Stock Analysis

Exploring Three High Growth Tech Stocks In None Exchange

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting political landscapes and economic indicators, recent developments have seen U.S. stocks retract some gains amid uncertainty surrounding the new administration's policies, while inflation data remains closely watched by investors. In this environment, identifying high-growth tech stocks requires a keen understanding of their potential to adapt and thrive amidst regulatory changes and evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1296 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture industries across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market capitalization of €1.02 billion.

Operations: With a market capitalization of €1.02 billion, Lectra SA generates revenue primarily from the Americas and Asia-Pacific regions, with contributions of €172.19 million and €124.33 million respectively.

Lectra's trajectory in the tech landscape shows a nuanced growth pattern, with its revenue expected to climb by 6.2% annually, slightly outpacing the French market's 5.6%. Despite a challenging year with earnings contraction of 10.8%, future forecasts are more optimistic, projecting an annual earnings increase of 30.6%. This robust growth expectation is significantly higher than the broader market forecast of 12.5%. Recent financials reveal a dip in net income from EUR 25.87 million to EUR 22.77 million over nine months, yet Lectra maintains positive free cash flow and invests substantially in R&D, crucial for sustaining innovation and competitiveness in evolving tech sectors. The company's recent participation at the Gilbert Dupont Forum highlights its active engagement with industry stakeholders, reinforcing its strategic positioning despite being dropped from the S&P Global BMI Index earlier this year. With R&D expenses aligned closely with revenue generation strategies—evident from their latest financial reports—Lectra is poised to leverage its technological advancements for future gains while navigating through current market challenges effectively.

- Click here and access our complete health analysis report to understand the dynamics of Lectra.

Evaluate Lectra's historical performance by accessing our past performance report.

Zhejiang Lante Optics (SHSE:688127)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Lante Optics Co., Ltd. is a company that manufactures and sells optical products in China, with a market capitalization of CN¥9.66 billion.

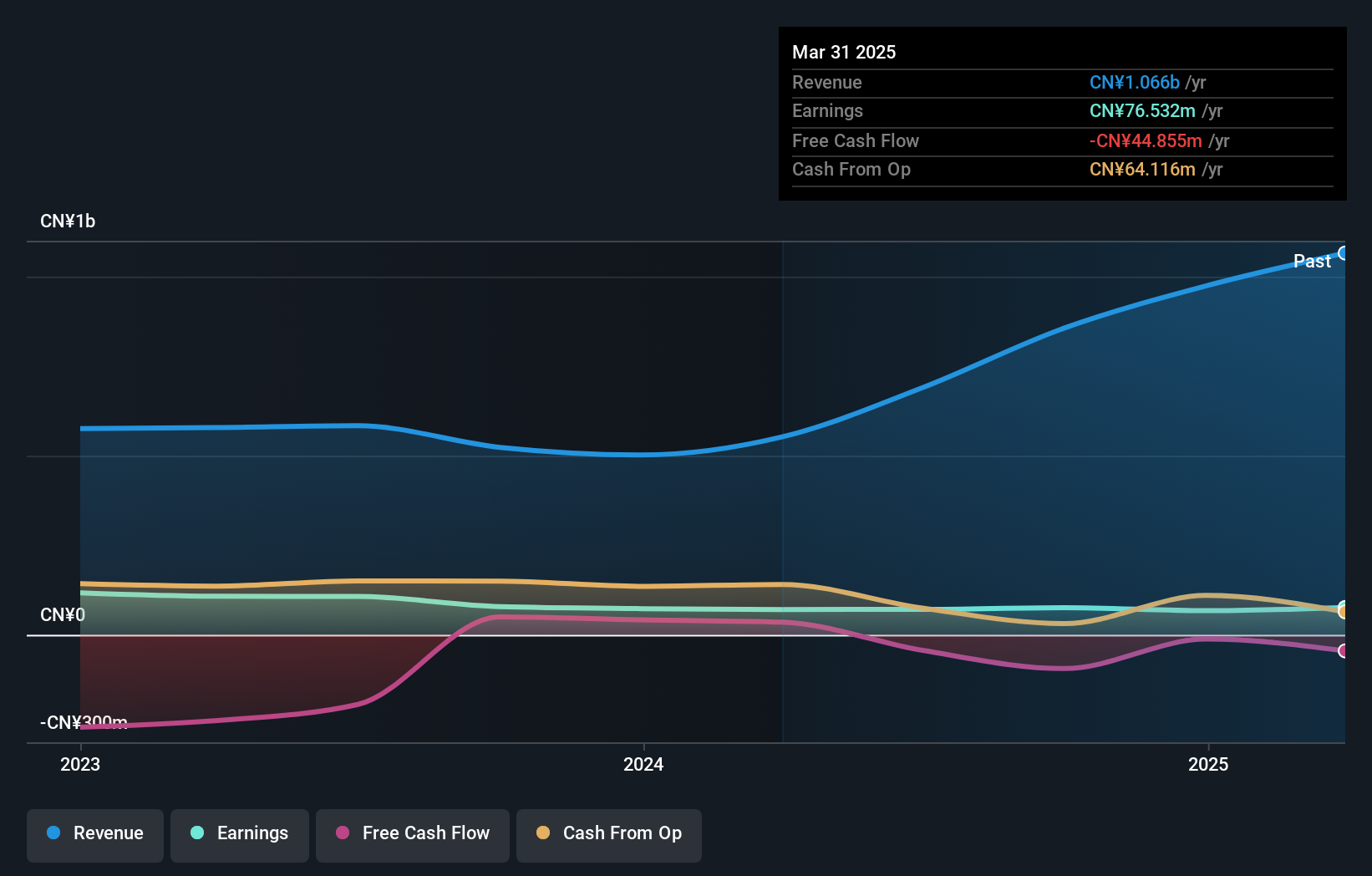

Operations: Lante Optics generates revenue primarily from its photographic equipment and supplies segment, totaling CN¥1.05 billion.

Zhejiang Lante Optics has demonstrated a robust financial performance, with its revenue soaring to CNY 786.31 million from CNY 490.2 million year-over-year, reflecting a growth rate of 20.4%. This surge is complemented by an impressive increase in net income, which nearly doubled to CNY 161.58 million. The company's commitment to innovation is underscored by its R&D expenditures, which are strategically aligned with its revenue growth strategies. Despite facing intense competition in the optics sector, Lante Optics continues to invest heavily in R&D, ensuring it remains at the forefront of technological advancements and maintains a competitive edge in high-precision optical components—an approach that could secure its position as a leader in the evolving tech landscape.

Shenzhen Zesum Technology (SZSE:301486)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Zesum Technology Co., Ltd. focuses on the research, design, development, manufacture, and sale of precision electronic components in China with a market capitalization of approximately CN¥5.93 billion.

Operations: The company generates revenue primarily from the sale of electronic components and parts, amounting to CN¥856.47 million. With a market capitalization of approximately CN¥5.93 billion, it operates within the precision electronics sector in China.

Shenzhen Zesum Technology has demonstrated notable agility in navigating the tech landscape, with its recent earnings report showing a revenue jump to CNY 725.69 million, nearly doubling from the previous year's CNY 371.17 million. This growth is paired with a modest increase in net income to CNY 59.71 million and reflects an earnings growth forecast of 32.5% per year, signaling robust future prospects. The company's strategic emphasis on R&D is evident as it continues to innovate amidst competitive pressures, ensuring its technology remains cutting-edge in a rapidly evolving market. Recent governance enhancements underscore this momentum; the election of new board members could infuse fresh perspectives into strategic decisions, further bolstering Zesum's market position. These developments come at a time when tech firms are increasingly reliant on advanced R&D capabilities and strategic leadership to sustain growth trajectories in challenging markets.

Seize The Opportunity

- Gain an insight into the universe of 1296 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.