Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that SRP Groupe S.A. (EPA:SRP) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for SRP Groupe

What Is SRP Groupe's Debt?

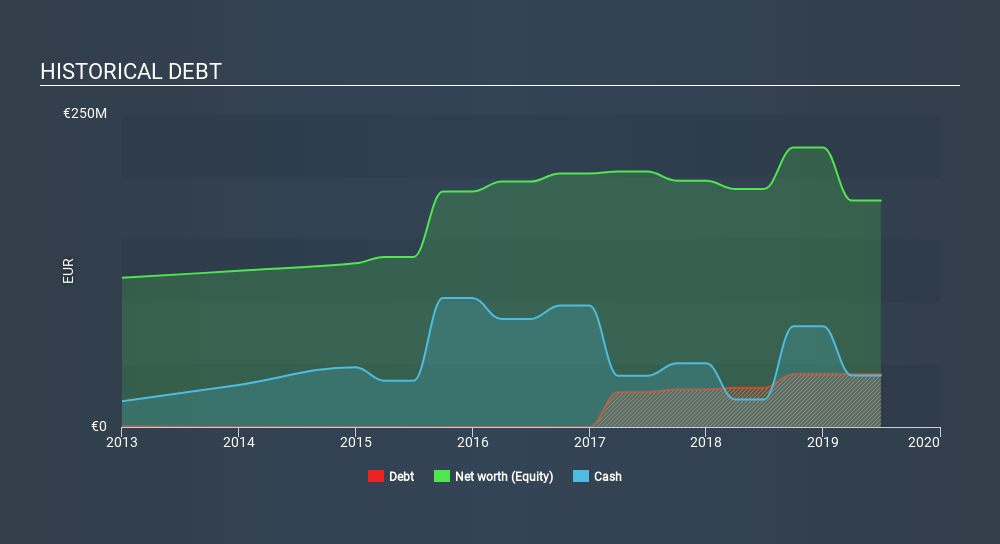

As you can see below, at the end of June 2019, SRP Groupe had €42.2m of debt, up from €31.3m a year ago. Click the image for more detail. On the flip side, it has €41.2m in cash leading to net debt of about €999.0k.

How Healthy Is SRP Groupe's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that SRP Groupe had liabilities of €184.9m due within 12 months and liabilities of €40.6m due beyond that. Offsetting this, it had €41.2m in cash and €22.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €162.0m.

The deficiency here weighs heavily on the €78.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we definitely think shareholders need to watch this one closely. At the end of the day, SRP Groupe would probably need a major re-capitalization if its creditors were to demand repayment. SRP Groupe has a very little net debt but plenty of other liabilities weighing it down. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for SRP Groupe which any shareholder or potential investor should be aware of.

Over 12 months, SRP Groupe saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

Caveat Emptor

Importantly, SRP Groupe had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost a very considerable €28m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of €25m over the last twelve months. That means it's on the risky side of things. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how SRP Groupe's profit, revenue, and operating cashflow have changed over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:SRP

SRP Groupe

Engages in the e-commerce business in France and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives