- France

- /

- Commercial Services

- /

- ENXTPA:ALDLT

Sidetrade And These 2 Undiscovered Gems In France To Enhance Your Portfolio

Reviewed by Simply Wall St

As the French market experiences mixed performance, with indices like the CAC 40 showing slight declines amidst broader European gains, investors are increasingly looking toward small-cap stocks for potential growth opportunities. In this environment, identifying undiscovered gems such as Sidetrade and two other promising companies can enhance your portfolio by leveraging unique market positions and innovative solutions.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| Société des Chemins de Fer et Tramways du Var et du Gard | NA | nan | -2.95% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA offers an AI-powered order-to-cash (O2C) software as a service platform in France and internationally, with a market cap of approximately €265.89 million.

Operations: Sidetrade generates revenue primarily from its software and programming segment, which accounts for €43.96 million. The company has a market cap of approximately €265.89 million.

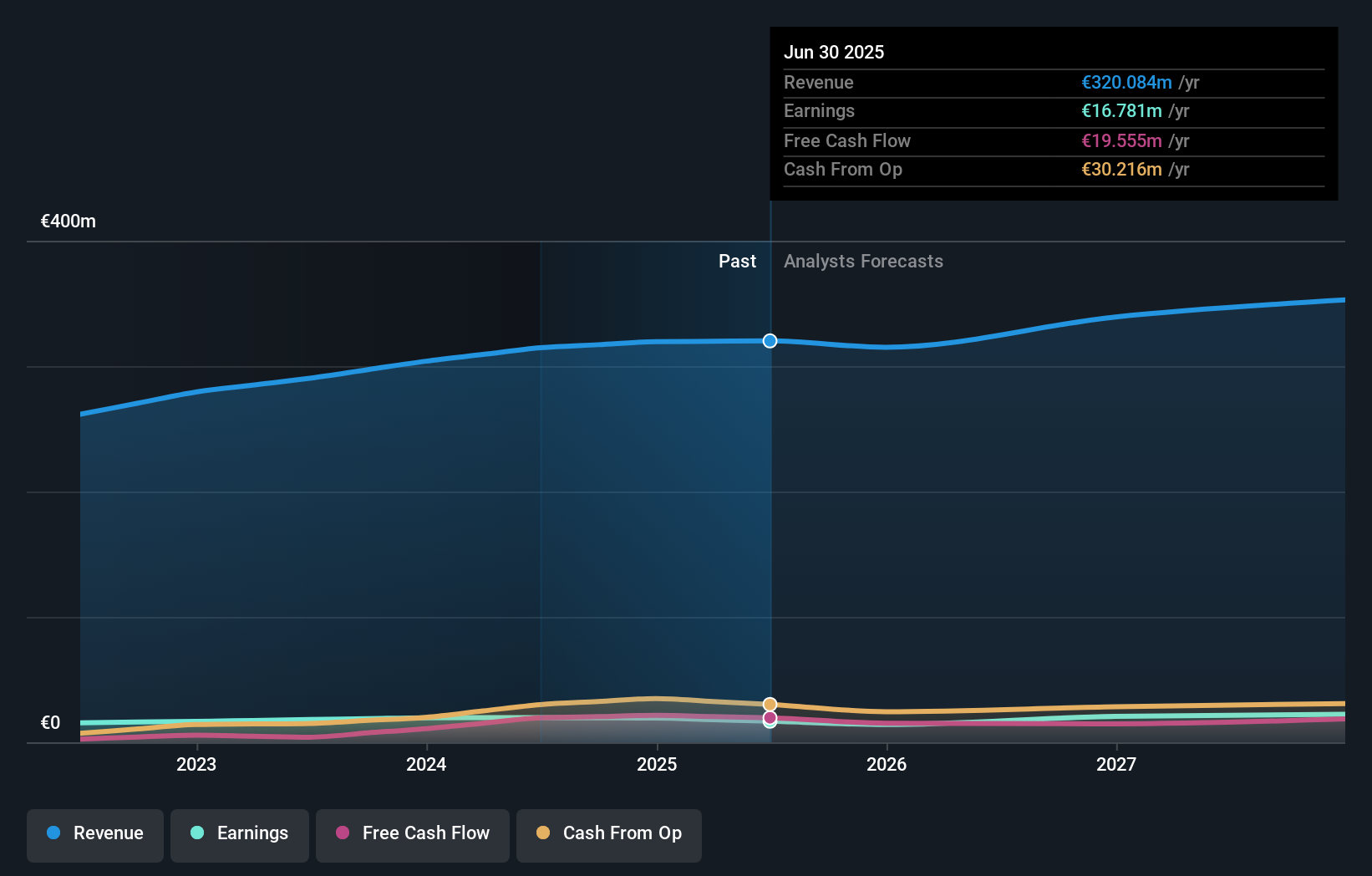

Sidetrade, a promising player in France's tech sector, reported revenue of €24.8 million for H1 2024, up from €20.9 million last year. The company recently appointed Allison Barlaz as Chief Marketing Officer to boost its North American presence and growth strategy. Additionally, Sidetrade launched 'Ask Aimie,' a generative AI feature enhancing user experience by summarizing lengthy emails and generating replies, leveraging over $6.1 trillion in O2C payment data for superior performance recommendations.

- Delve into the full analysis health report here for a deeper understanding of Sidetrade.

Gain insights into Sidetrade's past trends and performance with our Past report.

Delta Plus Group (ENXTPA:ALDLT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Delta Plus Group designs, manufactures, and distributes a range of personal protective equipment worldwide with a market cap of €517.12 million.

Operations: Delta Plus Group generates revenue primarily from its apparel segment, which accounted for €420.57 million. The company's market cap is €517.12 million.

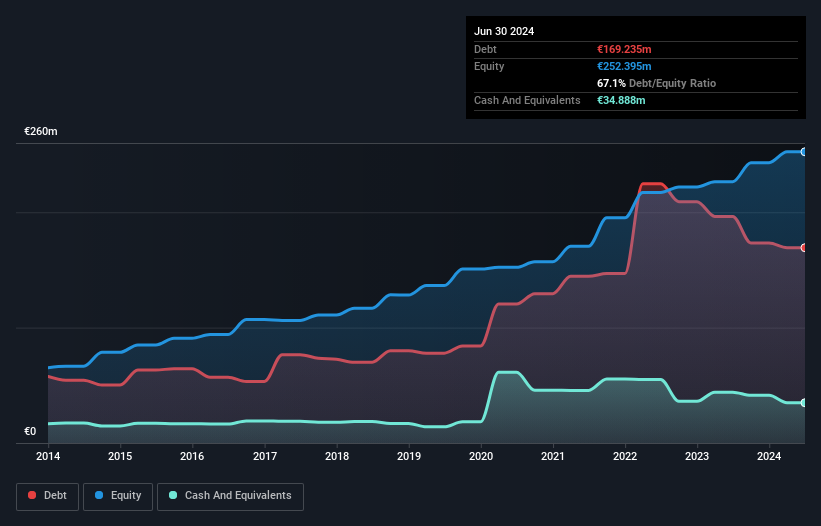

Delta Plus Group, a smaller French player in the commercial services sector, has shown promising growth. Its earnings surged by 12.3% last year, outpacing the industry average of 12.2%. The company is trading at 8.7% below its estimated fair value and boasts high-quality earnings. However, it carries a significant debt load with a net debt to equity ratio of 54.3%, which has risen from 62.4% to 71.4% over five years.

- Unlock comprehensive insights into our analysis of Delta Plus Group stock in this health report.

Understand Delta Plus Group's track record by examining our Past report.

Gérard Perrier Industrie (ENXTPA:PERR)

Simply Wall St Value Rating: ★★★★★★

Overview: Gérard Perrier Industrie S.A. engages in the design, manufacture, installation, and maintenance of electrical, electronic, automation, and instrumentation equipment in France and internationally with a market cap of €368.02 million.

Operations: Gérard Perrier Industrie generates revenue primarily from its Branch Installation Maintenance (€96.87 million), Branch Manufacturing and Specializations (€91.65 million), and Energy Branch (€88.26 million). The Aeronautical Branch contributes €35.65 million, while the Holding segment adds €8.91 million in revenue, with intra-group eliminations accounting for -€17.76 million.

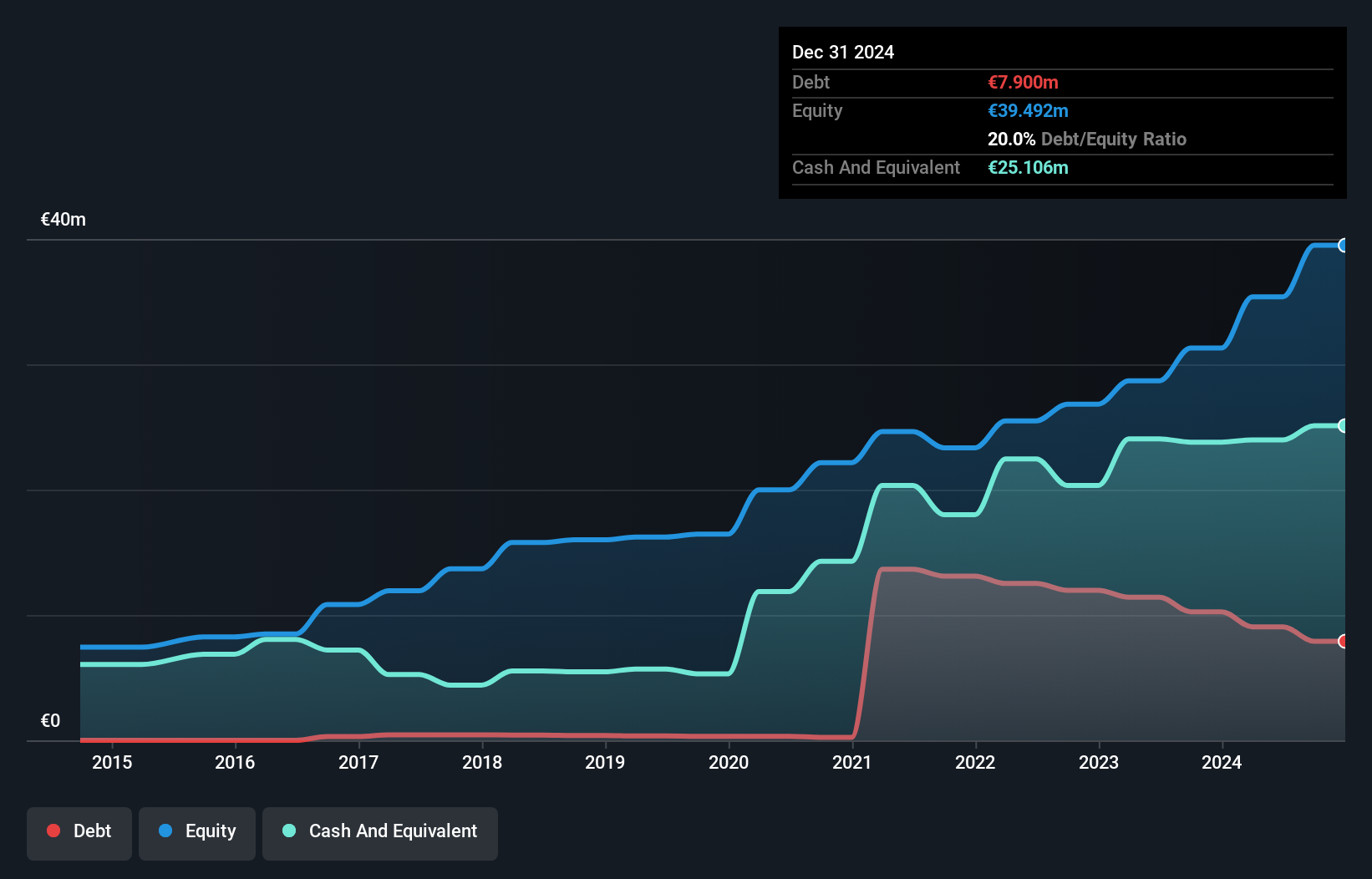

Gérard Perrier Industrie, a notable player in France's electrical industry, has shown consistent earnings growth of 8.7% annually over the past five years. The company's debt to equity ratio improved from 22.2% to 21.3%, indicating better financial health. Despite a price-to-earnings ratio of 18.8x being slightly below the industry average, its free cash flow remains positive at €10.90M as of December 2023, reflecting robust operational efficiency and potential for future growth

- Dive into the specifics of Gérard Perrier Industrie here with our thorough health report.

Assess Gérard Perrier Industrie's past performance with our detailed historical performance reports.

Summing It All Up

- Access the full spectrum of 34 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALDLT

Delta Plus Group

Engages in design, manufacture, and distribution of a range of personal protective equipment worldwide.

Good value with adequate balance sheet and pays a dividend.