- France

- /

- Life Sciences

- /

- ENXTPA:DIM

Here's Why We Think Sartorius Stedim Biotech (EPA:DIM) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Sartorius Stedim Biotech (EPA:DIM). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out the opportunities and risks within the XX Life Sciences industry.

Sartorius Stedim Biotech's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Sartorius Stedim Biotech has grown EPS by 38% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

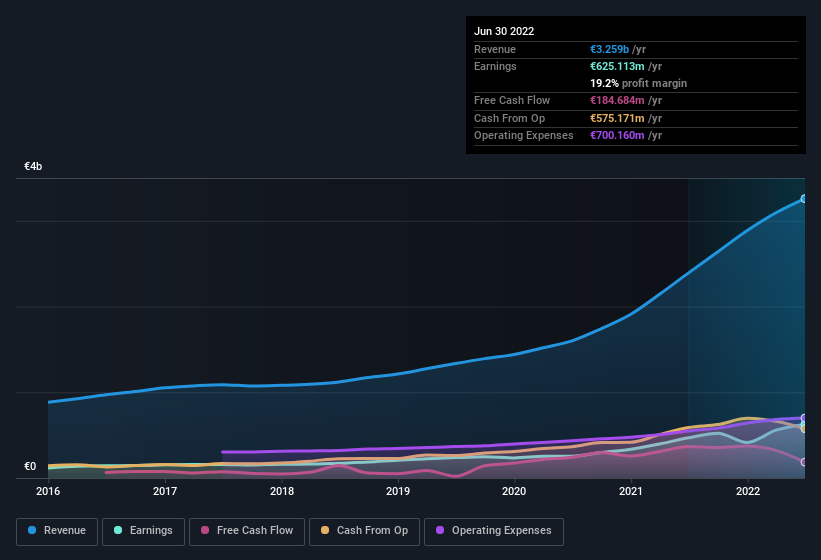

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Sartorius Stedim Biotech remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 36% to €3.3b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Sartorius Stedim Biotech's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Sartorius Stedim Biotech Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Sartorius Stedim Biotech, with market caps over €8.2b, is around €4.1m.

Sartorius Stedim Biotech's CEO took home a total compensation package of €2.0m in the year prior to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Sartorius Stedim Biotech To Your Watchlist?

Sartorius Stedim Biotech's earnings have taken off in quite an impressive fashion. Such fast EPS growth prompts the question: has the business reached an inflection point? Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Sartorius Stedim Biotech has the hallmarks of a quality business; and that would make it well worth watching. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Sartorius Stedim Biotech.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:DIM

Sartorius Stedim Biotech

Engages in the production and sale of instruments and consumables for the biopharmaceutical industry worldwide.

Moderate with reasonable growth potential.