Stock Analysis

As the broader European markets face challenges, with France's CAC 40 Index recently declining by 2.46%, investors might find potential in less conspicuous areas of the market. This environment could highlight the appeal of exploring lesser-known French stocks, which may offer unique opportunities amidst prevailing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| Société des Chemins de Fer et Tramways du Var et du Gard | NA | nan | -2.95% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Fiducial Real Estate | 33.77% | 1.63% | 3.30% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

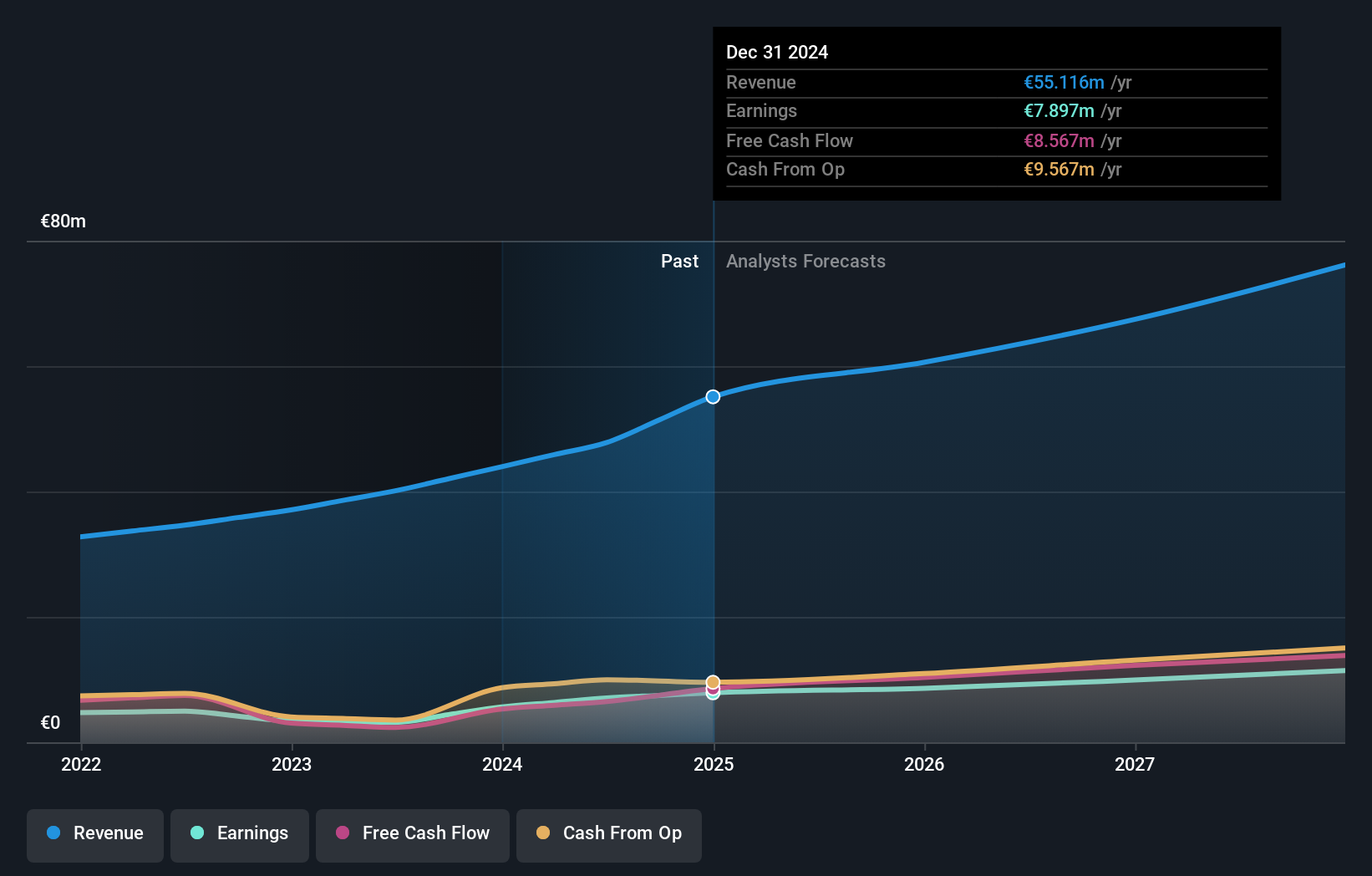

Overview: Sidetrade SA is a company that offers an AI-powered order-to-cash software as a service platform, operating both in France and internationally, with a market capitalization of approximately €256.91 million.

Operations: Sidetrade generates its revenue primarily from the software and programming sector, evidenced by a recent figure of €43.96 million. The company's business model involves managing costs related to goods sold and operational expenses while striving to optimize net income, which stood at €5.63 million as of the latest reporting period.

Sidetrade, a French technology firm, is making notable strides in the AI and software industry. Recently reporting a revenue increase to €24.8 million from €20.9 million last year, the company demonstrates robust growth. This performance is bolstered by its innovative 'Ask Aimie' feature within its Digital Case solution, enhancing user experience with generative AI capabilities. With the strategic appointment of Allison Barlaz as Chief Marketing Officer, Sidetrade aims to expand its North American market presence significantly.

- Click here to discover the nuances of Sidetrade with our detailed analytical health report.

Evaluate Sidetrade's historical performance by accessing our past performance report.

Société Fermière du Casino Municipal de Cannes (ENXTPA:FCMC)

Simply Wall St Value Rating: ★★★★☆☆

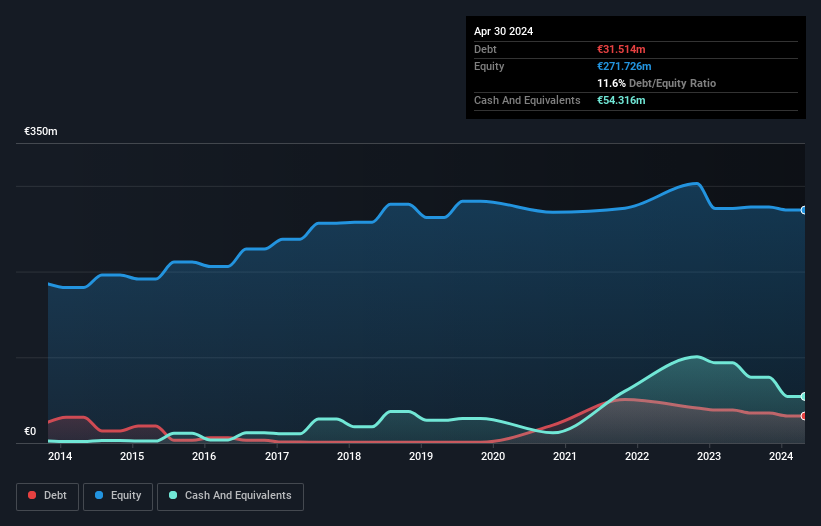

Overview: Société Fermière du Casino Municipal de Cannes is a French company engaged in the operation of casinos and hotels, with a market capitalization of €236.50 million.

Operations: The company generates the majority of its revenue from its hotel business, contributing €127.84 million, supplemented by casino operations which add another €17.25 million. Its financial performance shows a notable net income margin of 14.77% as of the latest reporting period in July 2024, indicating profitability in its operations despite varying costs and expenses over time.

Société Fermière du Casino Municipal de Cannes, often overlooked, showcases a robust potential with its recent half-year earnings. Sales rose to €49 million from €49 million last year, and revenue increased to €42 million from €42 million. Notably, the net loss narrowed significantly to €3 million from €15 million. The company's debt-to-equity ratio climbed modestly to 12%, yet it maintains a strong cash position exceeding total debt. Trading at 20% below estimated fair value and with a 58% earnings growth surpassing the industry's 1%, this entity hints at being undervalued with promising recovery signs.

Gérard Perrier Industrie (ENXTPA:PERR)

Simply Wall St Value Rating: ★★★★★★

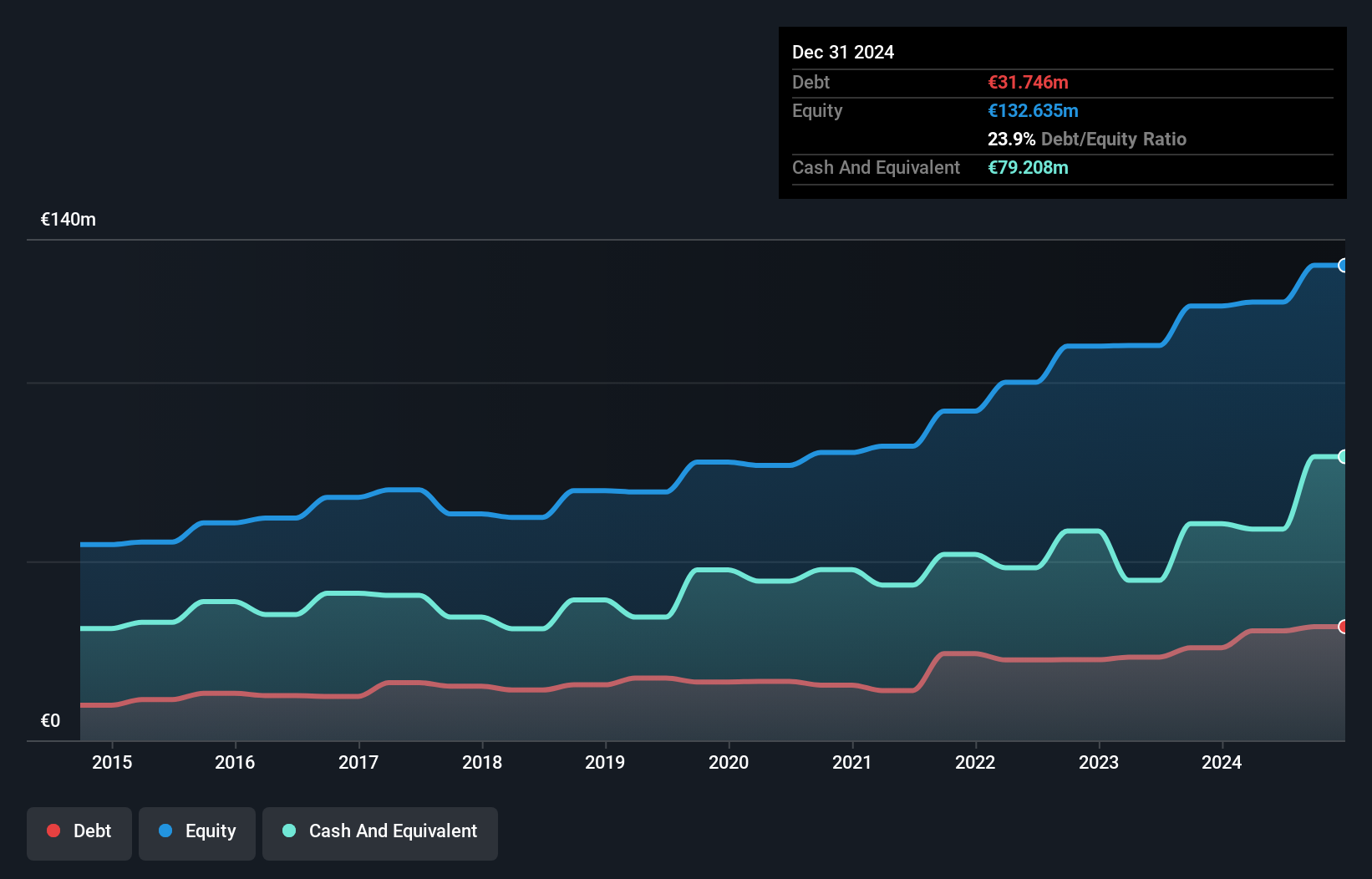

Overview: Gérard Perrier Industrie S.A. is a French company specializing in the design, manufacture, installation, and maintenance of electrical, electronic, automation, and instrumentation equipment for various industries both domestically and internationally. The company has a market capitalization of €360.48 million.

Operations: The company operates across multiple sectors including energy, aeronautics, installation maintenance, and specialized manufacturing. Its diverse revenue streams are supported by a consistent gross profit margin averaging around 72% over recent periods, reflecting efficient cost management relative to its revenue generation. This margin performance is indicative of the firm's ability to maintain profitability in its operations amidst varying market conditions.

Gérard Perrier Industrie, a notable player in the electrical sector, reported a robust financial performance with annual sales increasing to €304 million from €279 million. The firm's net income also rose to €19.55 million, up from €16.68 million last year, reflecting a solid earnings growth of 8.7% annually over five years. With a debt-to-equity ratio improving to 21.3%, and interest comfortably covered by profits, the company’s financial health appears strong. Additionally, its price-to-earnings ratio stands at 18.4x, below the industry average of 21.3x, suggesting potential undervaluation amidst positive forecasts for future earnings growth.

Seize The Opportunity

- Discover the full array of 33 Euronext Paris Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sidetrade is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALBFR

Sidetrade

Provides AI-powered order-to-cash (O2C) software as a service platform in France and internationally.

Solid track record with excellent balance sheet.