Pinning Down Makheia Group Société anonyme's (EPA:ALNMG) P/S Is Difficult Right Now

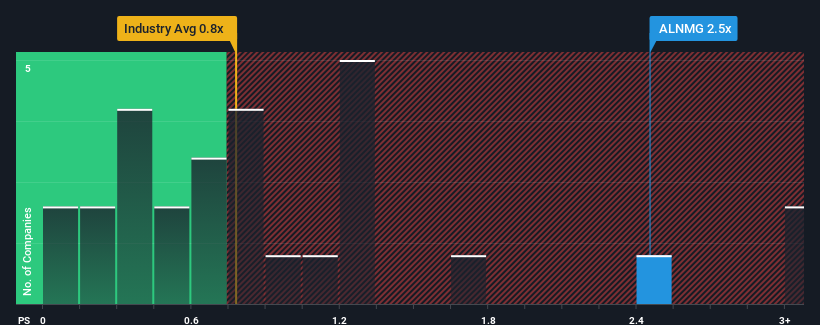

When you see that almost half of the companies in the Media industry in France have price-to-sales ratios (or "P/S") below 0.8x, Makheia Group Société anonyme (EPA:ALNMG) looks to be giving off some sell signals with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Makheia Group Société anonyme

How Has Makheia Group Société anonyme Performed Recently?

As an illustration, revenue has deteriorated at Makheia Group Société anonyme over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Makheia Group Société anonyme's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Makheia Group Société anonyme?

In order to justify its P/S ratio, Makheia Group Société anonyme would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.5%. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 2.4% shows the industry is more attractive on an annualised basis regardless.

With this in mind, we find it intriguing that Makheia Group Société anonyme's P/S exceeds that of its industry peers. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does Makheia Group Société anonyme's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Makheia Group Société anonyme currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the high P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Makheia Group Société anonyme (1 shouldn't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NetMedia Group société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNMG

NetMedia Group société anonyme

NetMedia Group société anonyme imagines, optimizes, organizes, and deploys communication devices in digital platforms, social media, brand content, marketing activations, and print and video.

Slight risk and slightly overvalued.

Market Insights

Community Narratives