Stock Analysis

High Growth Tech Stocks In France To Watch October 2024

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index rebounded by 2.69% in September, driven by hopes for interest rate cuts amid slowing business activity, France's CAC 40 Index also experienced a notable climb of 3.89%. In this context of shifting economic indicators and market sentiment, identifying high growth tech stocks in France involves looking for companies that are well-positioned to leverage technological advancements and adapt to evolving market demands.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 17.24% | 33.91% | ★★★★★☆ |

| Archos | 25.98% | 77.41% | ★★★★★☆ |

| Valneva | 28.00% | 25.49% | ★★★★★☆ |

| Munic | 26.73% | 149.96% | ★★★★★☆ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| Valbiotis | 33.52% | 39.79% | ★★★★★☆ |

| VusionGroup | 28.35% | 81.72% | ★★★★★★ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

We'll examine a selection from our screener results.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

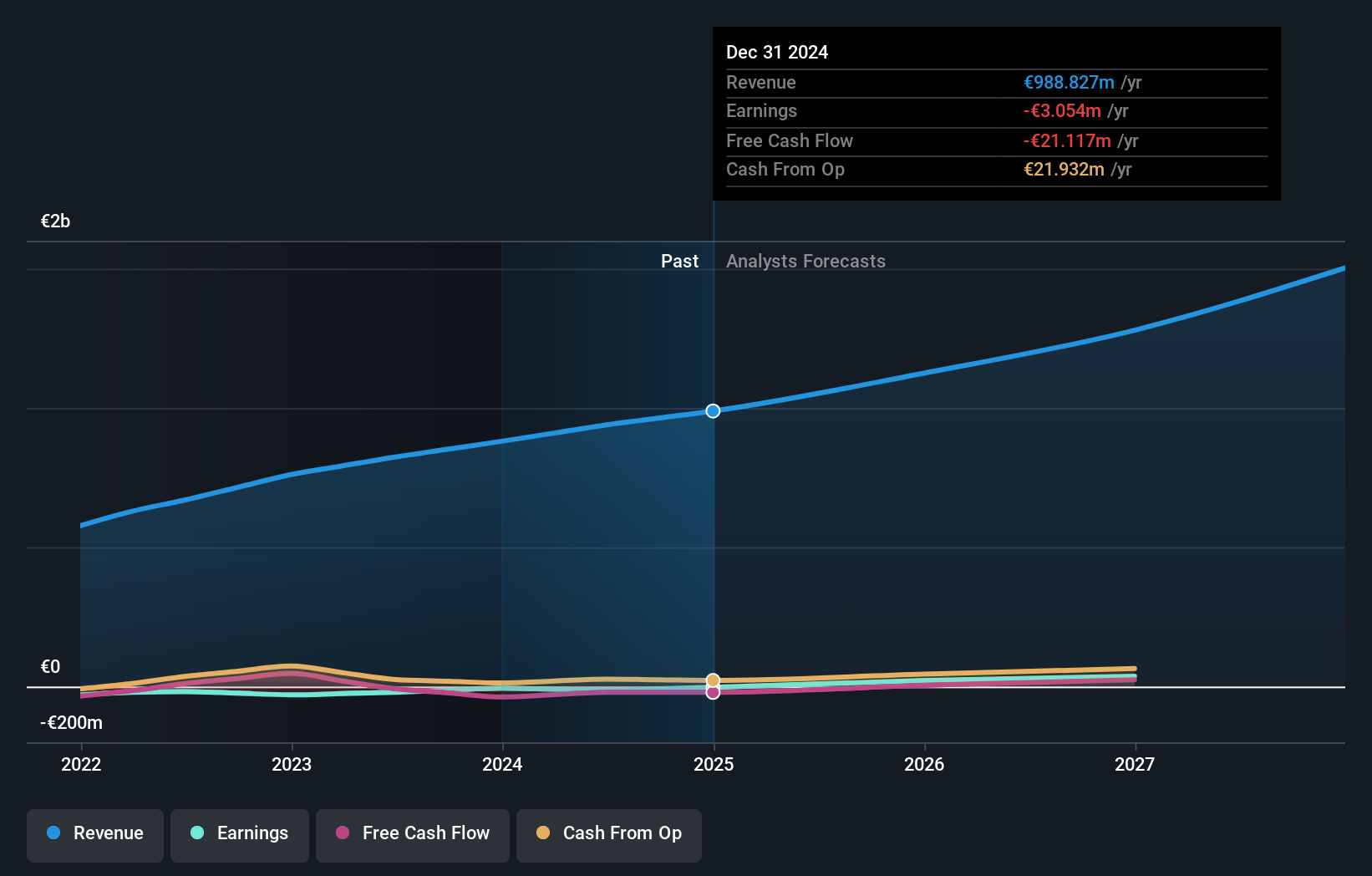

Overview: Believe S.A. is a company that offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of approximately €1.51 billion.

Operations: The company generates revenue primarily through Premium Solutions, contributing €877.53 million, and Automated Solutions, adding €61.50 million.

Believe S.A., amidst a challenging fiscal environment, reported a significant revenue jump to €474.13 million from last year's €415.42 million, marking a 13.1% increase despite transitioning into an unprofitable status with a net loss of €7.57 million. This contrasts sharply with the previous year's modest net income of €0.334 million, reflecting heightened operational costs or investment activities possibly linked to its R&D efforts aimed at innovation in the entertainment sector—a field where earnings are forecasted to surge by 56.79% annually over the next few years. As it navigates through these financial shifts, Believe’s focus on expanding its digital music distribution could set it apart in an industry grappling with rapid technological changes and consumer demand shifts.

- Get an in-depth perspective on Believe's performance by reading our health report here.

Assess Believe's past performance with our detailed historical performance reports.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA operates as a global cybersecurity specialist focusing on digital infrastructure, with a market capitalization of approximately €2.14 billion.

Operations: With a market capitalization of approximately €2.14 billion, Exclusive Networks SA generates significant revenue from its operations across key regions: €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas. The company specializes in cybersecurity solutions for digital infrastructure on a global scale.

Exclusive Networks, amidst a transformative acquisition by CD&R and Permira, is poised for significant shifts in its operational landscape. The company's recent financials reveal a slight dip in sales to €723 million from €776 million year-over-year and a net income decrease to €14 million from €16 million. Despite these figures, the proposed buyout at a 34.4% premium indicates strong confidence in its future prospects, particularly as it plans to refinance existing debts and offer an exceptional distribution of €5.29 per share to shareholders. With R&D expenses consistently aligning with industry innovation demands, Exclusive Networks continues to strengthen its foothold in the cybersecurity sector—a critical component of tech infrastructure amid escalating global data threats.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA specializes in designing, integrating, and operating mission-critical systems globally with a market capitalization of €281.82 million.

Operations: CS Communication & Systemes SA focuses on mission-critical system solutions across various industries worldwide. The company's revenue model is not detailed in the provided data, and specific financial figures related to revenue streams or cost breakdowns are unavailable.

CS Communication & Systemes, despite not leading the pack in France's high-growth tech sector, shows promising signs with a projected revenue increase of 10.4% per year. This growth rate surpasses the French market average of 5%, indicating a robust expansion trajectory. However, profitability remains a challenge as earnings are not expected to cover interest payments effectively. On an optimistic note, earnings are forecasted to surge by 88.2% annually, positioning CS for potential future profitability and making it a company to watch as it navigates these financial dynamics amidst evolving tech landscapes.

- Unlock comprehensive insights into our analysis of CS Communication & Systemes stock in this health report.

Gain insights into CS Communication & Systemes' past trends and performance with our Past report.

Where To Now?

- Dive into all 40 of the Euronext Paris High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure.