- France

- /

- Semiconductors

- /

- ENXTPA:SOI

Soitec (ENXTPA:SOI): Exploring Valuation as Share Price Volatility Prompts Investor Questions

Reviewed by Simply Wall St

If you’ve been following Soitec (ENXTPA:SOI), you’ll know the stock’s recent movements have raised more questions than answers. There hasn’t been a specific news event moving the needle this month, but sharp shifts in the share price are getting investor attention. It’s one of those moments where you have to ask yourself if this is noise, or if the market is quietly signaling a change beneath the surface.

The bigger picture hasn’t provided much comfort. Soitec shares are down about 69% over the last year, including a 32% drop in the past quarter and 14% over the past month. Even though the company delivered modest revenue and net income growth lately, momentum has clearly faded and investors seem to be recalibrating their expectations for future growth.

With the recent selloff, is Soitec positioned as a potential value pick for long-term investors, or is the gloomy performance exactly what’s baked into the price? Let’s dig into whether markets are already looking ahead or if there could be an opportunity at these levels.

Most Popular Narrative: 38% Undervalued

According to the most widely followed valuation narrative, Soitec is currently trading well below its estimated fair value. Many view this as a significant upside if assumptions hold true.

The ongoing large-scale transition to AI, data center expansion, and proliferating connected devices (including IoT) is driving robust and accelerating demand for advanced substrates like those Soitec produces. This supports long-term revenue visibility and potential for a twofold increase in revenue opportunity as their addressable market is projected to grow from 5 million wafers in 2024 to 12 million by 2030.

Curious what is fueling this bold upside projection? The narrative behind Soitec’s valuation hinges on ambitious growth in future demand, better profit margins, and a financial model that challenges conventional expectations for semiconductor stocks. Interested in which forecast figures justify this price target and what it would take for Soitec to deliver on these projections? Look closer at the detailed numbers powering this valuation call.

Result: Fair Value of €52.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, excess customer inventories and rising competition in advanced substrates could undermine Soitec’s growth narrative if the sector recovery takes longer than expected.

Find out about the key risks to this Soitec narrative.Another View: The SWS DCF Model Tells a Different Story

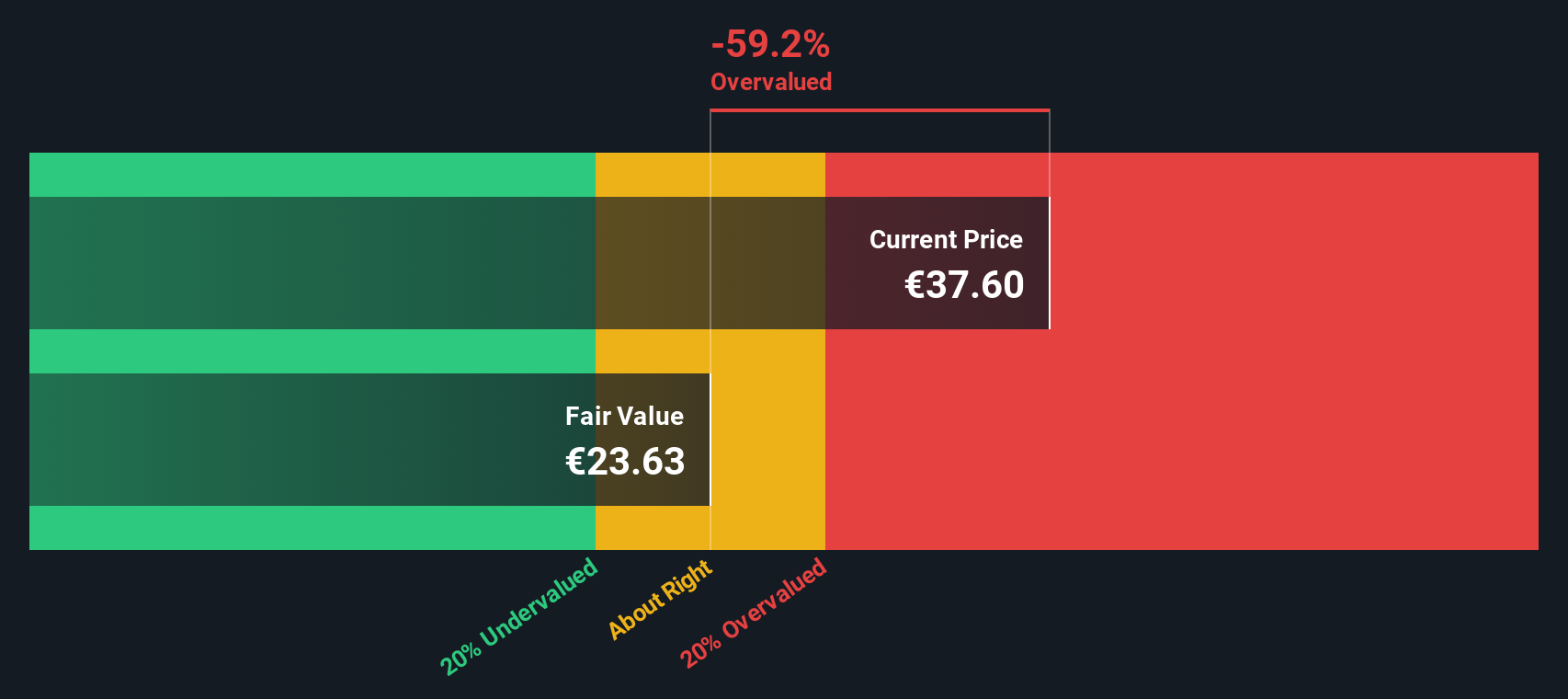

Looking at Soitec through the lens of our DCF model offers a different perspective. This method suggests the stock may not be as undervalued as some forecasts indicate, and it puts the spotlight on what matters most in today’s price. Which view will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Soitec Narrative

If you want to reach your own conclusions, you can dig into Soitec’s numbers yourself and build a personal narrative in just a few minutes, then Do it your way.

A great starting point for your Soitec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Want More Investment Ideas?

Don’t let potential opportunities pass you by. Make your next move with confidence and tap into top-rated stock picks others are already researching. Your smartest investment could be just a click away.

- Unlock rapid-growth companies at the frontier of artificial intelligence with AI penny stocks. See where tomorrow’s tech leaders are emerging right now.

- Spot undervalued gems hiding exceptional cash flow potential by using undervalued stocks based on cash flows to target stocks the market may be overlooking.

- Benefit from steady income streams by checking out dividend stocks with yields > 3% and find yields above 3% for your portfolio’s stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:SOI

Soitec

Develops and manufactures semiconductor materials in Asia, Europe, and the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives