Air France-KLM (ENXTPA:AF): Assessing Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Air France-KLM (ENXTPA:AF) has seen its stock move recently, prompting some investors to reassess the company’s valuation. Over the past month, shares have declined by 16%, raising questions about what is driving this momentum shift.

See our latest analysis for Air France-KLM.

This recent pullback comes after a robust run earlier in the year for Air France-KLM, with a 19.1% year-to-date share price return. However, momentum has clearly faded lately. Despite that, the longer-term picture shows a 23.7% total shareholder return over the past year, even as recent headwinds remind investors of the sector’s volatility.

If shifting airline dynamics have you thinking bigger, there has never been a better time to expand your horizons and discover See the full list for free.

This leaves investors wondering if Air France-KLM shares are now trading below their true value, or if the recent weakness merely reflects a market that has already accounted for the company's future prospects. Is this a buying opportunity, or has the market already priced in all the growth ahead?

Price-to-Earnings of 2.8x: Is it justified?

Air France-KLM’s current price-to-earnings (P/E) ratio stands at just 2.8x, a figure well below typical sector levels. This low multiple, set against a last close price of €9.63, signals the market might be significantly underpricing the airline’s recent and forecasted earnings power.

The price-to-earnings ratio compares a company’s share price to its per-share earnings, offering a snapshot of how much investors are willing to pay for each unit of profit. In sectors like airlines, where profits can be volatile, this measure helps investors weigh current performance against market optimism or caution for the future.

At 2.8x, Air France-KLM trades not only far below its peer average (54x) but also under the global airline industry average (8.7x). In addition, this multiple is much lower than the company’s estimated fair P/E of 14.5x. This highlights a sizable gap the market could eventually close if financial performance continues to improve.

Explore the SWS fair ratio for Air France-KLM

Result: Price-to-Earnings of 2.8x (UNDERVALUED)

However, persistent industry volatility and uncertain demand trends could undermine sustained gains. As a result, any valuation rebound remains far from guaranteed in the near term.

Find out about the key risks to this Air France-KLM narrative.

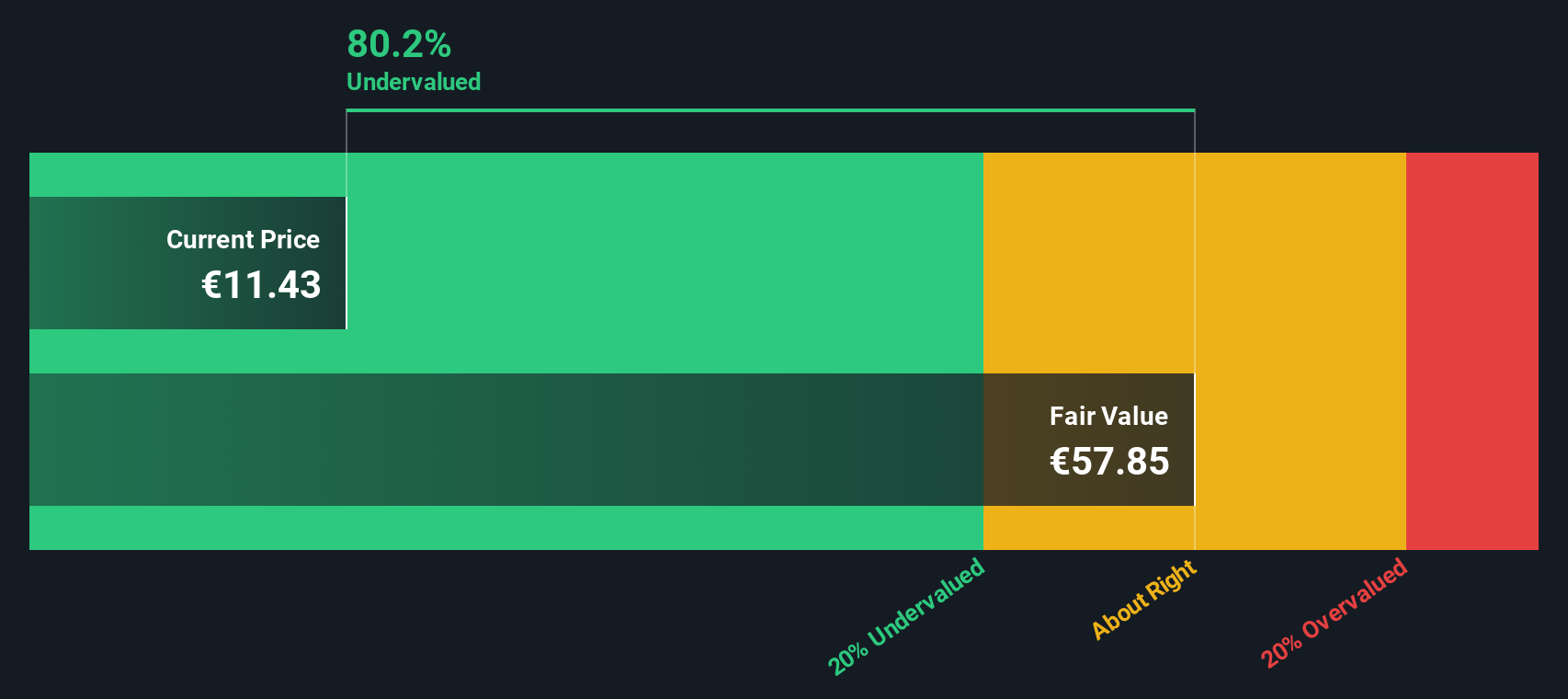

Another View: DCF Analysis Takes a Different Perspective

Alongside multiples, the SWS DCF model offers another lens on Air France-KLM’s valuation. This approach suggests shares are trading well below their estimated fair value. This implies significant upside. But how reliable is this figure, and do future cash flows justify today’s low price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air France-KLM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air France-KLM Narrative

If these numbers and valuation signals do not align with your outlook, take the opportunity to review the data firsthand and shape your own view of Air France-KLM in just a few minutes with Do it your way.

A great starting point for your Air France-KLM research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give your investing strategy an edge by uncovering standout stocks in high-potential sectors. Don’t settle for the ordinary when you can act on smart opportunities others might miss.

- Spot unique companies with serious market comeback potential by checking out these 3587 penny stocks with strong financials. These organizations are shaking up their industries and showing robust financials.

- Accelerate your growth prospects when you tap into these 32 healthcare AI stocks; innovation in medicine and technology is reshaping the future of healthcare.

- Boost your passive income plan with these 16 dividend stocks with yields > 3%, which features offerings with impressive yields above 3% and a track record of rewarding investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives