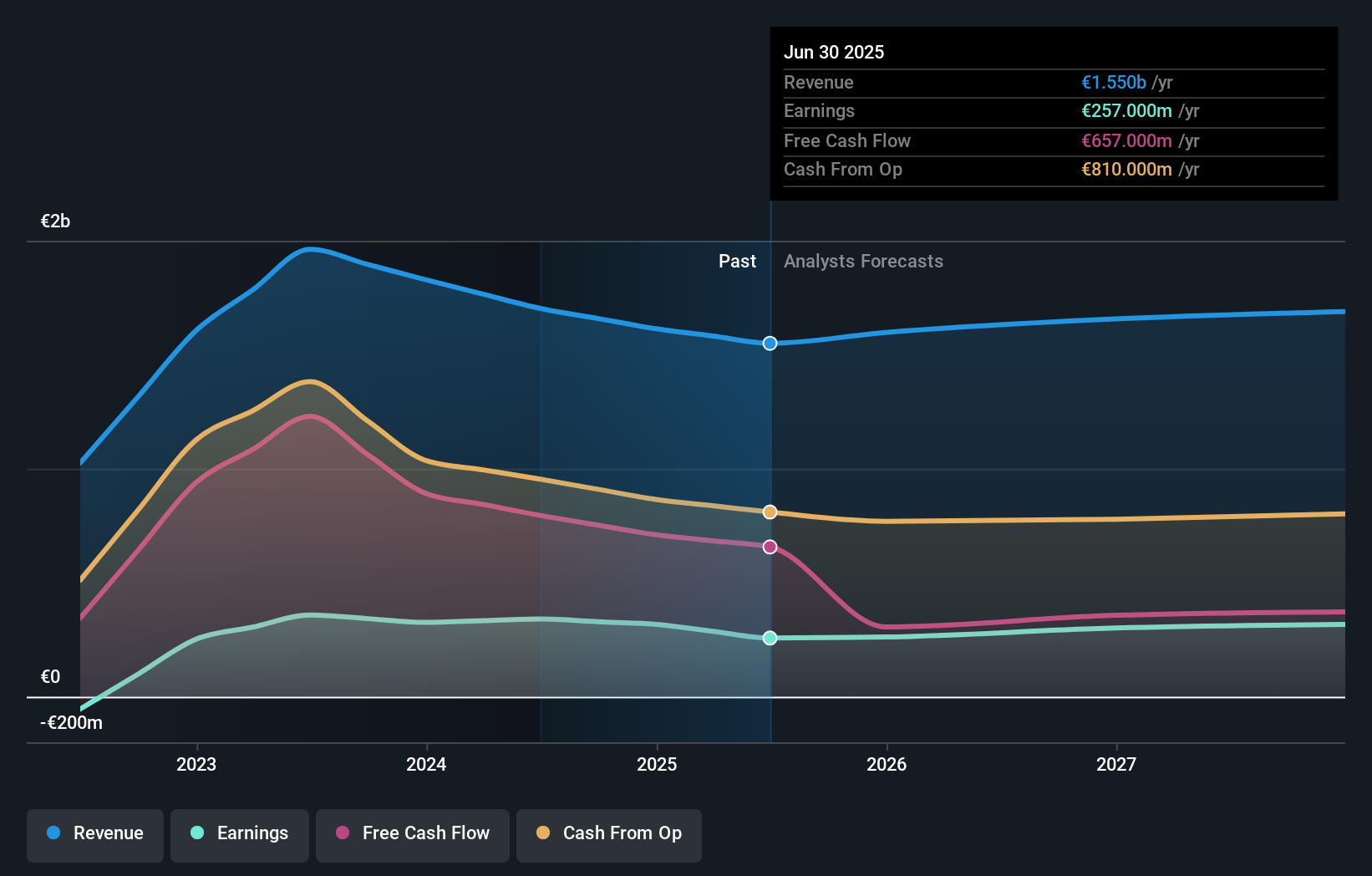

- This update highlighted concerns about ongoing elevated capital expenditures, which are expected to constrain the company’s free cash flow into the early 2030s.

- We’ll examine how the combined impact of weaker freight and increased capital spending could reshape Getlink’s investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Getlink's Investment Narrative?

For anyone considering Getlink, the investment story has always hinged on the company’s ability to unlock value from its crucial cross-Channel infrastructure while managing the capital intensity it demands. The latest operating results add complexity to that thesis. While passenger vehicle growth in October signaled robust demand, the larger drop in freight traffic underscores ongoing exposure to shifts in trade and logistics flows. This uneven momentum may affect near-term hopes for a rebound in operating margins, especially now that capital expenditures are set to remain high. As a result, key short-term catalysts such as traffic growth or margin improvement seem less likely to surprise to the upside in the coming months, and the risk profile has shifted; weak freight adds pressure just as capex weighs on free cash flow, bringing cash flow constraints more sharply into focus than before. The recent news tilts the balance of risks further in this direction, which may temper expectations set prior to October’s figures.

On the other hand, elevated capital spending will be on investors’ minds and could limit flexibility in the years ahead.

Exploring Other Perspectives

Explore another fair value estimate on Getlink - why the stock might be worth just €17.71!

Build Your Own Getlink Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getlink research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Getlink research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getlink's overall financial health at a glance.

No Opportunity In Getlink?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GET

Getlink

Engages in the design, finance, construction, and operation of fixed link infrastructure and transport system in France and the United Kingdom.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives