3 High Growth Companies With Significant Insider Ownership On Euronext Paris

Reviewed by Simply Wall St

As global markets react to mixed economic signals and the European indices experience declines, investors are increasingly seeking resilient opportunities in specific sectors. In this context, growth companies with significant insider ownership on Euronext Paris stand out as potentially strong investments due to their alignment of management interests with shareholder value. In a market characterized by cautious optimism and strategic capital allocation, stocks that demonstrate robust insider ownership often reflect confidence from those who know the business best. This article highlights three high-growth companies on Euronext Paris where insiders hold substantial stakes, suggesting a promising alignment of interests between management and shareholders amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 36% |

| VusionGroup (ENXTPA:VU) | 13.5% | 25.7% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 35.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 28.5% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 71.1% |

Here we highlight a subset of our preferred stocks from the screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €937.51 million.

Operations: The company's revenue segments are: Americas (€172.65 million) and Asia-Pacific (€118.54 million).

Insider Ownership: 19.6%

Lectra's earnings are forecast to grow 32.59% annually, outpacing the French market's 12.2%. Despite a recent dip in net income to €12.51 million for H1 2024 from €14.47 million a year ago, analysts see potential with the stock trading at 52.3% below its fair value estimate and expected revenue growth of 10.5% per year, faster than the market's 5.9%. However, return on equity is projected to be modest at 13.2% in three years.

- Get an in-depth perspective on Lectra's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Lectra is priced lower than what may be justified by its financials.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €425.84 million.

Operations: MedinCell's revenue from pharmaceuticals amounts to €11.95 million.

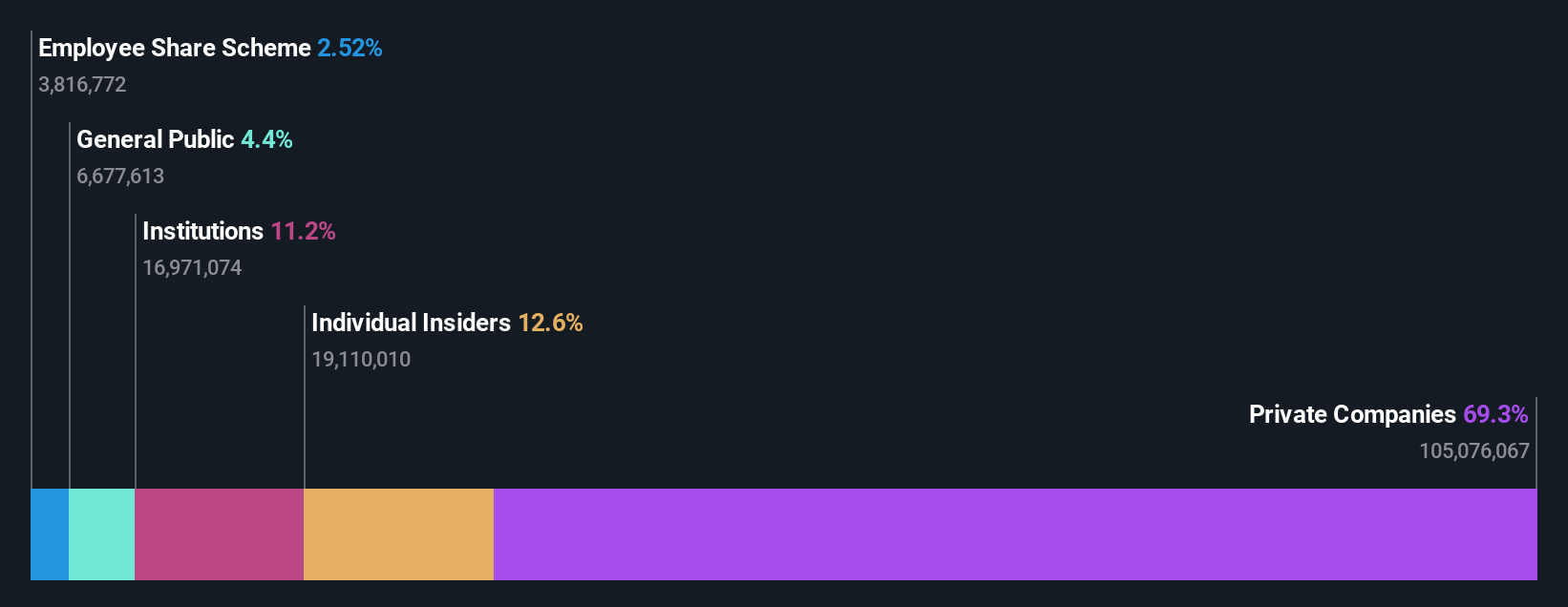

Insider Ownership: 16.4%

MedinCell's revenue is forecast to grow 44.7% annually, significantly outpacing the French market's 5.9%. Despite reporting a net loss of €25.04 million for the year ended March 31, 2024, this represents an improvement from the previous year's loss of €32.01 million. The company is expected to become profitable within three years and trades at a substantial discount to its estimated fair value. Recent Phase 3 trials showed promising secondary outcomes for its F14 drug and significant results for TEV-‘749 in schizophrenia treatment.

- Unlock comprehensive insights into our analysis of MedinCell stock in this growth report.

- The valuation report we've compiled suggests that MedinCell's current price could be inflated.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of approximately €1.02 billion.

Operations: Revenue segments for OVH Groupe S.A. include €169.01 million from Public Cloud, €589.61 million from Private Cloud, and €185.43 million from Web Cloud & Other services.

Insider Ownership: 10.5%

OVH Groupe is forecast to grow its revenue by 10% annually, outpacing the French market's 5.9%. The company expects to achieve profitability within three years, with earnings projected to grow over 100% per year. Recent product innovations, such as the ADV-Gen3 Bare Metal servers powered by AMD EPYC processors, highlight OVHcloud's commitment to performance and sustainability. Trading at a significant discount to its estimated fair value, OVH presents a compelling growth opportunity despite low forecasted return on equity (1.7%).

- Delve into the full analysis future growth report here for a deeper understanding of OVH Groupe.

- Our valuation report unveils the possibility OVH Groupe's shares may be trading at a discount.

Make It Happen

- Access the full spectrum of 23 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

High growth potential and slightly overvalued.