- France

- /

- Construction

- /

- ENXTPA:FGR

3 Top Euronext Paris Dividend Stocks Yielding Up To 5.8%

Reviewed by Simply Wall St

The European economy has recently seen a boost from Paris, with the CAC 40 Index gaining 1.71% amid growing hopes for interest rate cuts by the European Central Bank. This positive sentiment is further supported by increased business activity driven by the upcoming Olympic Games in France. In this favorable market environment, dividend stocks can offer a reliable income stream and potential for capital appreciation. Here are three top Euronext Paris dividend stocks yielding up to 5.8%.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 6.34% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.86% | ★★★★★★ |

| CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

| Samse (ENXTPA:SAMS) | 6.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.30% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 4.02% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.86% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.62% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.30% | ★★★★★☆ |

| Trigano (ENXTPA:TRI) | 3.26% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse customer segments in France, with a market cap of €924.56 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue by providing banking products and services to individuals, professionals, associations, farmers, businesses, private banking customers, and public and social housing community clients in France.

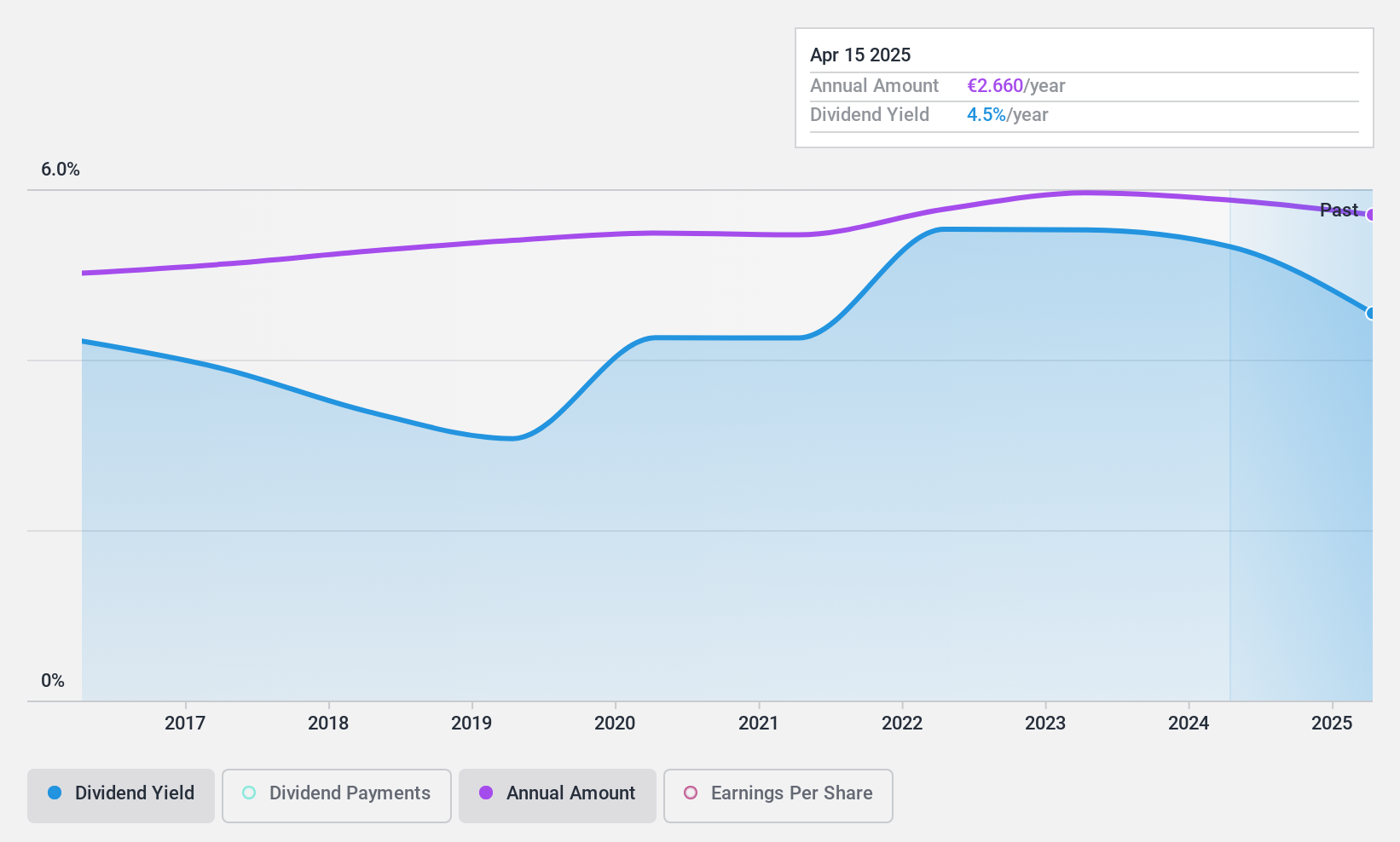

Dividend Yield: 5.9%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a high and reliable dividend yield of 5.86%, placing it in the top 25% of French dividend payers. Despite a slight dip in net interest income, earnings grew by 1.3% to €114.91 million for the half year ended June 30, 2024. The company's dividends have been stable and growing over the past decade, supported by a low payout ratio of 29.8%.

- Unlock comprehensive insights into our analysis of Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative stock in this dividend report.

- Our expertly prepared valuation report Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative implies its share price may be lower than expected.

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions both in France and internationally with a market cap of €8.78 billion.

Operations: Eiffage SA's revenue segments include Concessions (€3.90 billion), Construction (€4.29 billion), Energy Systems (€5.99 billion), and Infrastructures (€8.43 billion).

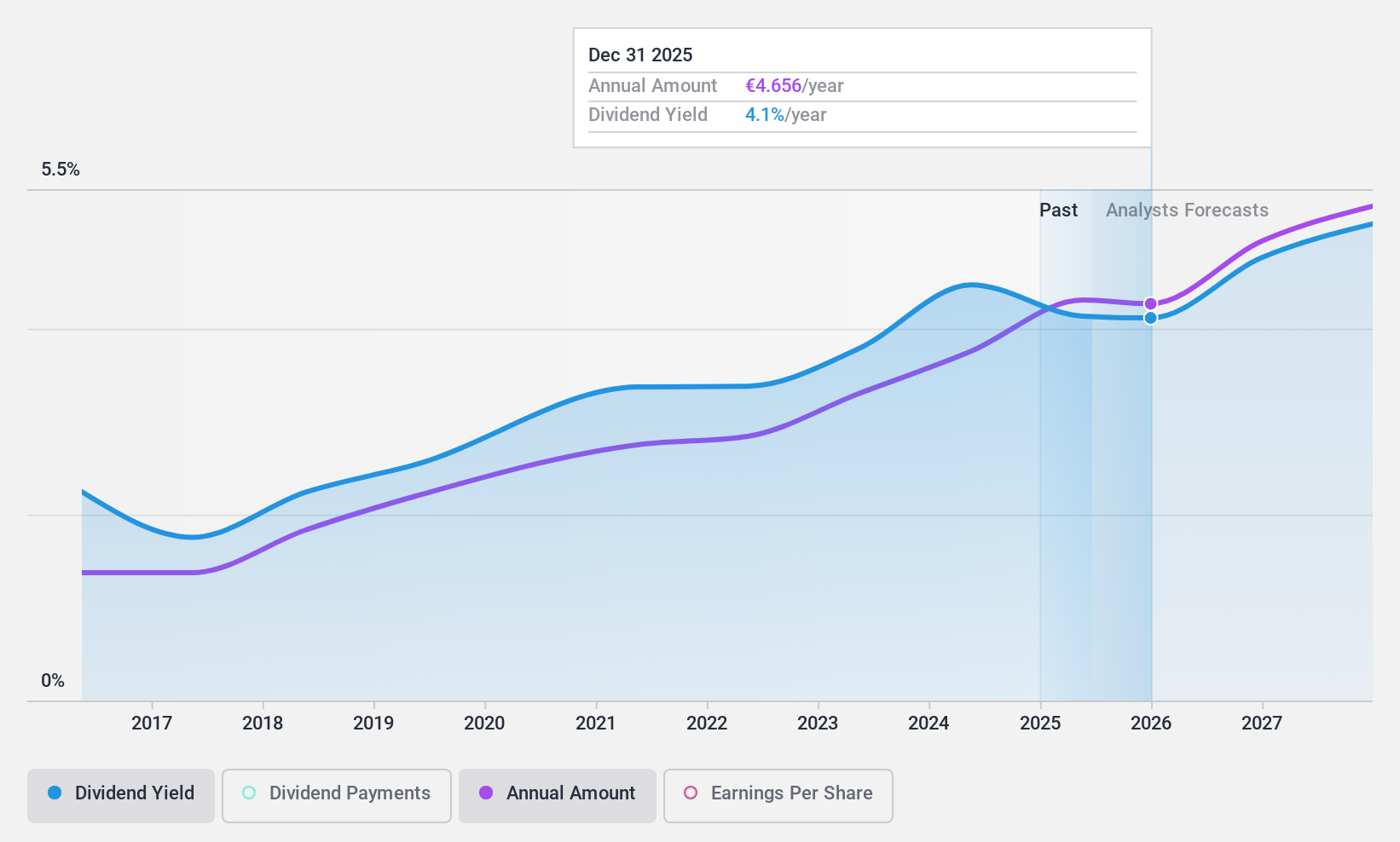

Dividend Yield: 4.4%

Eiffage's dividend yield of 4.39% is below the top 25% in France, but its payouts are well-covered by earnings (38.5%) and cash flows (15.6%). Despite a volatile dividend history over the past decade, recent strategic partnerships with Google Cloud to enhance AI capabilities and a significant construction contract for the Valby cloudburst tunnel highlight Eiffage's commitment to innovation and operational growth, potentially supporting future dividend stability.

- Click here to discover the nuances of Eiffage with our detailed analytical dividend report.

- The analysis detailed in our Eiffage valuation report hints at an deflated share price compared to its estimated value.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA designs, develops, markets, and maintains software solutions focused on security, performance, and management worldwide with a market cap of €270.36 million.

Operations: Infotel SA generates revenue through two primary segments: Services (€296.02 million) and Software (€11.53 million).

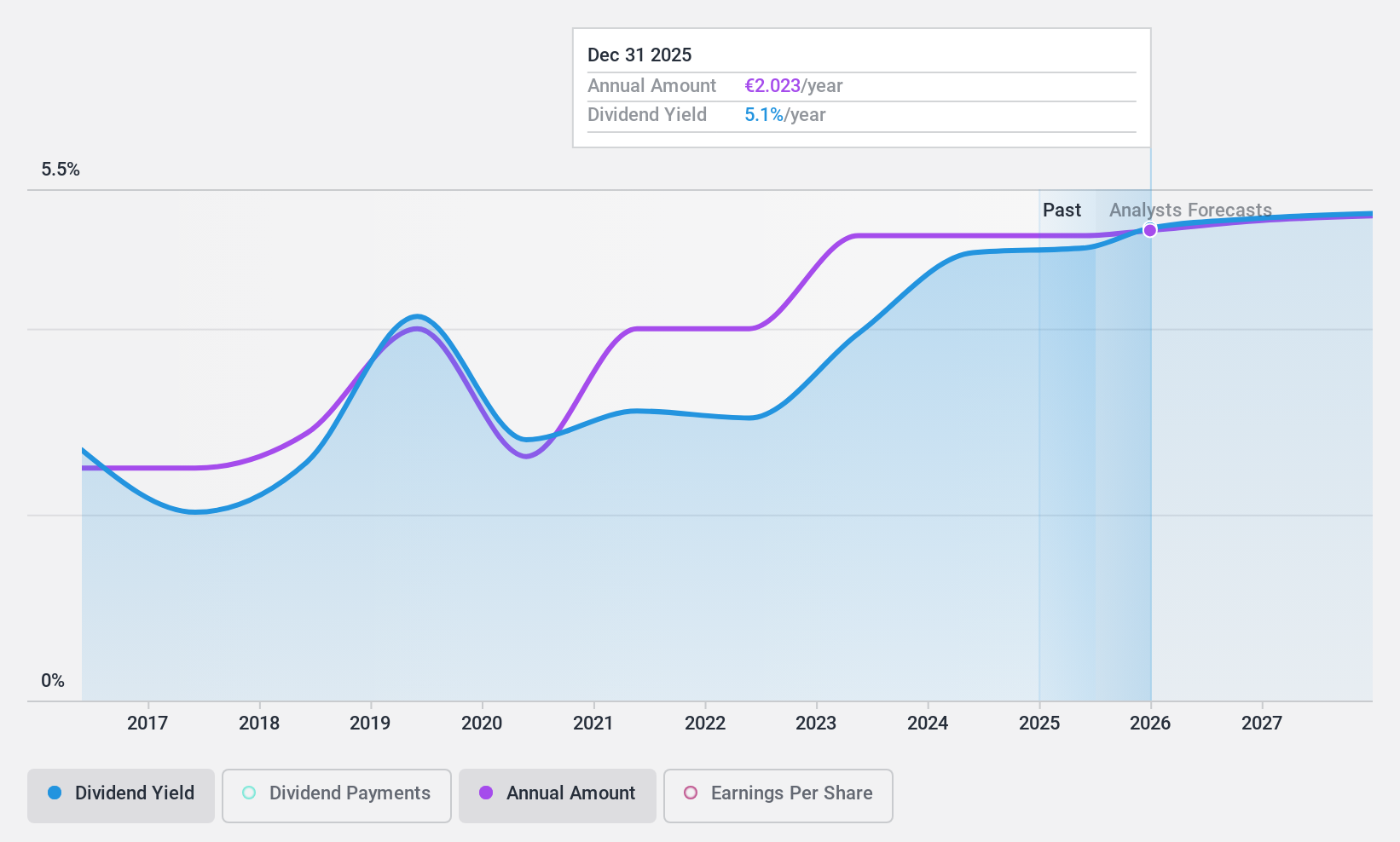

Dividend Yield: 5.1%

Infotel's dividend yield of 5.13% is slightly below the top 25% in France, and while its payout ratio (76.2%) and cash payout ratio (63.7%) indicate dividends are covered by earnings and cash flows, the company's dividend history has been unreliable over the past decade with volatility exceeding 20%. However, trading at 51.4% below estimated fair value suggests potential for capital appreciation alongside a forecasted earnings growth of 10.48% per year.

- Get an in-depth perspective on Infotel's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Infotel is priced lower than what may be justified by its financials.

Seize The Opportunity

- Embark on your investment journey to our 35 Top Euronext Paris Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eiffage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGR

Eiffage

Engages in the construction, property development, urban development, civil engineering, metallic construction, roads, energy systems, and concessions businesses in France and internationally.

Very undervalued with solid track record and pays a dividend.