Euronext Paris Showcases Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As political uncertainty looms over France with the upcoming snap election, the French market has shown volatility, particularly reflected in a significant drop in the CAC 40 Index. In such an environment, growth companies with high insider ownership on Euronext Paris may offer a compelling narrative of stability and commitment to long-term value creation.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

| Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

| Munic (ENXTPA:ALMUN) | 29.4% | 150% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 72.7% |

We're going to check out a few of the best picks from our screener tool.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €410.34 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €11.95 million.

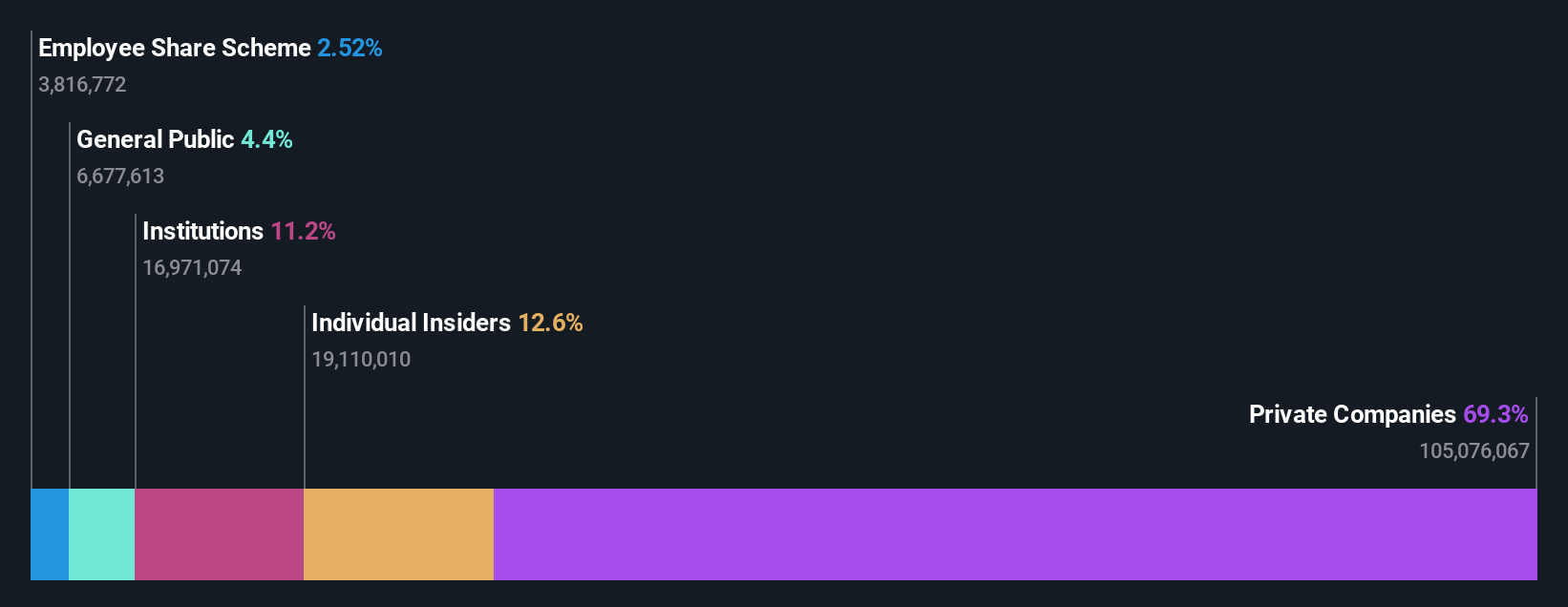

Insider Ownership: 16.4%

Revenue Growth Forecast: 43.4% p.a.

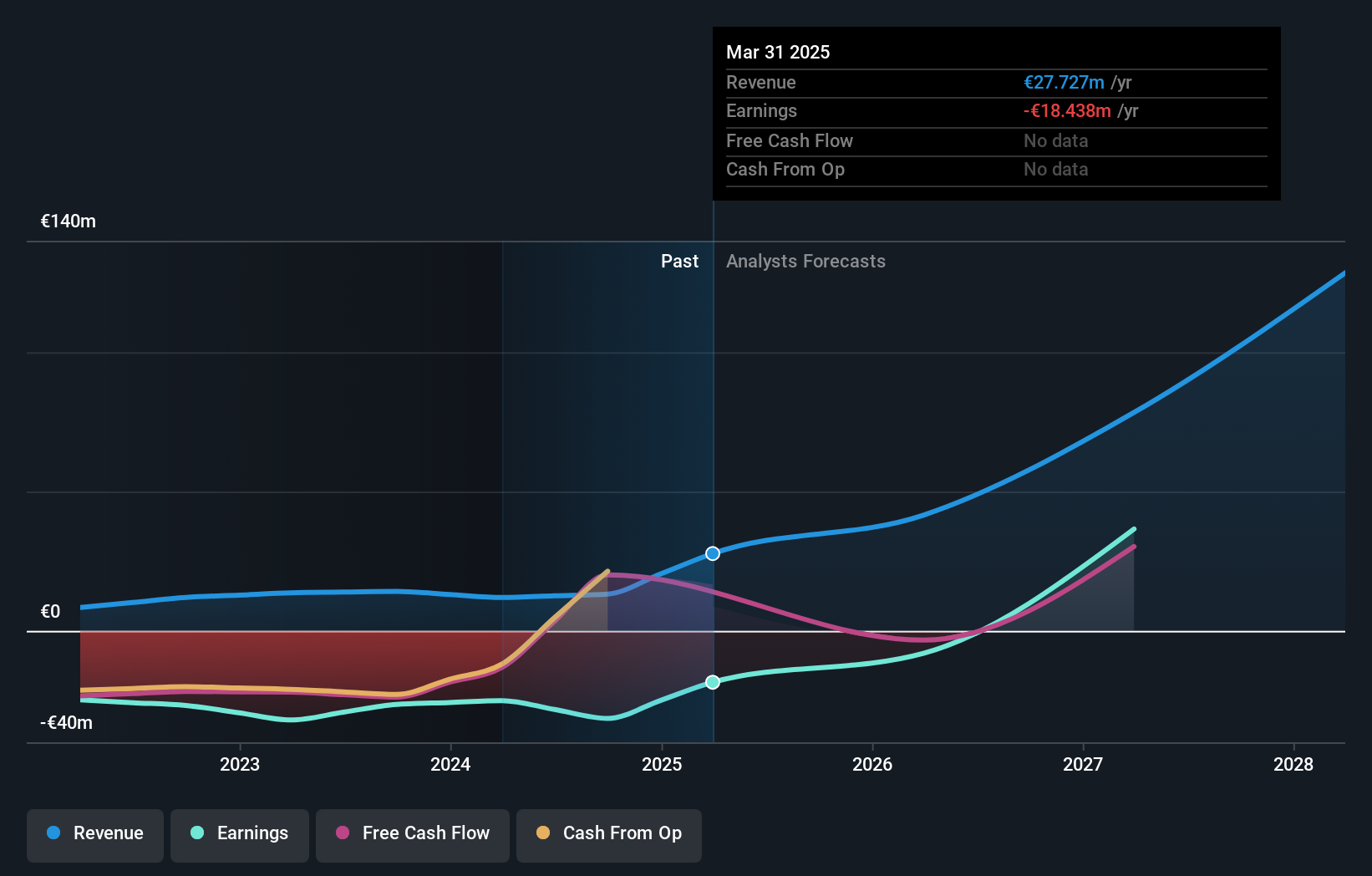

MedinCell, a French biotech firm, currently trades at a significant discount to its estimated fair value and is expected to become profitable within the next three years. Despite recent financial challenges, including a year-over-year revenue decrease from €13.66 million to €11.95 million and net losses reducing from €32.01 million to €25.04 million, the company shows promise with anticipated high annual revenue growth of 43.4%. However, shareholder dilution occurred over the past year, adding a note of caution for potential investors interested in high insider ownership growth companies.

- Take a closer look at MedinCell's potential here in our earnings growth report.

- According our valuation report, there's an indication that MedinCell's share price might be on the expensive side.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.13 billion.

Operations: The company generates revenue through its public cloud (€169.01 million), private cloud (€589.61 million), and web cloud segments (€185.43 million).

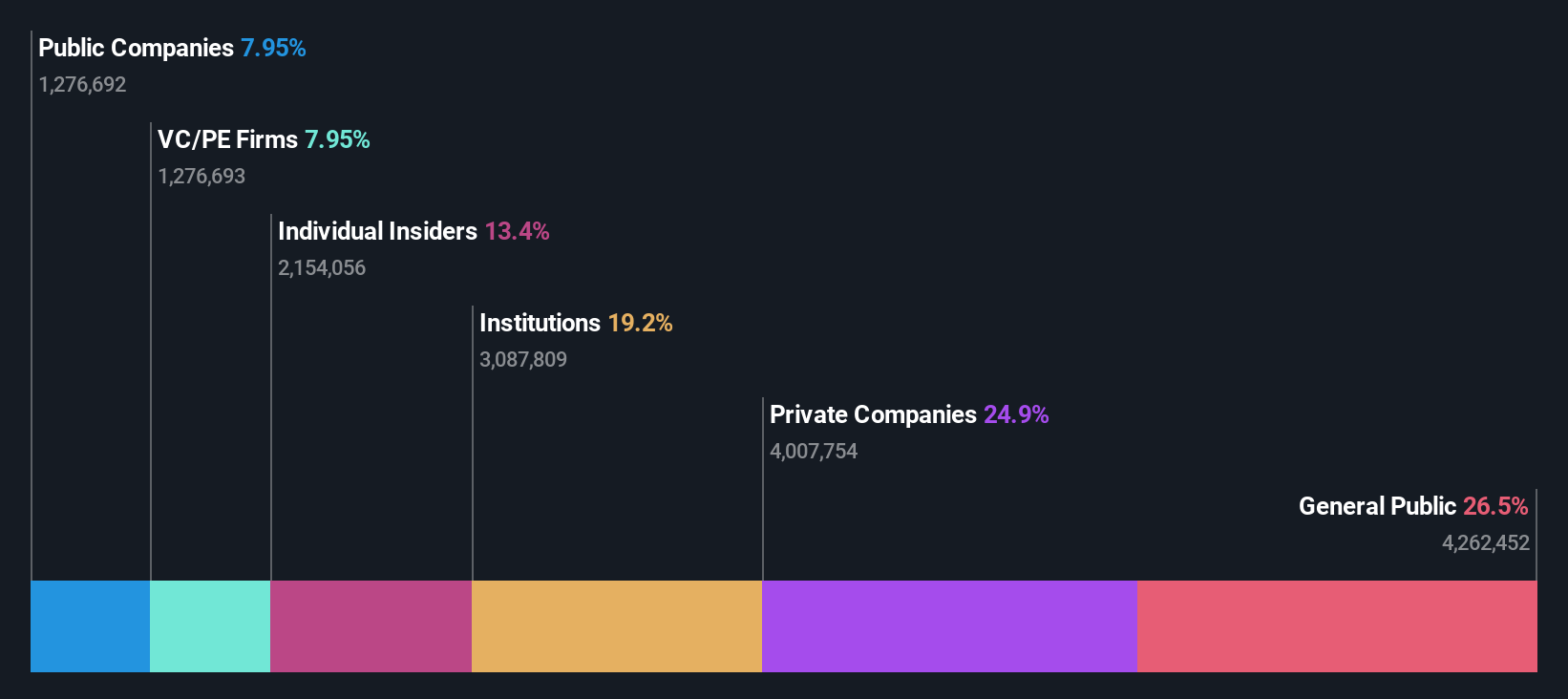

Insider Ownership: 10.5%

Revenue Growth Forecast: 10.9% p.a.

OVH Groupe, a French growth company with high insider ownership, reported a reduction in net losses from €26.59 million to €17.24 million year-over-year and an increase in sales to €486.09 million for the half-year ended February 2024. Despite its highly volatile share price recently, OVH is expected to grow earnings significantly by 101.5% annually and become profitable within three years, outpacing the average market growth predictions. Recent product enhancements include launching advanced servers featuring cutting-edge AMD technology, underscoring its commitment to innovation and performance optimization.

- Delve into the full analysis future growth report here for a deeper understanding of OVH Groupe.

- Our comprehensive valuation report raises the possibility that OVH Groupe is priced higher than what may be justified by its financials.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. operates in Europe, Asia, and North America, offering digitalization solutions for commerce with a market cap of approximately €2.15 billion.

Operations: The company generates revenue primarily through the installation and maintenance of electronic shelf labels, contributing €801.96 million.

Insider Ownership: 13.5%

Revenue Growth Forecast: 21.9% p.a.

VusionGroup S.A., a French company with high insider ownership, has shown robust growth with a significant increase in earnings and sales, reporting €79.77 million in net income and €801.96 million in sales for 2023. Despite its highly volatile share price, the company is forecasted to outperform the market with revenue and earnings expected to grow by 21.9% and 25.2% annually respectively, well above the French market averages of 5.7% and 10.9%. Recent activities include a special shareholders meeting and participation at an international conference, indicating active engagement in strategic expansions.

- Get an in-depth perspective on VusionGroup's performance by reading our analyst estimates report here.

- Our valuation report here indicates VusionGroup may be overvalued.

Where To Now?

- Access the full spectrum of 22 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and fair value.