Dassault Systèmes (ENXTPA:DSY): Exploring Valuation After Recent Share Price Drop

Reviewed by Simply Wall St

Dassault Systèmes (ENXTPA:DSY) shares have tracked moderately lower across the past year as investors weigh its recent performance against evolving software sector dynamics. The stock’s moves prompt a closer look at its current valuation and business outlook.

See our latest analysis for Dassault Systèmes.

Dassault Systèmes has seen sentiment shift sharply in recent weeks, with its share price falling 20.8% year-to-date and a one-day decline of nearly 13%. This suggests some investors are adjusting their outlook amid sector uncertainty. The broader story is one of fading momentum, with a 12-month total shareholder return of -18.4% and five-year performance trailing the wider market.

If the recent volatility has you rethinking your watchlist, this is the perfect moment to discover fast growing stocks with high insider ownership.

With shares in Dassault Systèmes now trading below many analysts’ price targets, the core question for investors is whether the current price reflects all known risks and growth prospects or if there is genuine upside yet to be unlocked.

Most Popular Narrative: 26% Undervalued

The most widely followed perspective values Dassault Systèmes at €35.56, which is substantially above the last close of €26.21. This narrative points to a disconnect between current pricing and long-term potential, setting the stage for a revealing catalyst below.

Rapid expansion into high-growth verticals such as sustainable infrastructure (nuclear, rail, data centers), space/defense, and "lab-to-fab" transitions in life sciences is broadening Dassault Systèmes' addressable market and is likely to drive double-digit earnings growth over the next several years. This would support higher long-term revenue growth.

Craving the inside story powering this high price target? This narrative’s bold fair value hinges on future profitability, aggressive top-line expansion, and razor-sharp margin forecasts. Ready to discover which expectations are stirring up analyst conviction? Get the full scoop and see what could spark the next revaluation.

Result: Fair Value of €35.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower cloud adoption or ongoing weakness in key life sciences operations could undermine the growth outlook that supports this bullish valuation.

Find out about the key risks to this Dassault Systèmes narrative.

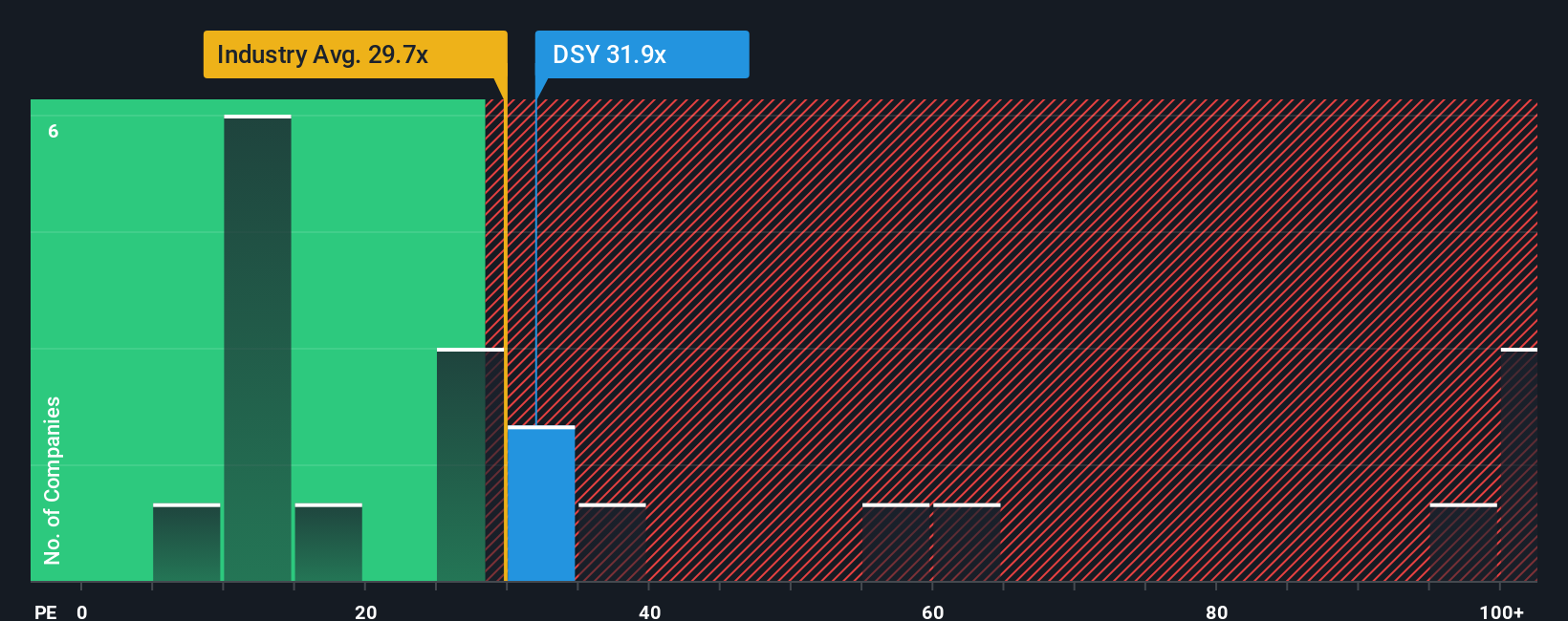

Another View: Multiples Comparison Tells a Different Story

While the analyst target points to sizable upside, a review of the company's current price-to-earnings ratio signals caution. Dassault Systèmes trades on a P/E of 30.4x, above both the European industry average (29.4x) and its own fair ratio of 29.2x. This suggests shares could be expensive if the market shifts toward those benchmarks. It also reminds investors that assumptions underpinning any valuation can change quickly. Is there hidden value, or does this highlight a premium that could erode?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dassault Systèmes Narrative

If you see the story playing out differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dassault Systèmes.

Looking for More Investment Ideas?

Smart investors are always on the lookout for the next big opportunity. Broaden your perspective and see what’s moving the market with these handpicked screens. Missing out now could mean leaving potential gains on the table.

- Uncover opportunities for passive income by targeting steady yields with these 17 dividend stocks with yields > 3% that pay above-average returns.

- Tap into the future of medicine by identifying innovators on the front lines with these 33 healthcare AI stocks making waves in healthcare technology.

- Stay ahead of the AI gold rush and seize your stake in tomorrow’s leaders by tracking these 26 AI penny stocks shaping intelligent automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DSY

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives