Stock Analysis

- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

High Growth Tech And 2 Other High Potential Stocks To Watch

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investor sentiment is buoyed by strong labor market data and positive home sales reports. In this environment of broad-based gains, identifying high-growth tech stocks alongside other promising opportunities requires a focus on companies that demonstrate robust innovation potential and adaptability to evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1295 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market cap of approximately €2.30 billion.

Operations: VusionGroup generates revenue primarily through installing and maintaining electronic shelf labels, accounting for €830.16 million. The company operates across Europe, Asia, and North America.

VusionGroup S.A. is navigating a dynamic landscape with its aggressive R&D investment strategy, allocating significant resources that underscore its commitment to innovation. In the last year, R&D expenses surged to 23.4% of revenue, reflecting a strategic emphasis on developing cutting-edge technologies which could catalyze future growth. Despite recent challenges marked by a net loss in H1 2024, the company's revenue trajectory remains robust with an anticipated increase of 84.2% annually over the next three years. This growth is supported by recent earnings calls and sales statements that highlight VusionGroup's resilience and adaptability in a competitive market. The firm’s focus on expanding its technological capabilities while managing current financial volatilities presents a balanced view of potential risks and rewards in the evolving tech landscape.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of HK$42.39 billion.

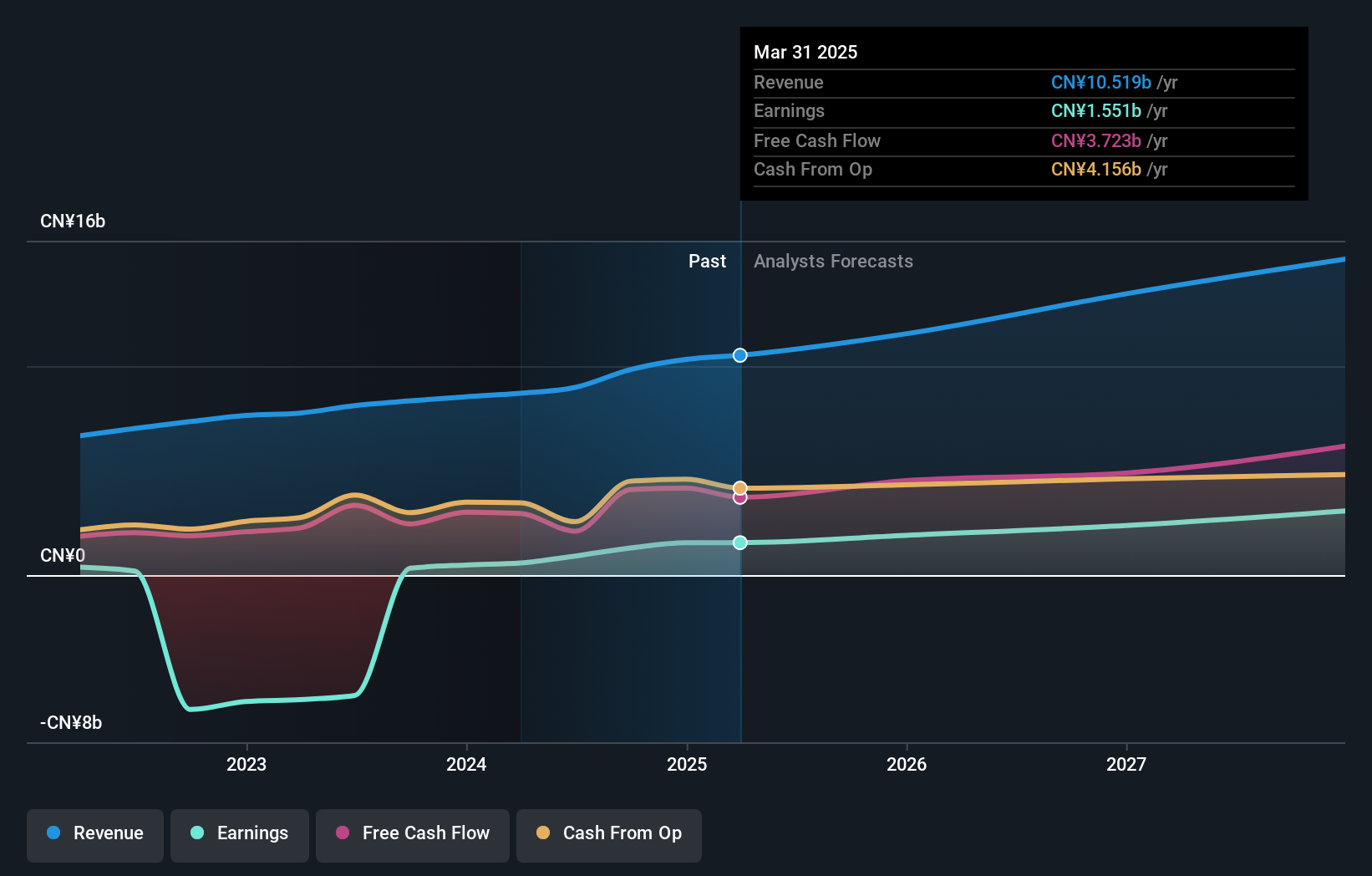

Operations: Kingsoft Corporation Limited generates revenue from two primary segments: Online Games and Office Software and Services, with each contributing approximately CN¥4.93 billion and CN¥4.91 billion, respectively. The company's operations span Mainland China, Hong Kong, and international markets.

Kingsoft Corporation Limited has demonstrated a robust financial performance with its Q3 earnings skyrocketing to CNY 413.45 million from CNY 28.49 million the previous year, showcasing a significant turnaround with basic EPS increasing from CNY 0.02 to CNY 0.31. This growth trajectory is underpinned by strategic R&D investments, which have been crucial in driving innovation and maintaining competitive advantage in the fast-evolving tech landscape; notably, R&D expenses as a percentage of revenue are expected to align with industry growth trends. Additionally, the company's proactive approach in shareholder value enhancement is evident from its recent share repurchase of approximately 1.95% for HKD 592.96 million, reflecting confidence in its operational stability and future prospects.

- Get an in-depth perspective on Kingsoft's performance by reading our health report here.

Explore historical data to track Kingsoft's performance over time in our Past section.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

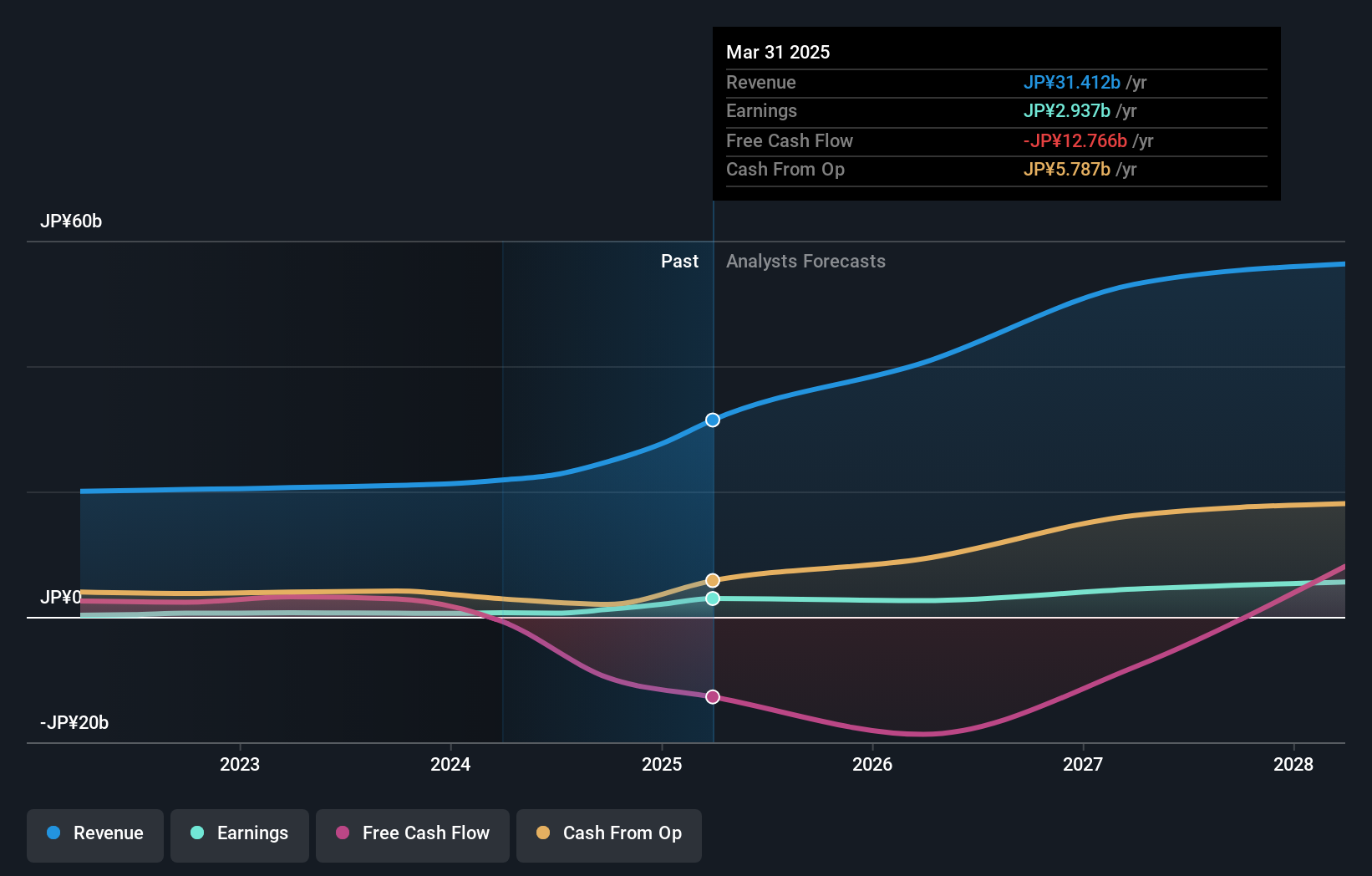

Overview: SAKURA Internet Inc. is a Japanese company that offers cloud computing services, with a market capitalization of ¥197.99 billion.

Operations: The primary revenue stream for SAKURA Internet Inc. is its Internet Infrastructure Business, generating ¥24.75 billion. The company focuses on providing cloud computing services within Japan.

SAKURA Internet, amidst a highly competitive tech landscape, is demonstrating promising growth trajectories with its earnings forecast to surge by 48.9% annually. This robust expansion is supported by significant R&D investments, which have been pivotal in maintaining the company's competitive edge; indeed, R&D expenses are projected to align with industry growth trends. Additionally, the company's recent corporate guidance anticipates substantial increases in net sales and profits for the upcoming fiscal year—JPY 29 billion in sales and JPY 1.55 billion profit attributable to owners—underscoring strong operational performance and strategic market positioning.

Taking Advantage

- Embark on your investment journey to our 1295 High Growth Tech and AI Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.