Sopra Steria Group (ENXTPA:SOP): Evaluating Valuation Following Recent Share Price Movement

Reviewed by Simply Wall St

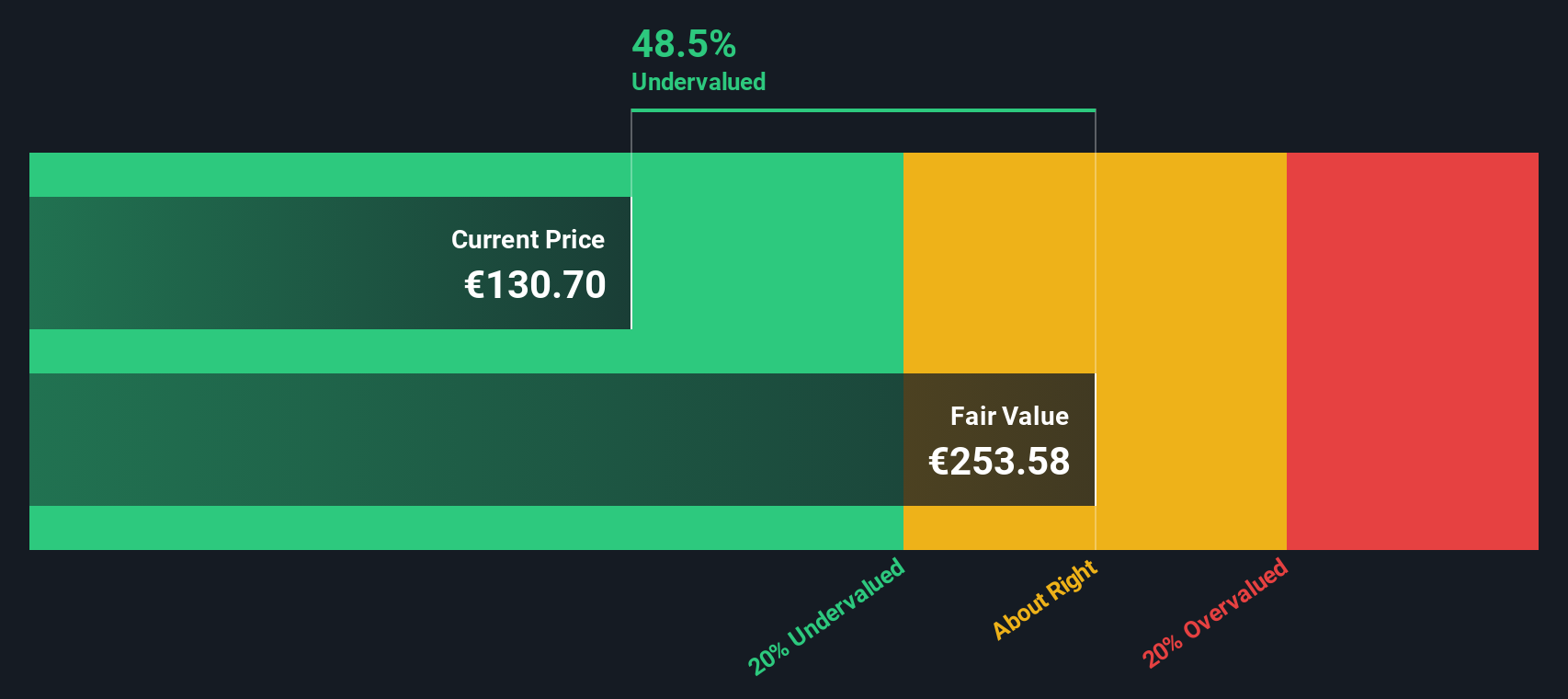

Most Popular Narrative: 29.5% Undervalued

The prevailing narrative identifies Sopra Steria Group as significantly undervalued based on forward-looking sector trends and resilient earnings potential.

Increased investment in European defense, security, and sovereignty, amplified by geopolitical tensions and digital threats, is driving demand for Sopra Steria's cybersecurity, mission-critical systems, and sovereign cloud solutions. This is already evidenced by new contracts and ramp-ups with major government and defense clients, supporting stronger, higher-margin revenue streams and improved long-term earnings.

Want to know what’s driving analyst optimism? Discover the one strategic pivot and a set of bullish performance projections that have pushed expected returns far above today’s trading levels. Curious how future contracts and margin shifts are fueling a valuation nearly a third higher than the current price? Keep reading to unlock the financial forecasts that are turning heads.

Result: Fair Value of €222.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as persistent weak organic revenue and margin pressures from rising costs could challenge the optimistic outlook for Sopra Steria Group’s future.

Find out about the key risks to this Sopra Steria Group narrative.Another View: What About the DCF Model?

While the consensus price target suggests Sopra Steria Group is undervalued, our DCF model arrives at a similar verdict by projecting future cash flows. However, an important question remains: can cash flow assumptions hold up if growth slows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sopra Steria Group Narrative

If you have a different point of view or want to take a hands-on approach, you can review the data and develop your own narrative quickly and easily. Do it your way

A great starting point for your Sopra Steria Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Go beyond a single stock and open the door to smarter possibilities with specialized investment ideas you can act on today. See what’s trending, spot overlooked gems, and grab advantages others are missing right now.

- Tap into the potential of secure income streams and find companies offering reliable, high-yield payouts with dividend stocks with yields > 3%.

- Get ahead of the curve in artificial intelligence by searching for high-impact innovators disrupting industries using AI penny stocks.

- Uncover stocks trading below their true worth and seize opportunities many investors overlook with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:SOP

Sopra Steria Group

Provides consulting, digital, and software development services in France and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives