Stock Analysis

High Growth Tech Stocks In France Featuring Esker And Two More

Reviewed by Simply Wall St

As the French market continues to show resilience, with the CAC 40 Index adding 0.47% amidst broader European gains, investors are increasingly eyeing high-growth tech stocks for potential opportunities. In this dynamic environment, companies like Esker and others that demonstrate robust innovation and adaptability stand out as promising candidates for growth-focused portfolios.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 14.08% | 28.13% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| Valneva | 23.46% | 25.74% | ★★★★★☆ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| VusionGroup | 28.35% | 82.32% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Esker (ENXTPA:ALESK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esker SA operates a cloud platform for finance and customer service professionals in France and internationally, with a market cap of €1.58 billion.

Operations: Esker SA generates revenue primarily through its Software & Programming segment, which contributes €202.22 million. The company focuses on providing cloud solutions for finance and customer service sectors across various regions.

Esker, a Paris-listed software provider, is navigating a transformative landscape with its recent proposal for acquisition by General Atlantic and Bridgepoint Group at €262 per share, valuing the company at approximately €1.58 billion. This move underscores Esker's robust position in the tech sector, evidenced by a 12% annual earnings growth over the past five years and an expected surge in earnings by 27% annually over the next three years. The company's commitment to innovation is highlighted by its significant R&D expenses which are strategically aligned with evolving market demands and regulatory frameworks. Furthermore, Esker’s adaptation of sustainability features into its Source-to-Pay suite not only enhances operational efficiency but also positions it favorably amid increasing environmental regulations, potentially driving long-term growth in a competitive industry.

- Get an in-depth perspective on Esker's performance by reading our health report here.

Review our historical performance report to gain insights into Esker's's past performance.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across France, Europe, the Americas, Asia, Oceania, and Africa with a market cap of €17.06 billion.

Operations: Bolloré SE generates revenue primarily from its communications segment (€14.86 billion), followed by Bollore Energy (€2.75 billion) and industry operations (€353 million). The company's diverse geographical presence spans multiple continents including Europe, the Americas, Asia, Oceania, and Africa.

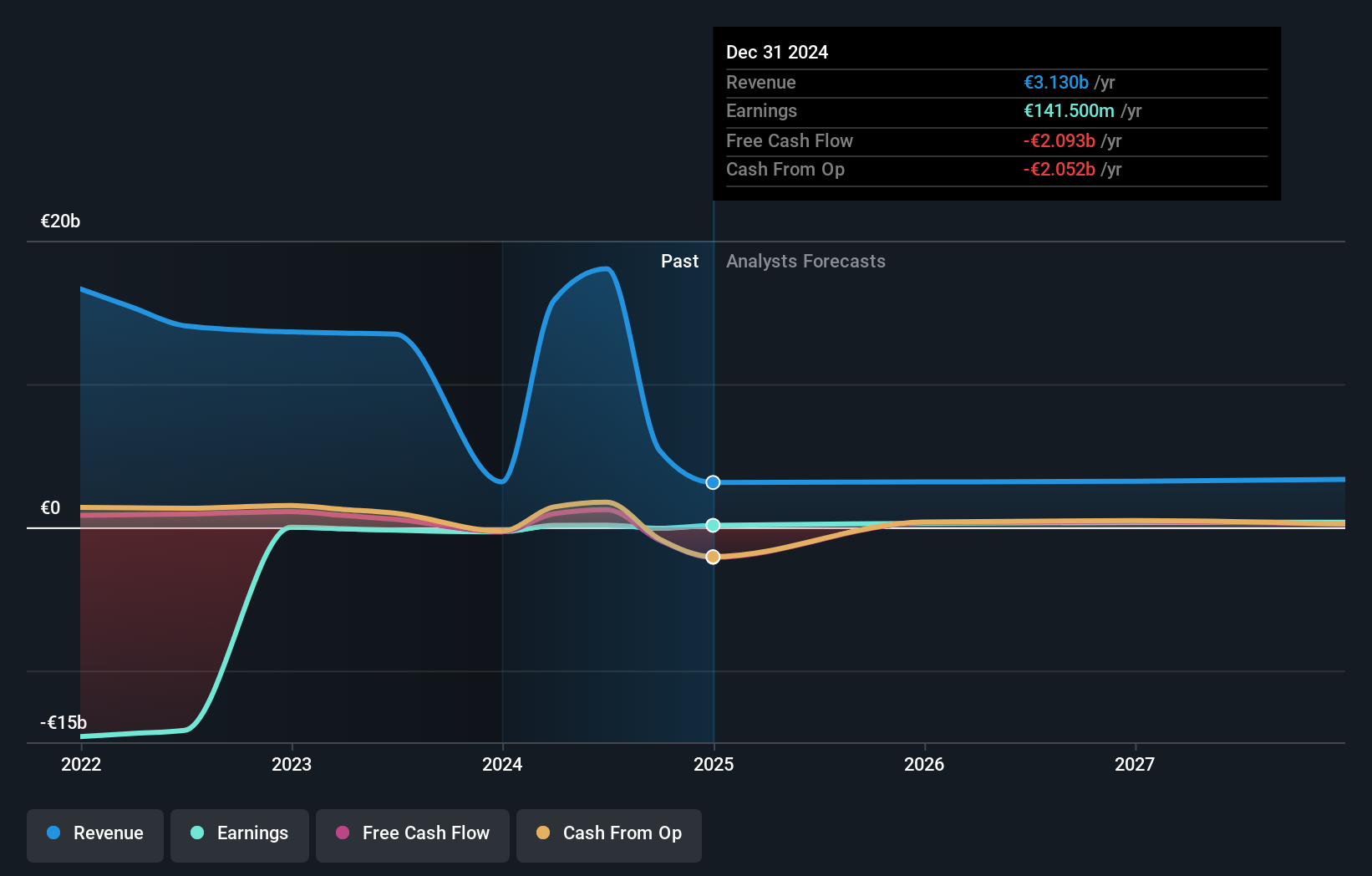

Bolloré SE stands out with a projected earnings growth of 32.7% annually, significantly outpacing the French market's average of 12.3%. This surge is supported by a robust increase in half-year sales from €6.23 billion to €10.59 billion, demonstrating a sharp revenue uptick of 8.3% per year, which also exceeds the national growth rate of 5.7%. The firm’s strategic emphasis on R&D is evident from its recent financial statements, aligning with technological advancements and market demands, positioning Bolloré well for sustained future growth despite a modest forecasted return on equity of 4.9%.

- Unlock comprehensive insights into our analysis of Bolloré stock in this health report.

Gain insights into Bolloré's past trends and performance with our Past report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is an entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa; it has a market cap of €10.58 billion.

Operations: Vivendi SE generates revenue primarily from Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), and Gameloft (€304 million). The company also has smaller revenue streams from Prisma Media, New Initiatives, Vivendi Village, and Generosity and Solidarity.

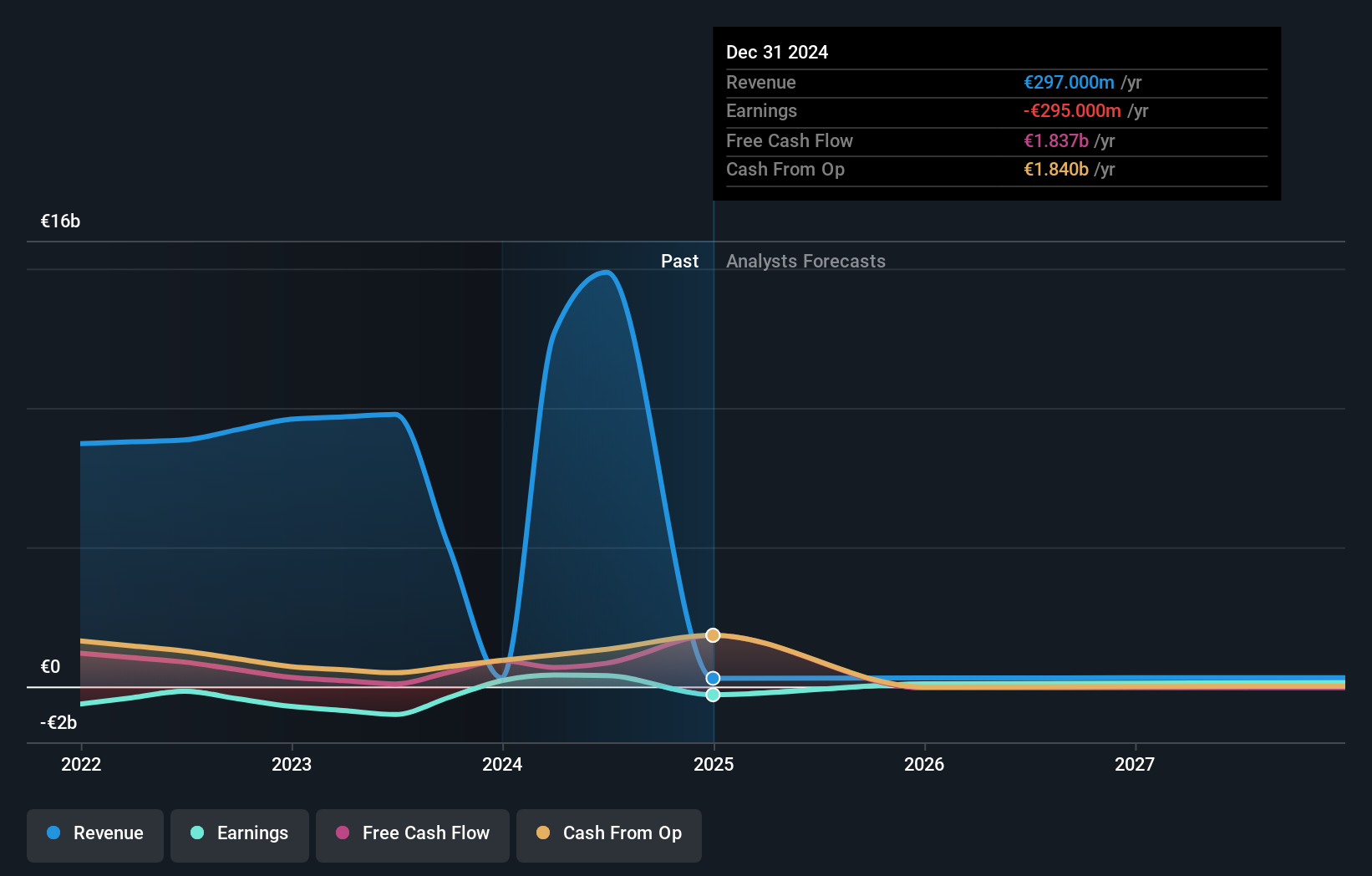

Vivendi SE, amid a dynamic French tech landscape, showcases significant growth with its earnings forecast to surge by 30.6% annually, outstripping the broader market's average of 12.3%. This growth is underpinned by a robust half-year sales increase to €9.05 billion from €4.7 billion previously. The firm's commitment to innovation is reflected in its R&D spending, crucial for sustaining its competitive edge in a rapidly evolving industry. Moreover, Vivendi has strategically repurchased shares worth €184 million this year, reinforcing shareholder value while navigating through complex legal settlements and exploring potential spin-offs like Canal+ listing on the London Stock Exchange, signaling agility and forward-thinking in corporate strategy.

- Click to explore a detailed breakdown of our findings in Vivendi's health report.

Examine Vivendi's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Access the full spectrum of 43 Euronext Paris High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Esker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALESK

Esker

Operates cloud platform for finance, procurement, and customer service professionals in France, Germany, the United Kingdom, Southern Europe, Australia, Asia, the Americas, and internationally.