Will Premium Demand Outweigh Cost Pressures for Air France-KLM (ENXTPA:AF) This Earnings Season?

Reviewed by Sasha Jovanovic

- Air France-KLM recently reported its third-quarter and nine-month 2025 results, highlighting group sales of €9.21 billion and net income of €730 million for the quarter, alongside a continued increase in passenger numbers and capacity.

- While the Group achieved solid operating margins and premium cabin demand remained strong, earnings were weighed down by strike-related costs and yield pressure in economy cabins, especially for its Dutch subsidiary.

- We'll examine how the balance between premium demand strength and cost challenges shapes Air France-KLM's current investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Air France-KLM's Investment Narrative?

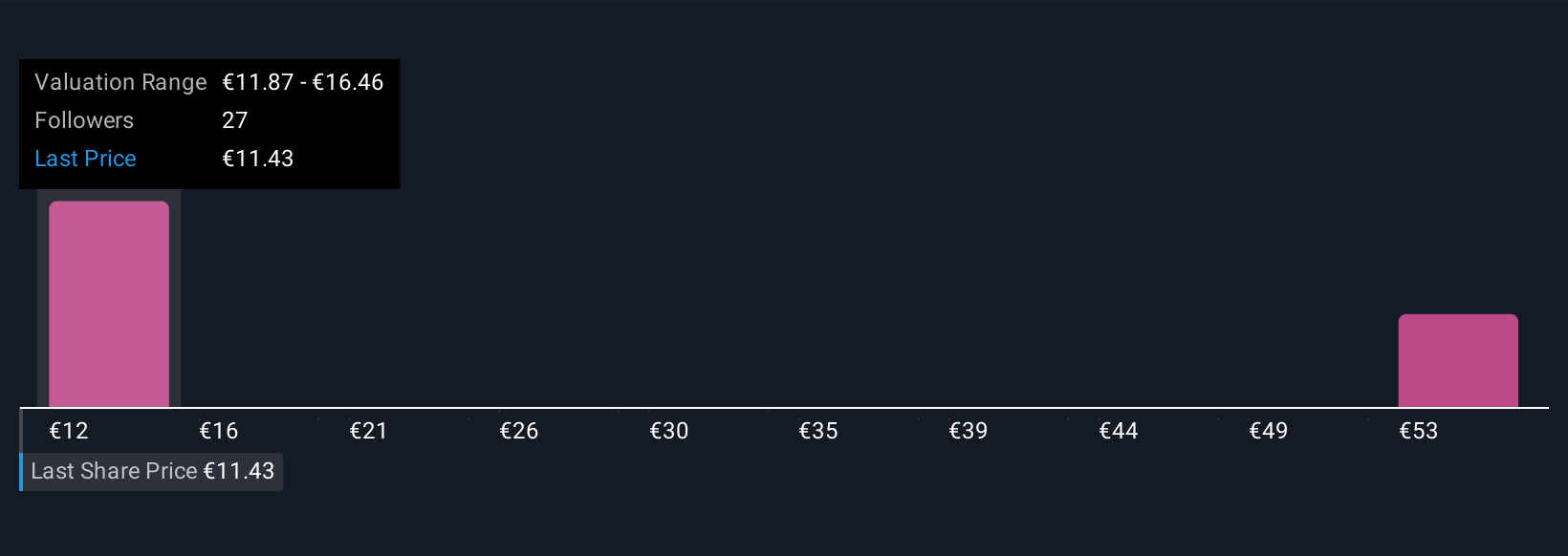

For investors who see potential in Air France-KLM, the appeal rests on disciplined cost management, steadily growing capacity, and robust demand in premium cabins. This latest earnings release tested short-term optimism, as strike-related costs and pressure on economy yields hit earnings and contributed to a sharp 13% share price drop. Despite these headwinds, management reaffirmed full-year guidance and capacity growth targets, signaling confidence in operational resilience. Cost control and capital allocation remain front and center, especially as debt has ticked slightly higher and inflationary pressures persist. While the price-to-earnings ratio still screens as attractive against peers, the market’s swift reaction suggests near-term sentiment may hinge on resolving labor disruptions and stabilizing margins, especially at KLM. The risk profile shifts in the short term, with labor relations and yield pressure now more immediate concerns than previously recognized.

But with labor costs flaring up, investors now face an increasingly real operational risk. Despite retreating, Air France-KLM's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on Air France-KLM - why the stock might be worth over 3x more than the current price!

Build Your Own Air France-KLM Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air France-KLM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Air France-KLM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air France-KLM's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives