Vetoquinol (ENXTPA:VETO) Discusses 2025 Half-Year Financials In Recent Board Meeting

Reviewed by Simply Wall St

Vetoquinol (ENXTPA:VETO) recently convened a board meeting on September 9 to review and approve its financial statements for the first half of 2025. Despite this significant internal event, the company's stock price remained flat over the last week, aligning with the broader market trends. Major U.S. stock indices like the Dow Jones and S&P 500 reached record highs, buoyed by encouraging inflation data and interest rate cut hopes. While the neutral movement of Vetoquinol's share price mirrors the overall market sentiment, macroeconomic factors seemed to exert a greater influence than the company's individual financial developments.

Buy, Hold or Sell Vetoquinol? View our complete analysis and fair value estimate and you decide.

Over the past five years, Vetoquinol's total shareholder return, including share price and dividends, has seen a cumulative increase of 5.61%. This growth contrasts with its recent underperformance against the French Pharmaceuticals industry over the last year, where it fell short of the industry's returns by more than 21%. Similarly, it trailed behind the French market's return of 3.9% over the same one-year period.

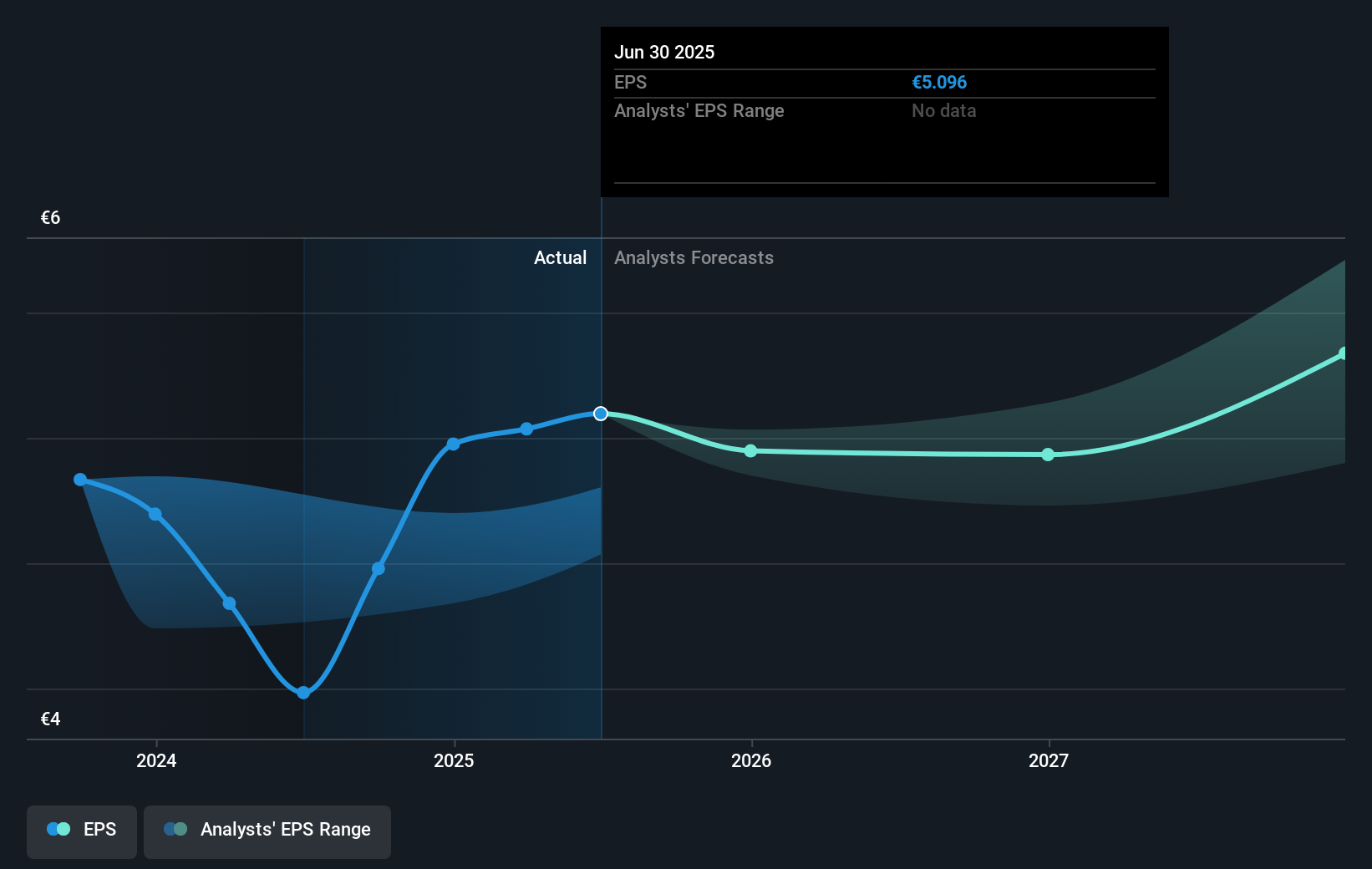

While Vetoquinol's share price has remained flat in recent days, aligning with broader market trends, its long-term performance provides a mixed context for value. Despite a series of earnings reports and sales updates, the market's focus seems more influenced by macroeconomic conditions than company-specific developments. The company's forecasts for revenue and earnings, at growth rates of 2.8% and 2.93% respectively, are expected to lag behind those of the overall French market. The current share price of €72.40 is notably below the consensus analyst price target of €91.57, suggesting a potential opportunity for appreciation if future earnings and revenue evidence stronger performance.

Our valuation report unveils the possibility Vetoquinol's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VETO

Vetoquinol

A veterinary pharmaceutical company, designs, develops, and sells veterinary drugs and non-medicinal products for cattle, pigs, dogs, and cats in Europe, the Americas, and the Asia Pacific region.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives